Intro

Boost your credit score with a goodwill letter template for credit repair. Learn how to write an effective letter to request removal of negative marks, late payments, and collections. Includes a sample template and expert tips to improve your credit report, dispute errors, and negotiate with creditors for a brighter financial future.

Goodwill letters are a crucial tool in the credit repair process, allowing individuals to request that creditors remove negative marks from their credit reports. These letters can be a powerful way to improve your credit score and overall financial health.

A goodwill letter is a formal request to a creditor to remove a negative mark from your credit report, typically in exchange for paying off a debt or making a payment plan. The goal of a goodwill letter is to persuade the creditor to remove the negative mark, which can help improve your credit score.

Why Goodwill Letters Matter

Goodwill letters are essential in the credit repair process because they can help:

- Improve your credit score by removing negative marks

- Enhance your credit history by showing responsible payment behavior

- Increase your chances of getting approved for loans and credit cards

- Reduce stress and anxiety related to poor credit

When to Use a Goodwill Letter

A goodwill letter is typically used in situations where:

- You have paid off a debt, but the creditor is still reporting the negative mark on your credit report

- You are making payments on a debt, but the creditor is still reporting the negative mark on your credit report

- You have a one-time mistake on your credit report, such as a late payment

How to Write a Goodwill Letter

Writing a goodwill letter can seem daunting, but it's a relatively straightforward process. Here are some steps to follow:

- Gather information: Before writing your goodwill letter, gather all relevant information, including your account number, payment history, and any communication with the creditor.

- Choose the right tone: Your goodwill letter should be polite and courteous, yet firm and assertive. Avoid being aggressive or confrontational.

- Explain the situation: Clearly explain the situation and why you are requesting the creditor to remove the negative mark.

- Provide evidence: Include any evidence that supports your request, such as payment receipts or communication with the creditor.

- Make a specific request: Clearly state what you are asking the creditor to do, such as removing the negative mark from your credit report.

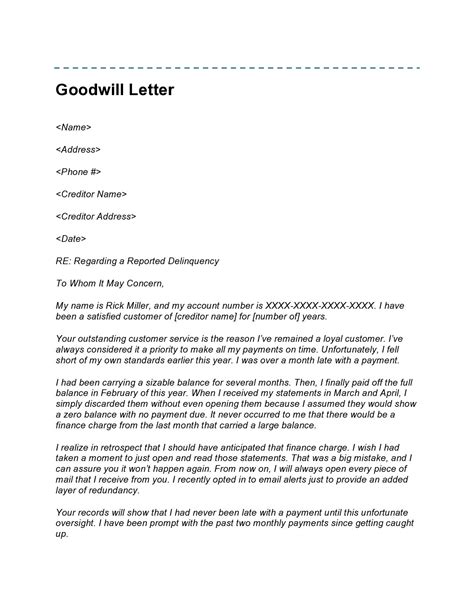

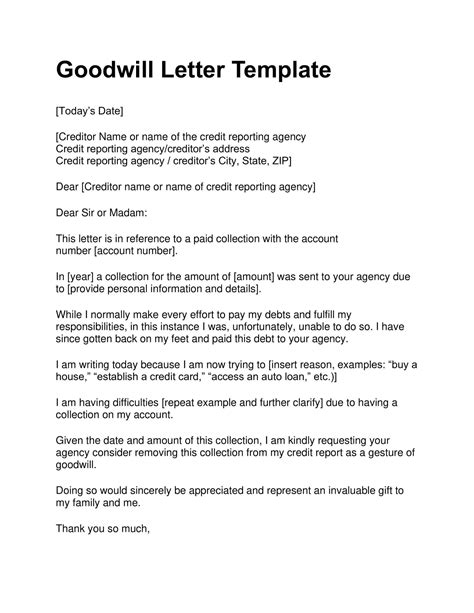

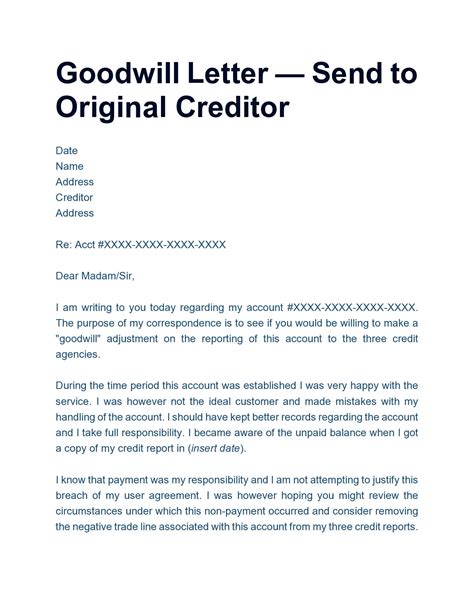

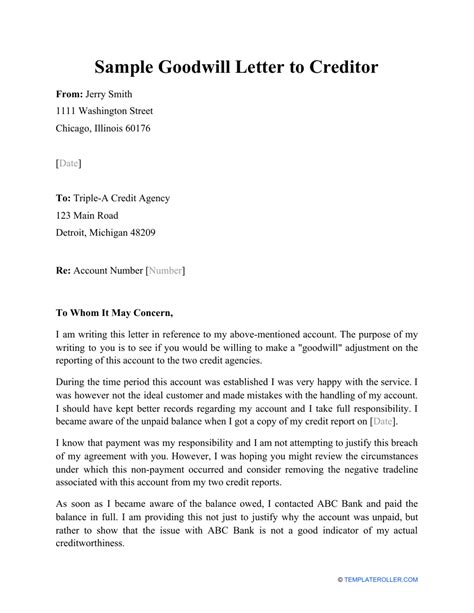

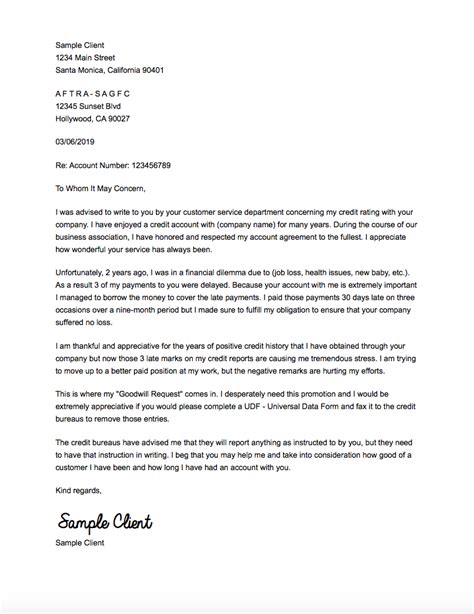

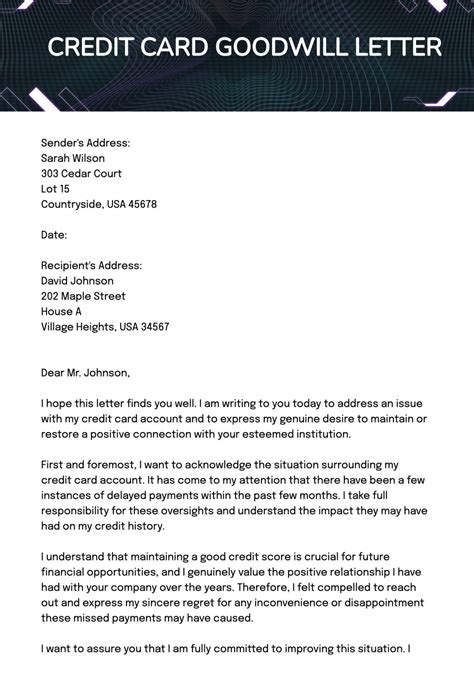

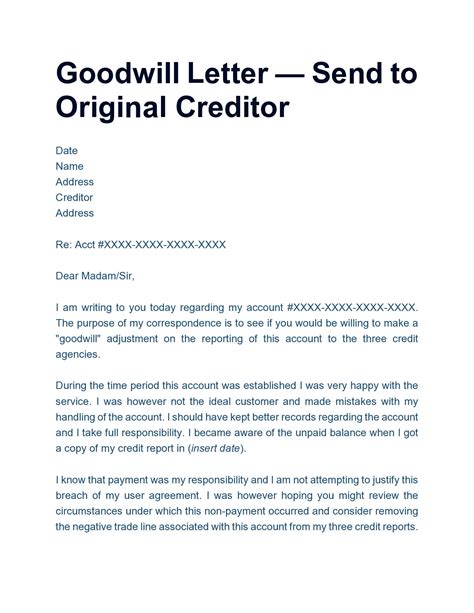

Goodwill Letter Template

Here is a basic goodwill letter template you can use as a starting point:

[Your Name] [Your Address] [City, State, ZIP] [Email Address] [Phone Number] [Date]

[Creditor's Name] [Creditor's Title] [Creditor's Company] [Creditor's Address] [City, State, ZIP]

Dear [Creditor's Name],

Re: Request for Goodwill Adjustment on Account [Account Number]

I am writing to respectfully request that you consider removing the negative mark on my credit report related to my account with your company. As you are aware, I have been making regular payments on this account and have a good payment history.

I understand that the negative mark was a result of a [briefly explain the situation, e.g., "late payment" or "missed payment"]. However, I have since taken steps to rectify the situation and ensure that all payments are made on time.

I would greatly appreciate it if you could consider removing the negative mark from my credit report. I believe that this would be a fair and reasonable decision, given my good payment history and the steps I have taken to correct the situation.

Please find attached a copy of my payment history and any other relevant documentation. If you require any further information from me, please do not hesitate to contact me.

Thank you for considering my request. I look forward to hearing from you soon.

Sincerely,

[Your Name]

Tips for Writing a Goodwill Letter

Here are some additional tips to keep in mind when writing a goodwill letter:

- Be polite and courteous: Your goodwill letter should be polite and courteous, yet firm and assertive.

- Use proper grammar and spelling: Make sure to use proper grammar and spelling throughout your letter.

- Include all relevant information: Make sure to include all relevant information, including your account number, payment history, and any communication with the creditor.

- Proofread your letter: Before sending your letter, proofread it carefully to ensure that there are no errors or typos.

Gallery of Goodwill Letter Templates

Goodwill Letter Templates Gallery

Frequently Asked Questions

Q: What is a goodwill letter?

A: A goodwill letter is a formal request to a creditor to remove a negative mark from your credit report.

Q: When should I use a goodwill letter?

A: You should use a goodwill letter when you have paid off a debt, are making payments on a debt, or have a one-time mistake on your credit report.

Q: How do I write a goodwill letter?

A: Writing a goodwill letter involves gathering information, choosing the right tone, explaining the situation, providing evidence, and making a specific request.

Q: What should I include in my goodwill letter?

A: You should include your account number, payment history, and any communication with the creditor.

Q: Can I use a goodwill letter template?

A: Yes, you can use a goodwill letter template as a starting point, but make sure to customize it to fit your specific situation.

Conclusion

A goodwill letter is a powerful tool in the credit repair process, allowing you to request that creditors remove negative marks from your credit report. By following the tips and guidelines outlined above, you can write an effective goodwill letter that helps improve your credit score and overall financial health.

Encourage Engagement

If you have any questions or comments about goodwill letters or credit repair, please feel free to leave them in the comments section below.