Intro

Learn how to write off debt with a goodwill deletion letter template. Discover the process of requesting debt removal from credit reports using a goodwill letter sample. Improve your credit score by deleting negative marks with a well-structured goodwill deletion request. Get the template and expert tips to boost your creditworthiness.

If you're struggling with debt, you're not alone. Millions of Americans are facing financial difficulties, and the pressure to pay off creditors can be overwhelming. One way to potentially reduce or eliminate debt is by using a goodwill deletion letter template. In this article, we'll explore what a goodwill deletion letter is, how it works, and provide a template you can use to write off debt.

Understanding Goodwill Deletion

Goodwill deletion is a process where a creditor agrees to remove a negative mark from your credit report in exchange for paying off a debt. This can be a win-win for both parties, as the creditor receives payment, and you get to improve your credit score. However, it's essential to note that goodwill deletion is not a guaranteed outcome and requires negotiation with the creditor.

How Goodwill Deletion Works

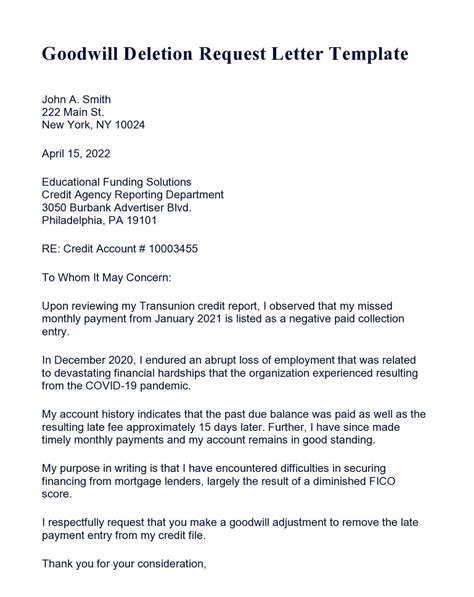

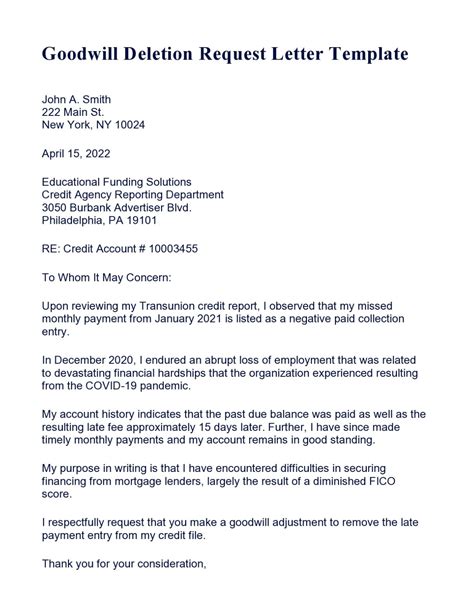

When you send a goodwill deletion letter, you're essentially asking the creditor to remove the negative mark from your credit report as a gesture of goodwill. This letter should include the following elements:

- A polite and respectful tone

- An explanation of your financial situation and how it led to the debt

- A request to remove the negative mark from your credit report

- A commitment to pay off the debt in full

Benefits of Using a Goodwill Deletion Letter Template

Using a goodwill deletion letter template can be an effective way to write off debt and improve your credit score. Here are some benefits of using a template:

- Professional tone: A template helps you maintain a professional tone, which is essential when communicating with creditors.

- Clear structure: A template provides a clear structure for your letter, making it easier to include all the necessary information.

- Increased chances of success: By using a template, you can increase your chances of getting a positive response from the creditor.

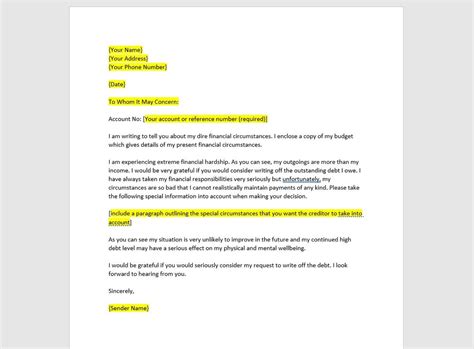

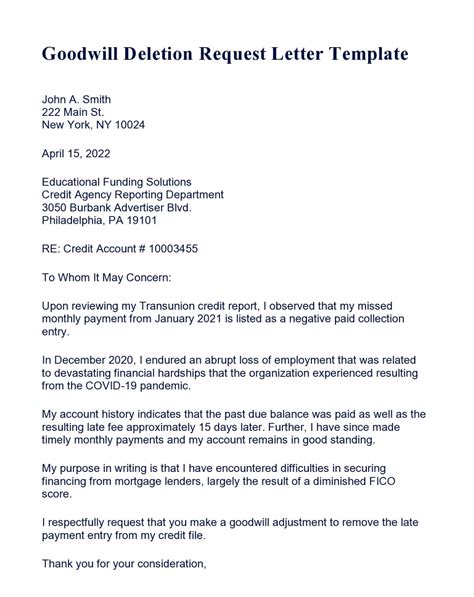

Goodwill Deletion Letter Template

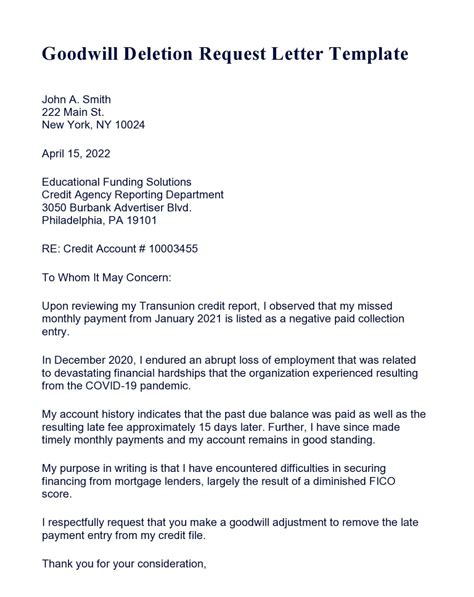

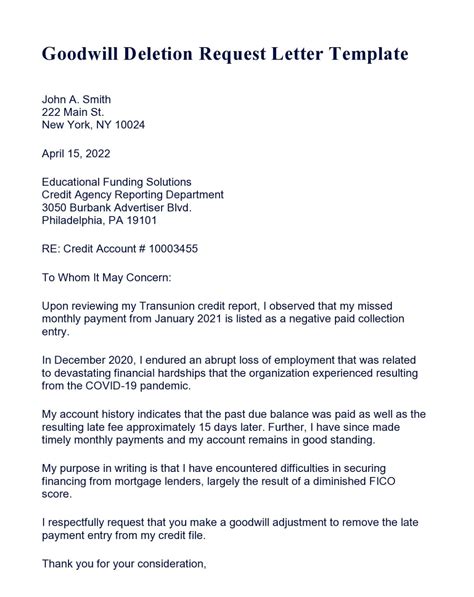

Here's a sample goodwill deletion letter template you can use:

[Your Name] [Your Address] [City, State, ZIP] [Date]

[Creditor's Name] [Creditor's Address] [City, State, ZIP]

Dear [Creditor's Representative],

Re: [Account Number]

I am writing to request that you consider removing the negative mark associated with my account [Account Number] from my credit report. As you are aware, I have been struggling with financial difficulties, which led to the accumulation of debt.

However, I am committed to paying off the debt in full and am willing to make a payment of [Payment Amount] on [Payment Date]. I believe that removing the negative mark from my credit report would be a gesture of goodwill, considering my efforts to pay off the debt.

I would greatly appreciate it if you could consider my request. Please let me know if there's any additional information I need to provide to facilitate this process.

Thank you for your time and consideration.

Sincerely,

[Your Name]

Tips for Writing a Effective Goodwill Deletion Letter

When writing a goodwill deletion letter, keep the following tips in mind:

- Be polite and respectful: Remember to maintain a professional tone throughout the letter.

- Explain your financial situation: Provide context for your financial difficulties and how they led to the debt.

- Commit to paying off the debt: Assure the creditor that you're committed to paying off the debt in full.

- Proofread: Make sure to proofread your letter for grammar and spelling errors.

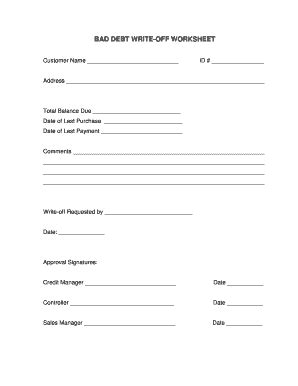

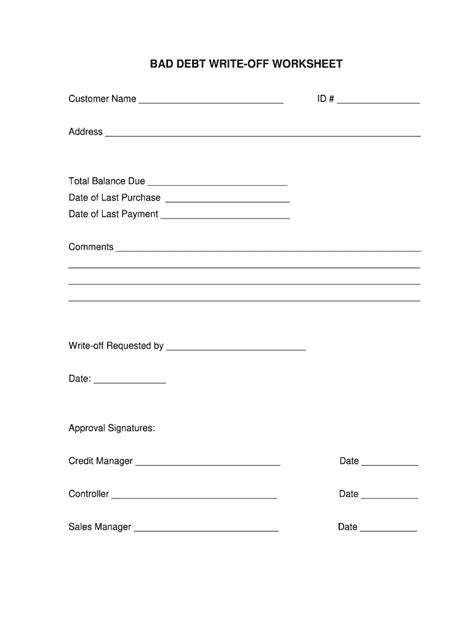

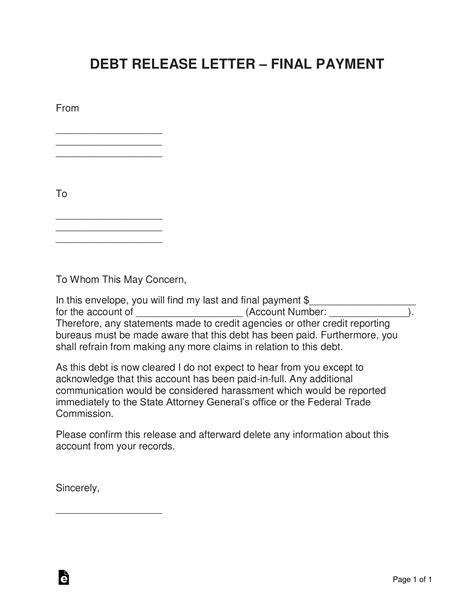

Gallery of Goodwill Deletion Letter Templates

Goodwill Deletion Letter Templates

Conclusion

Writing off debt with a goodwill deletion letter template can be an effective way to improve your credit score and reduce financial stress. By using a template and following the tips outlined in this article, you can increase your chances of getting a positive response from the creditor. Remember to stay polite, explain your financial situation, commit to paying off the debt, and proofread your letter. Don't hesitate to reach out if you have any questions or need further assistance.