Intro

Negotiate debt forgiveness with a goodwill letter. Our sample template helps you write a compelling letter to creditors, requesting removal of negative marks from credit reports. Learn how to draft a persuasive goodwill letter, including essential elements and strategies to improve your chances of approval and boost your credit score.

The Importance of Goodwill Letters in Credit Repair

In the world of credit repair, goodwill letters can be a powerful tool for individuals looking to improve their credit scores. A goodwill letter is a polite and professional request to a creditor to remove a negative mark from your credit report. This type of letter is often used to request the removal of late payments, collections, or other derogatory marks that can negatively impact your credit score. In this article, we will explore the importance of goodwill letters and provide a sample template to help you get started.

The Benefits of Goodwill Letters

Goodwill letters can be an effective way to improve your credit score by removing negative marks from your credit report. Here are some benefits of using goodwill letters:

- Improved credit score: By removing negative marks from your credit report, you can significantly improve your credit score.

- Increased creditworthiness: A good credit score can make you more attractive to lenders and creditors, making it easier to obtain credit or loans in the future.

- Reduced debt: By removing collections and other negative marks, you may be able to reduce the amount of debt you owe.

How to Write a Goodwill Letter

Writing a goodwill letter can be a daunting task, but it's essential to get it right. Here are some tips to help you write an effective goodwill letter:

- Be polite and professional: Use a polite and professional tone in your letter. Avoid being confrontational or aggressive.

- Explain the situation: Clearly explain the situation that led to the negative mark on your credit report. Be honest and take responsibility for your actions.

- Show willingness to pay: If you owe money, show a willingness to pay the debt. This can help demonstrate your commitment to resolving the issue.

- Request removal: Clearly request that the creditor remove the negative mark from your credit report.

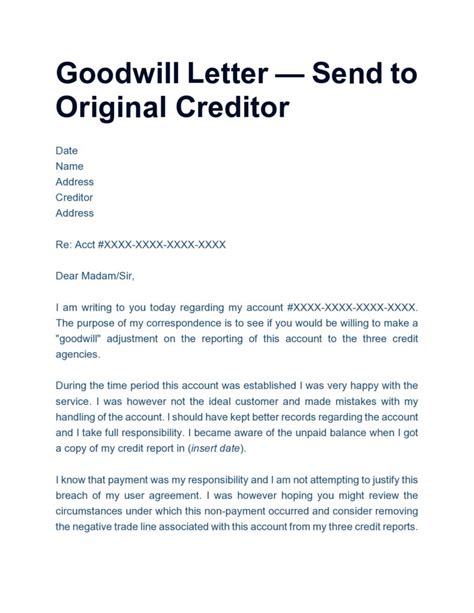

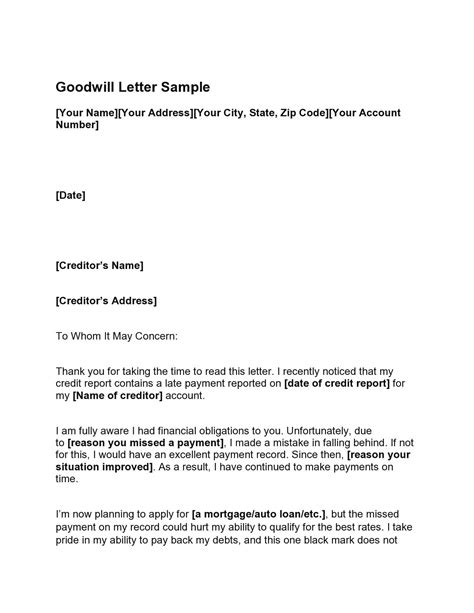

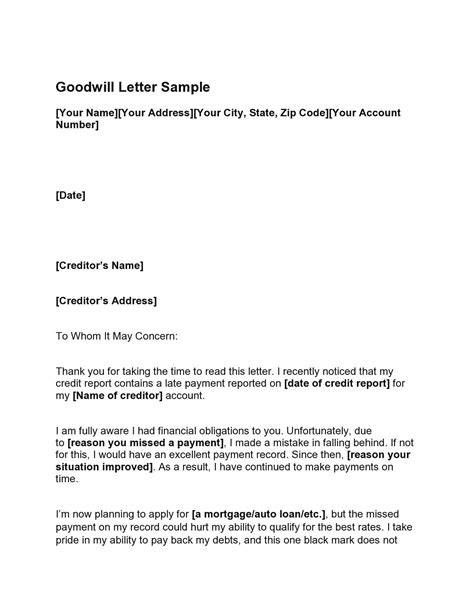

Sample Goodwill Letter Template

Here is a sample goodwill letter template you can use as a starting point:

[Your Name] [Your Address] [City, State, ZIP] [Email Address] [Phone Number] [Date]

[Creditor's Name] [Creditor's Address] [City, State, ZIP]

Dear [Creditor's Representative],

I am writing to request that you consider removing the [negative mark] from my credit report. I understand that this mark was placed on my report due to [briefly explain the situation that led to the negative mark].

I want to assure you that I take full responsibility for my actions and am committed to resolving this issue. I have [briefly explain any steps you have taken to resolve the issue, such as making payments or setting up a payment plan].

I would greatly appreciate it if you could remove the [negative mark] from my credit report. I believe that this would be a fair resolution, given the circumstances. I am willing to [offer a specific solution, such as making a payment or setting up a payment plan].

Please let me know if there is any additional information you need from me to consider my request. I appreciate your time and consideration, and I look forward to hearing from you soon.

Sincerely,

[Your Name]

Tips for Sending a Goodwill Letter

Here are some tips to keep in mind when sending a goodwill letter:

- Send the letter via certified mail: This will provide proof that the letter was sent and received.

- Keep a copy: Keep a copy of the letter for your records.

- Follow up: If you don't hear back from the creditor, follow up with a phone call or additional letter.

Common Mistakes to Avoid

Here are some common mistakes to avoid when writing a goodwill letter:

- Being confrontational or aggressive

- Failing to take responsibility for your actions

- Not offering a specific solution

- Not keeping a copy of the letter

What to Expect After Sending a Goodwill Letter

After sending a goodwill letter, you can expect one of several outcomes:

- The creditor agrees to remove the negative mark: If the creditor agrees to remove the negative mark, you can expect to see an improvement in your credit score.

- The creditor denies your request: If the creditor denies your request, you may need to consider other options, such as disputing the mark or seeking the help of a credit repair professional.

- The creditor requests additional information: If the creditor requests additional information, be sure to provide it promptly.

Gallery of Goodwill Letter Examples

Goodwill Letter Examples

Conclusion

Writing a goodwill letter can be an effective way to improve your credit score by removing negative marks from your credit report. By following the tips outlined in this article and using the sample template provided, you can increase your chances of success. Remember to be polite and professional, explain the situation, show a willingness to pay, and request removal of the negative mark. Don't be discouraged if the creditor denies your request – there are other options available to help you improve your credit score.

We hope this article has been helpful in providing you with the information you need to write a goodwill letter. If you have any further questions or would like to share your experiences with goodwill letters, please leave a comment below.