Managing payroll can be a daunting task, especially for small businesses or individuals who are not familiar with the process. One way to simplify payroll management is by using a Google Pay Stub Template. In this article, we will explore the importance of using a pay stub template, its benefits, and provide a step-by-step guide on how to create and use a Google Pay Stub Template.

What is a Pay Stub Template?

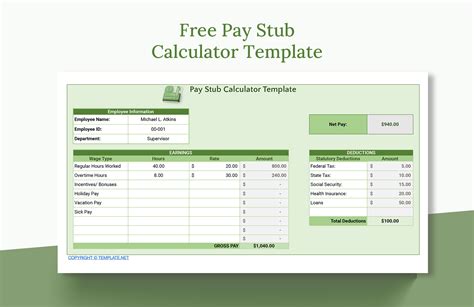

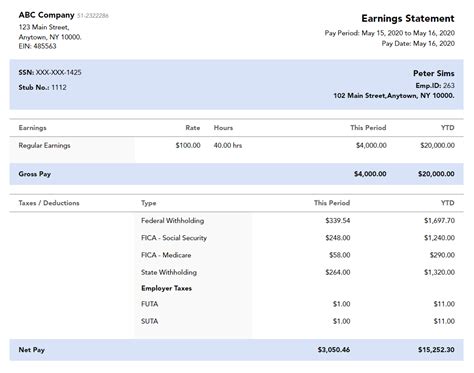

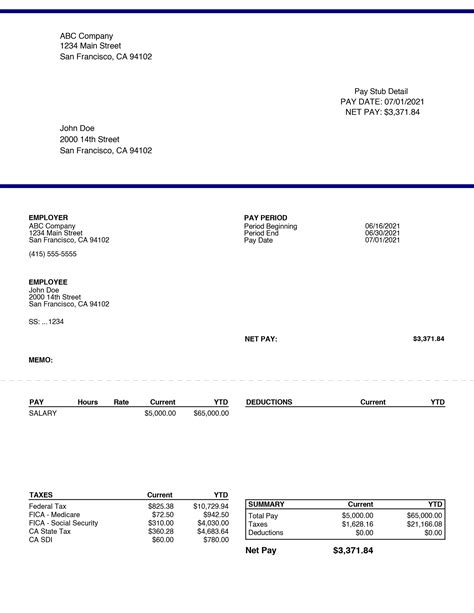

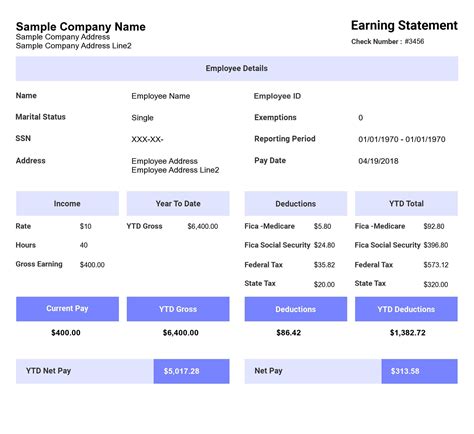

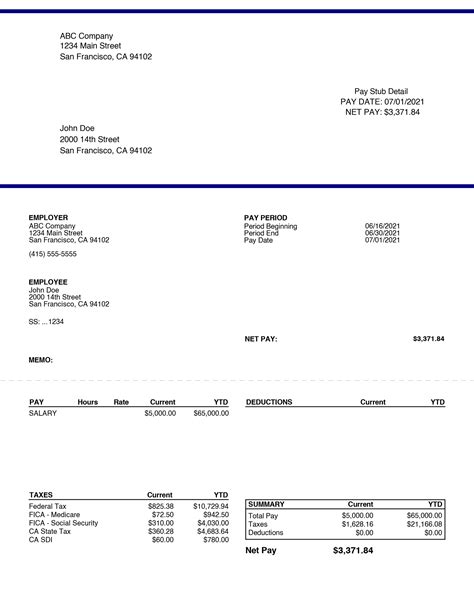

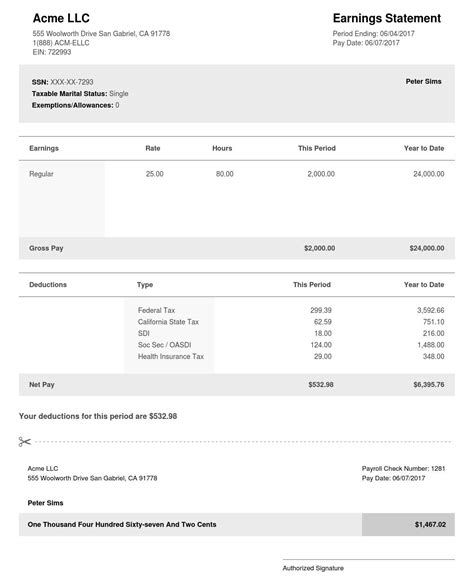

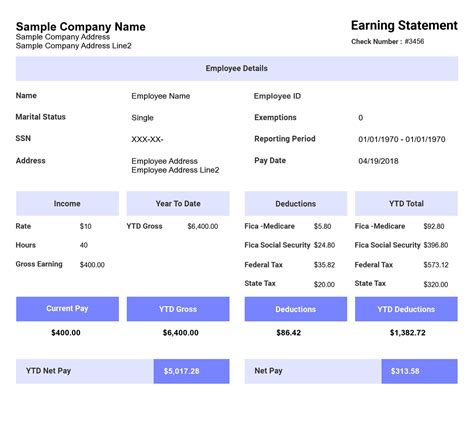

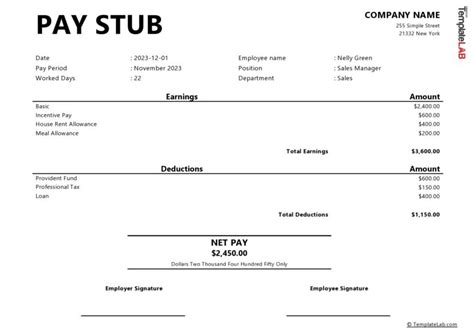

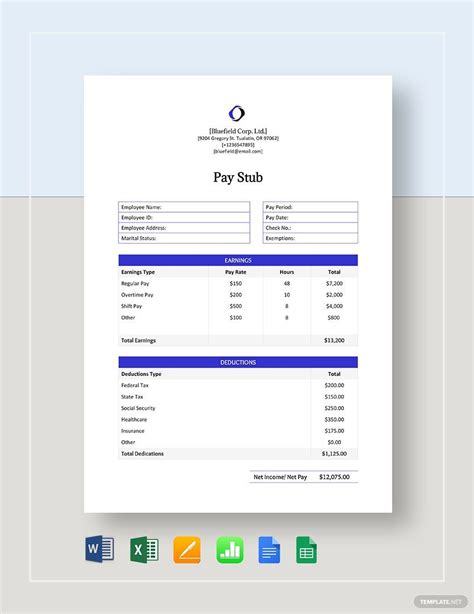

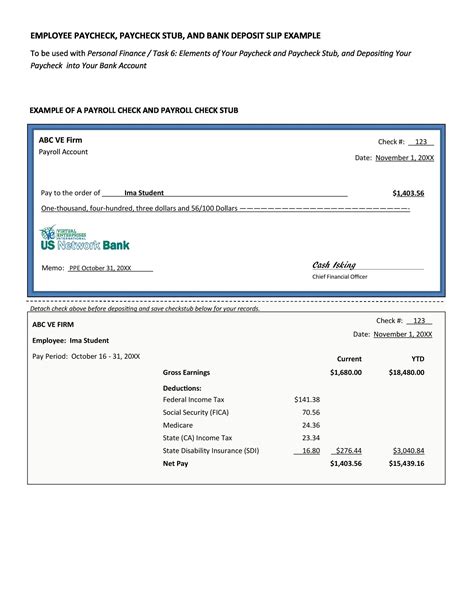

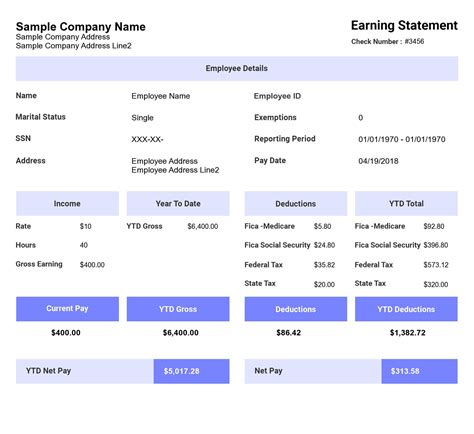

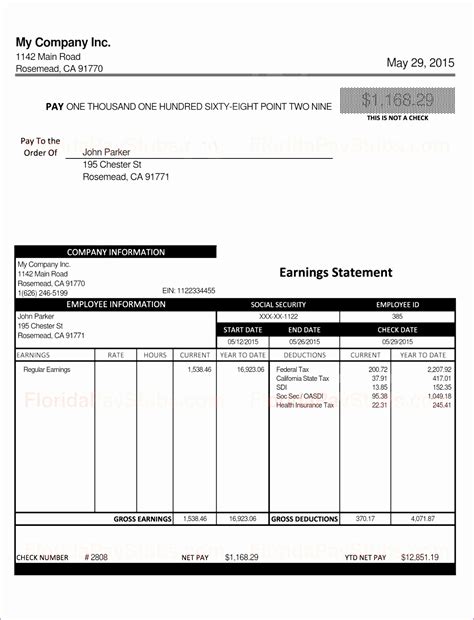

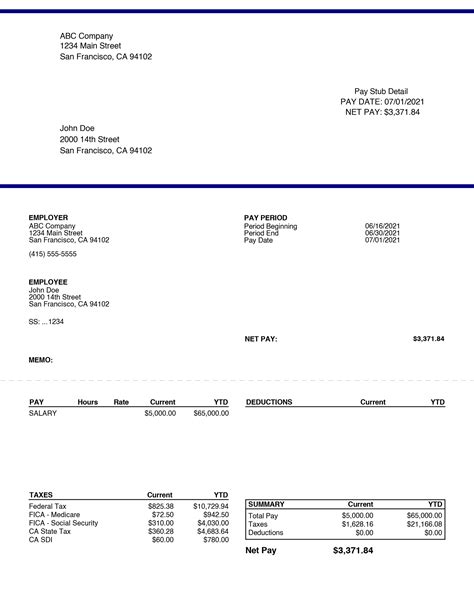

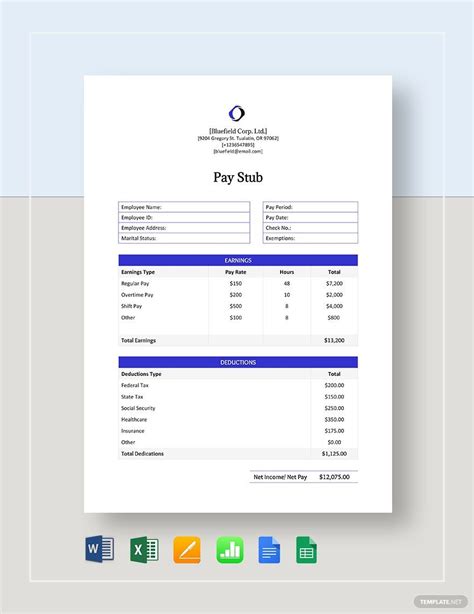

A pay stub template is a pre-designed document that outlines an employee's payment information, including their name, pay period, gross pay, deductions, and net pay. It is a useful tool for employers to manage payroll efficiently and accurately.

Benefits of Using a Google Pay Stub Template

Using a Google Pay Stub Template offers several benefits, including:

- Efficient payroll management: A pay stub template helps streamline the payroll process, reducing the time and effort required to manage employee payments.

- Accuracy: A template ensures that all necessary information is included, reducing the risk of errors or omissions.

- Customization: Google templates can be easily customized to fit your business's specific needs.

- Cost-effective: Google templates are free and easily accessible, reducing the need for expensive payroll software.

- Secure: Google Drive provides a secure platform to store and manage payroll documents.

How to Create a Google Pay Stub Template

Creating a Google Pay Stub Template is a straightforward process. Here's a step-by-step guide:

- Log in to Google Drive: Go to drive.google.com and log in to your Google account.

- Create a new document: Click on the "New" button and select "Google Docs" from the dropdown menu.

- Choose a template: Search for "pay stub template" in the Google Docs template gallery and select a template that suits your needs.

- Customize the template: Modify the template to fit your business's specific needs, including adding your company's logo, name, and address.

- Save the template: Save the template as a Google Doc, making sure to give it a descriptive name, such as "Pay Stub Template".

How to Use a Google Pay Stub Template

Using a Google Pay Stub Template is easy and efficient. Here's a step-by-step guide:

- Open the template: Go to Google Drive and open the pay stub template you created.

- Enter employee information: Fill in the employee's name, pay period, and payment information.

- Calculate deductions: Calculate any deductions, such as taxes, health insurance, or retirement contributions.

- Calculate net pay: Calculate the employee's net pay by subtracting deductions from their gross pay.

- Review and approve: Review the pay stub for accuracy and approve it for payment.

Best Practices for Using a Google Pay Stub Template

To get the most out of your Google Pay Stub Template, follow these best practices:

- Keep it up-to-date: Regularly update the template to reflect changes in payroll laws or regulations.

- Use it consistently: Use the template for all employee payments to ensure consistency and accuracy.

- Secure it: Store the template in a secure location, such as Google Drive, to protect employee information.

- Back it up: Regularly back up the template to prevent loss or damage.

Common Pay Stub Template Mistakes to Avoid

When using a Google Pay Stub Template, avoid the following common mistakes:

- Inaccurate information: Double-check employee information and payment details to ensure accuracy.

- Insufficient deductions: Ensure that all necessary deductions are included, such as taxes and health insurance.

- Inconsistent formatting: Use a consistent format for all pay stubs to ensure clarity and readability.

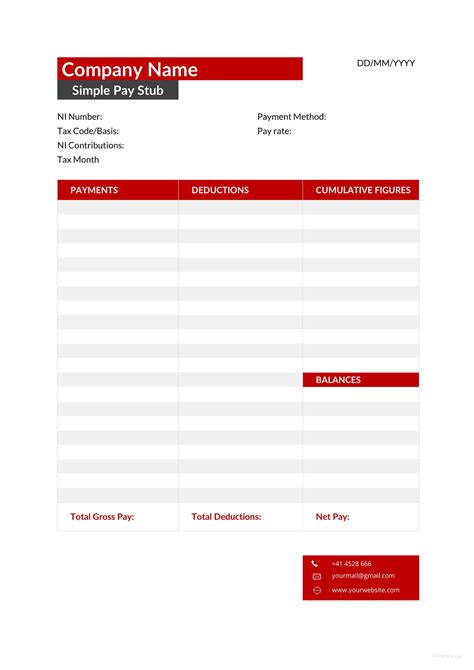

Gallery of Pay Stub Templates

Pay Stub Template Gallery

We hope this article has provided you with a comprehensive guide to using a Google Pay Stub Template for easy payroll management. By following the steps outlined above and avoiding common mistakes, you can streamline your payroll process and reduce errors. Remember to keep your template up-to-date and secure to ensure accurate and efficient payroll management.