Managing your finances effectively is crucial for achieving financial stability and security. With the numerous budgeting tools available, finding the right one can be overwhelming. Google Sheets, a free online spreadsheet tool, offers a versatile and customizable solution for budgeting. Here are 7 ways to budget with Google Sheets:

Benefits of Budgeting with Google Sheets

Before we dive into the 7 ways to budget with Google Sheets, let's explore the benefits of using this tool for budgeting:

- Accessibility: Google Sheets is a cloud-based tool, allowing you to access your budget from anywhere, at any time.

- Customization: With Google Sheets, you can create a budget that suits your needs, using formulas and functions to automate calculations.

- Collaboration: Share your budget with a partner or financial advisor, and work together in real-time.

- Automatic backups: Google Sheets automatically saves changes, ensuring your data is safe and up-to-date.

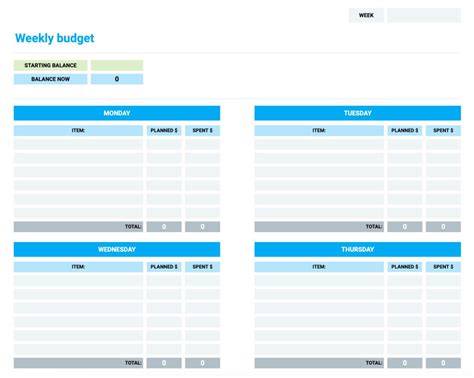

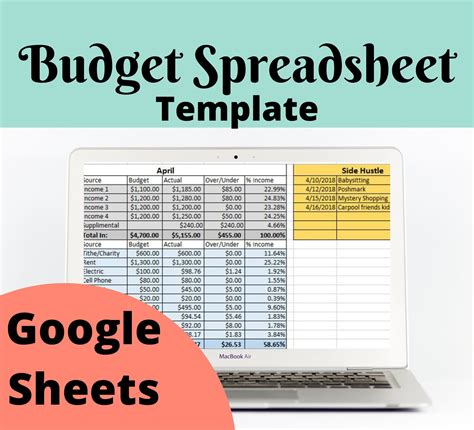

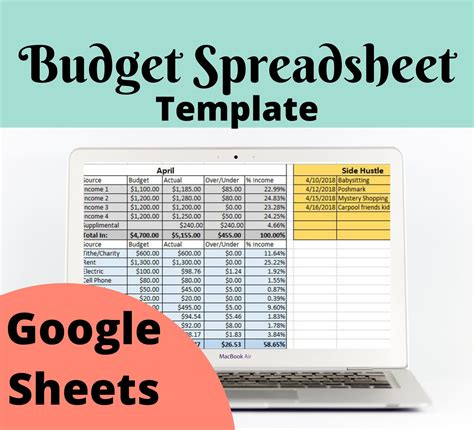

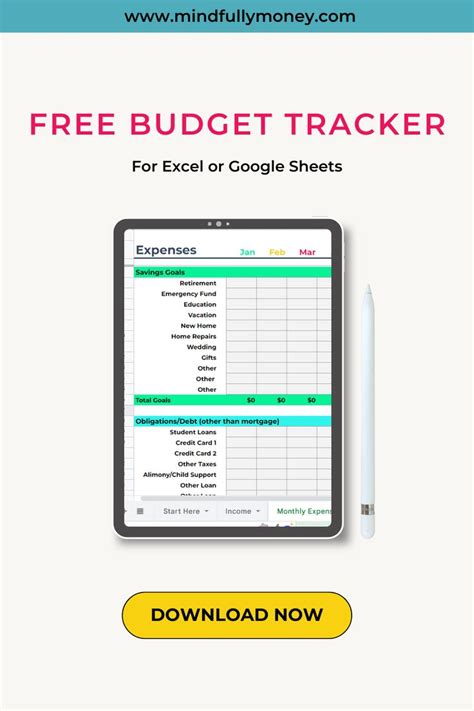

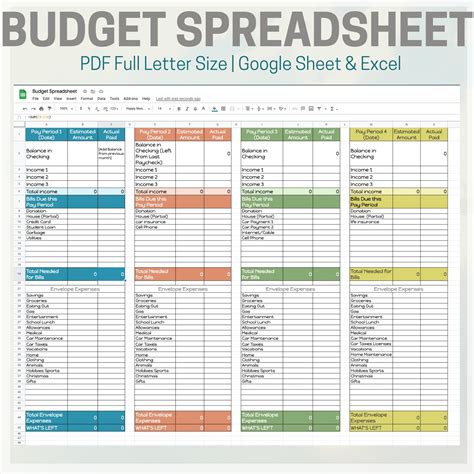

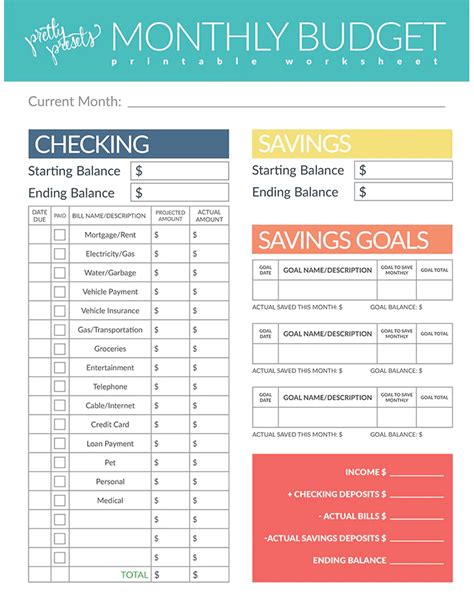

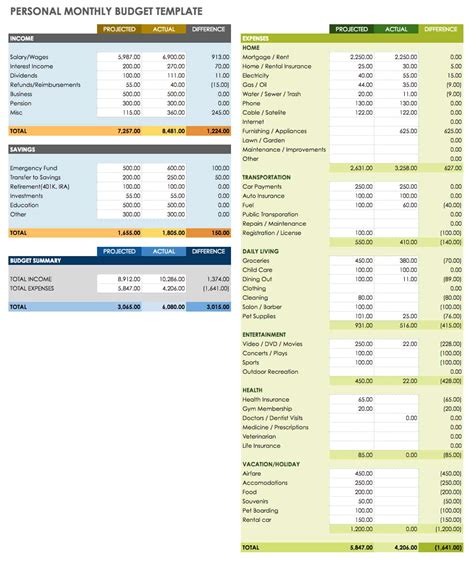

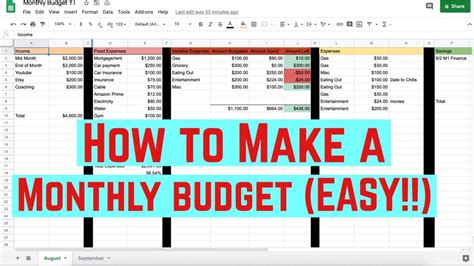

1. Creating a Budget Template

To start budgeting with Google Sheets, create a budget template. This will serve as the foundation for your budget, outlining income, expenses, and savings goals.

To create a budget template:

- Open Google Sheets and create a new spreadsheet.

- Set up the following sheets: Income, Fixed Expenses, Variable Expenses, Savings, and Debt Repayment.

- Create columns for date, category, and amount.

- Use formulas to calculate totals and percentages.

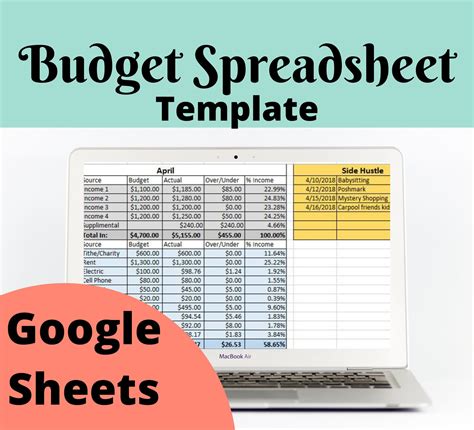

2. Tracking Income

Accurately tracking your income is crucial for creating a realistic budget. Google Sheets allows you to easily record and calculate your income.

To track income:

- Create a table in the Income sheet to record your income.

- Use formulas to calculate total income and average monthly income.

- Set up automatic calculations for income taxes and deductions.

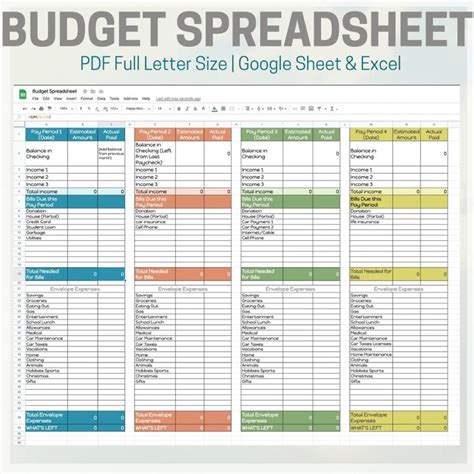

3. Categorizing Expenses

Categorizing expenses helps you identify areas where you can cut back and allocate funds more efficiently. Google Sheets allows you to create custom categories and track expenses.

To categorize expenses:

- Create tables in the Fixed Expenses and Variable Expenses sheets to record expenses.

- Use formulas to calculate totals and percentages for each category.

- Set up automatic calculations for expense trends and alerts.

4. Setting Savings Goals

Saving money is an essential part of any budget. Google Sheets helps you set and track savings goals.

To set savings goals:

- Create a table in the Savings sheet to record savings goals.

- Use formulas to calculate progress toward goals.

- Set up automatic calculations for savings rates and trends.

5. Managing Debt

Google Sheets helps you manage debt by tracking payments, balances, and interest rates.

To manage debt:

- Create a table in the Debt Repayment sheet to record debt information.

- Use formulas to calculate payment schedules and interest rates.

- Set up automatic calculations for debt trends and alerts.

6. Budgeting for Irregular Expenses

Irregular expenses, such as car maintenance or property taxes, can be challenging to budget for. Google Sheets helps you anticipate and prepare for these expenses.

To budget for irregular expenses:

- Create a table to record irregular expenses.

- Use formulas to calculate averages and trends.

- Set up automatic calculations for irregular expense alerts.

7. Reviewing and Adjusting Your Budget

Regularly reviewing and adjusting your budget is crucial for ensuring you're on track to meet your financial goals. Google Sheets makes it easy to review and adjust your budget.

To review and adjust your budget:

- Schedule regular budget reviews.

- Use formulas to calculate budget variances and trends.

- Adjust your budget as needed to stay on track.

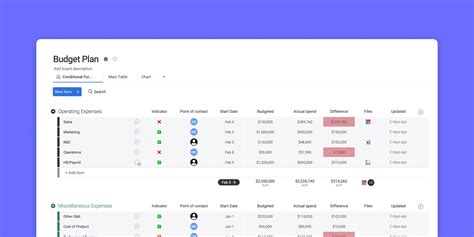

Google Sheets Budgeting Image Gallery

In conclusion, Google Sheets offers a powerful and customizable solution for budgeting. By following these 7 ways to budget with Google Sheets, you can create a budget that helps you achieve financial stability and security. Share your budgeting experiences and tips in the comments below!