Intro

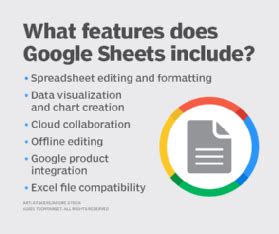

Boost your financial management skills by mastering Google Sheets for balance sheet management. Learn how to create, edit, and analyze balance sheets using Google Sheets advanced features, including budgeting, forecasting, and data visualization. Discover tips and tricks for automating tasks, tracking expenses, and making data-driven decisions with this comprehensive guide.

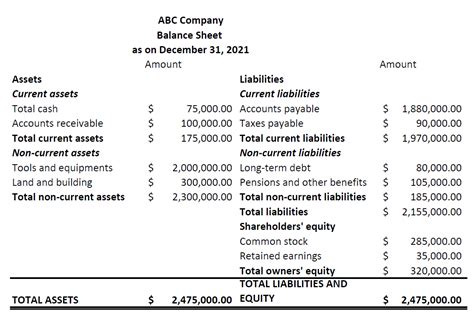

Google Sheets has revolutionized the way businesses and individuals manage their finances, and one of the most critical aspects of financial management is balance sheet management. A balance sheet provides a snapshot of a company's financial position at a specific point in time, showcasing its assets, liabilities, and equity. In this article, we will explore the world of Google Sheets and how to master it for effective balance sheet management.

As a financial manager, accountant, or business owner, you understand the importance of accurate and up-to-date financial reporting. Google Sheets offers a powerful platform for creating and managing balance sheets, making it an essential tool for anyone involved in financial management. By mastering Google Sheets for balance sheet management, you can streamline your financial reporting, improve accuracy, and make informed business decisions.

Benefits of Using Google Sheets for Balance Sheet Management

Using Google Sheets for balance sheet management offers several benefits, including:

- Real-time collaboration: Multiple users can collaborate on a single balance sheet, ensuring that everyone is on the same page.

- Automatic calculations: Google Sheets performs calculations automatically, reducing errors and saving time.

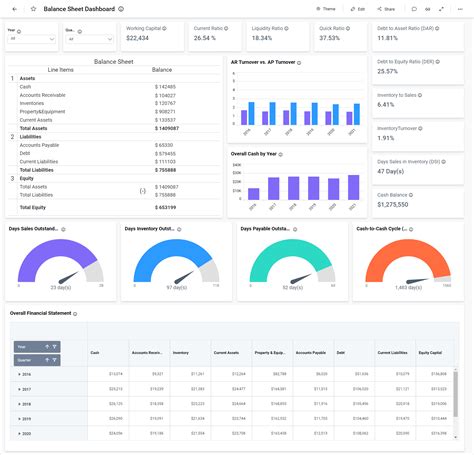

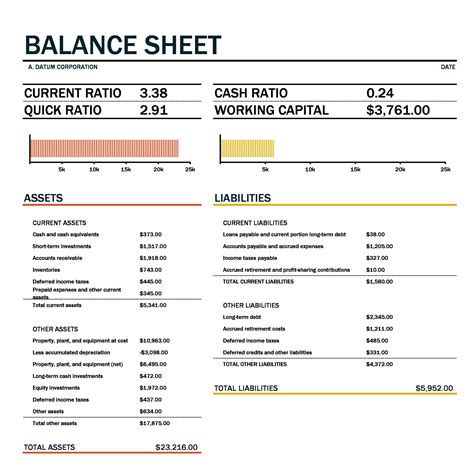

- Data visualization: Sheets provides various chart and graph options to help you visualize your financial data, making it easier to identify trends and patterns.

- Scalability: Google Sheets can handle large datasets, making it suitable for businesses of all sizes.

- Cloud-based storage: Your balance sheets are stored securely in the cloud, allowing you to access them from anywhere and at any time.

Setting Up a Balance Sheet in Google Sheets

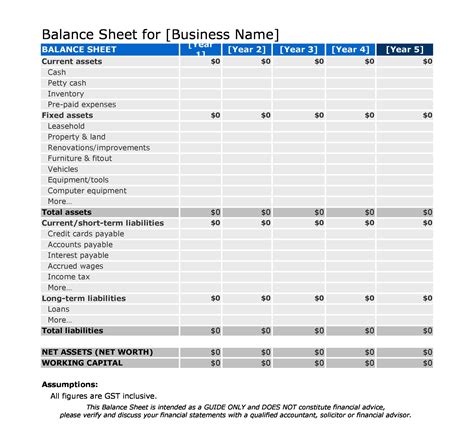

Setting up a balance sheet in Google Sheets is relatively straightforward. Here are the steps to follow:

- Create a new sheet: Open Google Sheets and create a new spreadsheet.

- Set up your columns: Create columns for your assets, liabilities, and equity.

- Enter your data: Enter your financial data into the respective columns.

- Use formulas: Use formulas to calculate totals and percentages.

- Format your sheet: Format your sheet to make it easier to read and understand.

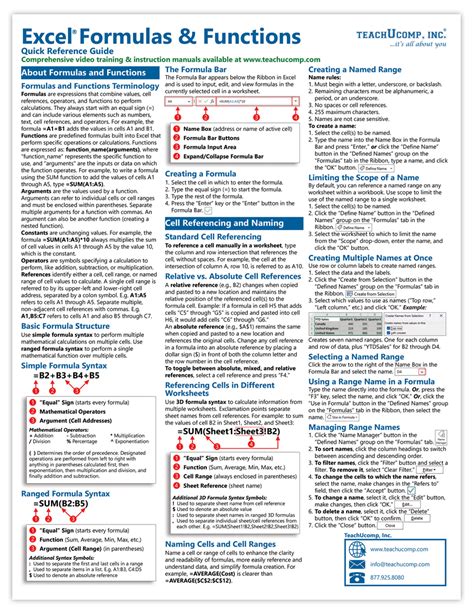

Formulas and Functions for Balance Sheet Management

Google Sheets provides a range of formulas and functions to help you manage your balance sheet. Some of the most commonly used formulas and functions include:

- SUM: Calculates the total value of a range of cells.

- AVERAGE: Calculates the average value of a range of cells.

- PERCENTAGE: Calculates the percentage value of a range of cells.

- IF: Tests a condition and returns a value if true or false.

- VLOOKUP: Looks up a value in a table and returns a corresponding value.

Tips and Tricks for Effective Balance Sheet Management

Here are some tips and tricks to help you manage your balance sheet effectively:

- Use clear and concise labels: Use clear and concise labels for your columns and rows.

- Use formatting: Use formatting to make your sheet easier to read and understand.

- Use formulas: Use formulas to automate calculations and reduce errors.

- Regularly review and update: Regularly review and update your balance sheet to ensure accuracy and relevance.

Common Challenges and Solutions

Some common challenges and solutions when using Google Sheets for balance sheet management include:

- Data accuracy: Ensure that your data is accurate and up-to-date.

- Formula errors: Use error-checking formulas to detect and prevent errors.

- Collaboration: Use real-time collaboration features to ensure that all users are on the same page.

Best Practices for Balance Sheet Management

Here are some best practices for balance sheet management:

- Regularly review and update: Regularly review and update your balance sheet to ensure accuracy and relevance.

- Use clear and concise labels: Use clear and concise labels for your columns and rows.

- Use formatting: Use formatting to make your sheet easier to read and understand.

- Use formulas: Use formulas to automate calculations and reduce errors.

Balance Sheet Management Image Gallery

We hope this article has provided you with a comprehensive guide to mastering Google Sheets for balance sheet management. By following the tips and tricks outlined in this article, you can streamline your financial reporting, improve accuracy, and make informed business decisions. Remember to regularly review and update your balance sheet, use clear and concise labels, and take advantage of the collaboration features offered by Google Sheets. Happy spreadsheeting!