Reconciling your business's bank statements can be a daunting task, but it's essential for maintaining accurate financial records. A well-designed bank reconciliation template can simplify this process, making it easier to identify discrepancies and ensure that your financial statements are accurate. In this article, we'll explore how to use a Google Sheets bank reconciliation template to streamline your accounting tasks.

Why Bank Reconciliation is Important

Bank reconciliation is the process of comparing your business's internal financial records with the records provided by your bank. This process helps to identify any discrepancies or errors that may have occurred, ensuring that your financial statements are accurate and reliable. Regular bank reconciliation can help you:

- Identify and correct errors or unauthorized transactions

- Detect and prevent fraudulent activities

- Ensure that your financial statements are accurate and up-to-date

- Make informed business decisions based on reliable financial data

Benefits of Using a Google Sheets Bank Reconciliation Template

Using a Google Sheets bank reconciliation template offers several benefits, including:

- Easy to set up and use, even for those without extensive accounting experience

- Automates calculations, reducing the risk of human error

- Provides a clear and organized format for comparing internal records with bank statements

- Allows for real-time collaboration and sharing with colleagues or accountants

- Scalable and adaptable to meet the needs of businesses of all sizes

How to Create a Bank Reconciliation Template in Google Sheets

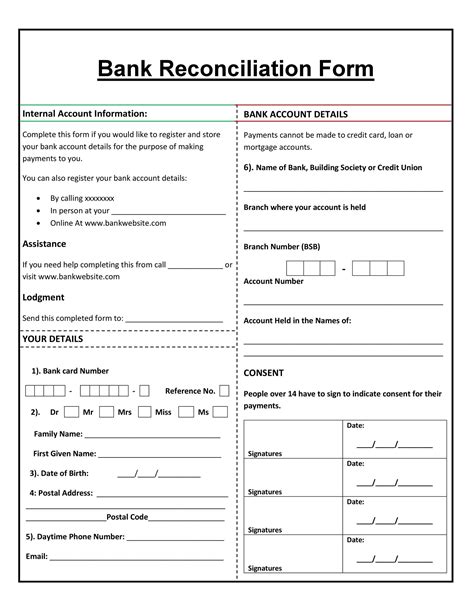

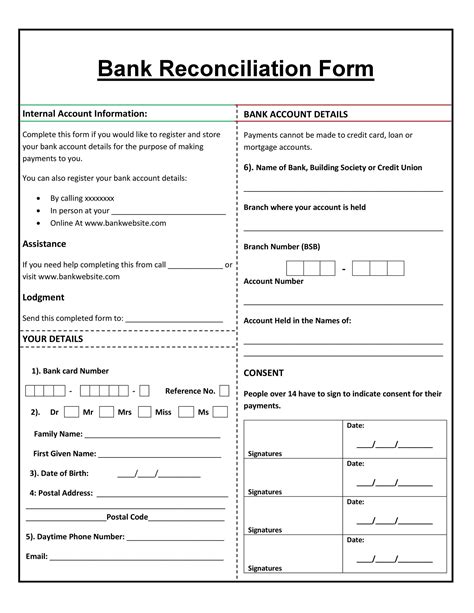

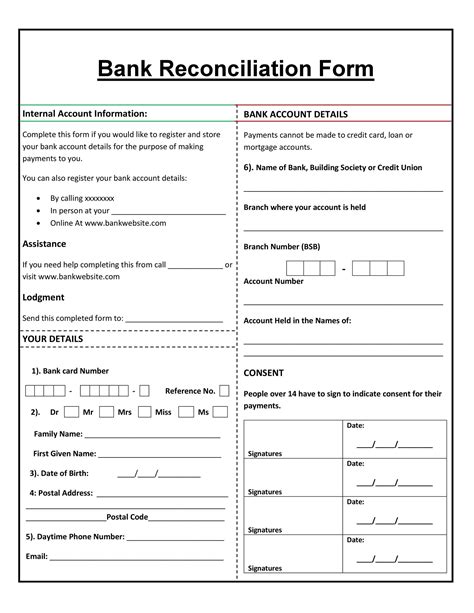

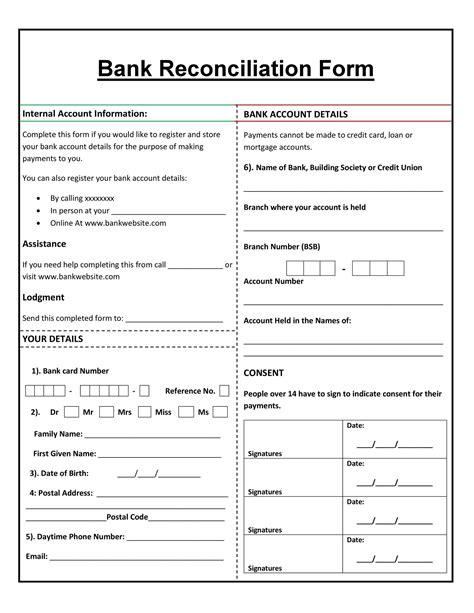

Creating a bank reconciliation template in Google Sheets is a straightforward process. Here's a step-by-step guide to get you started:

- Open Google Sheets and create a new spreadsheet.

- Set up a table with the following columns: Date, Description, Debit, Credit, and Balance.

- Enter your business's internal financial records, including transactions and balances.

- Create a separate table for your bank statement records, including the same columns as above.

- Use formulas to compare the internal records with the bank statement records, highlighting any discrepancies.

- Use conditional formatting to highlight any errors or discrepancies.

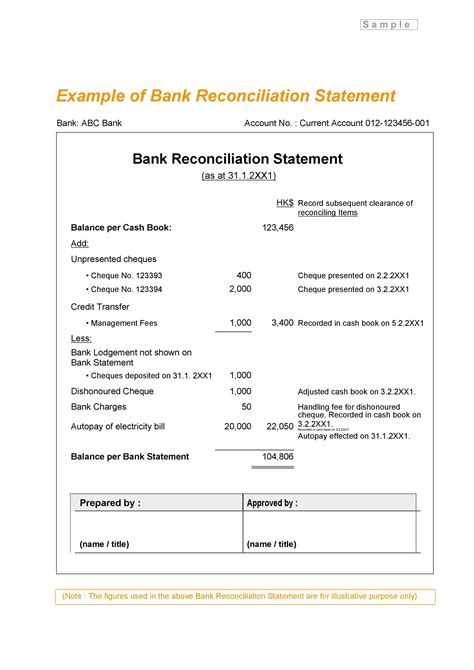

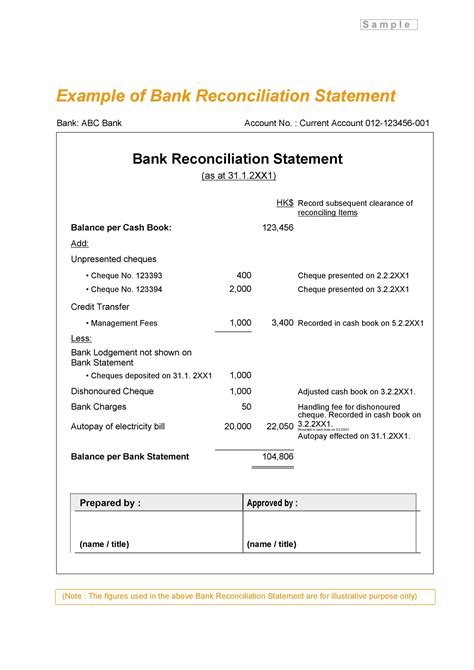

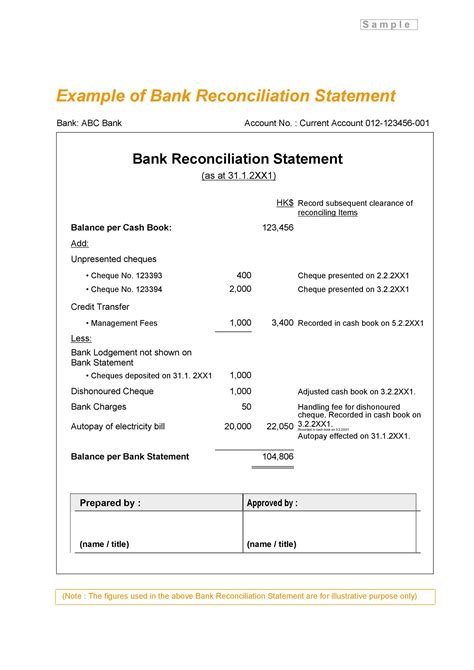

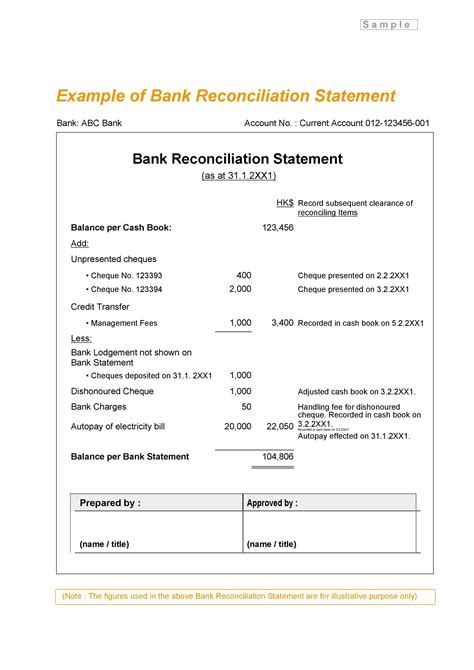

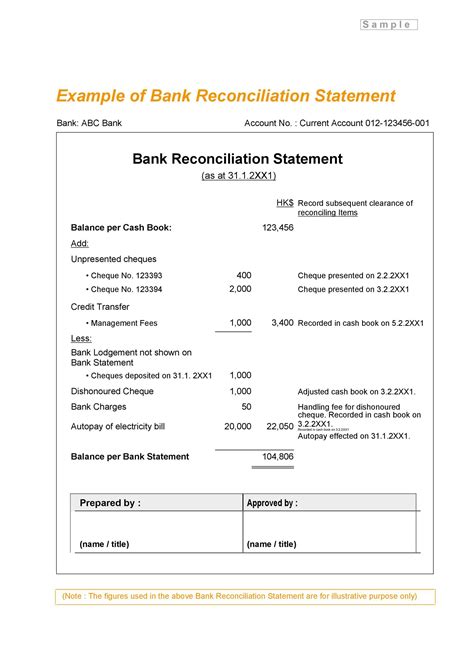

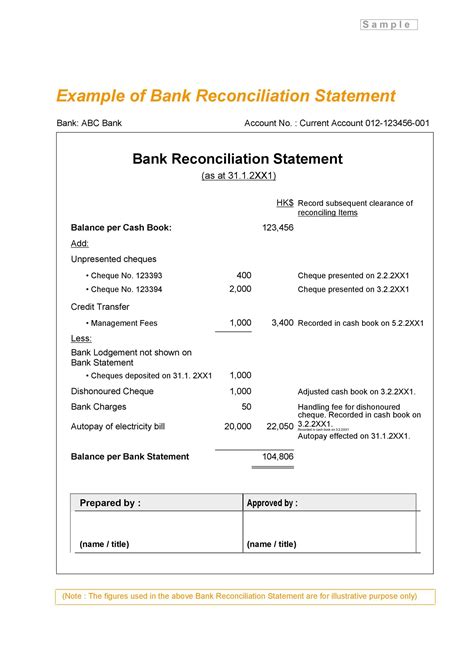

Step-by-Step Example

Here's an example of how to create a simple bank reconciliation template in Google Sheets:

| Date | Description | Debit | Credit | Balance |

|---|---|---|---|---|

| 2023-02-01 | Opening Balance | 10,000.00 | ||

| 2023-02-05 | Transaction 1 | 1,000.00 | 9,000.00 | |

| 2023-02-10 | Transaction 2 | 500.00 | 9,500.00 | |

| 2023-02-15 | Transaction 3 | 2,000.00 | 7,500.00 |

Bank Statement Records:

| Date | Description | Debit | Credit | Balance |

|---|---|---|---|---|

| 2023-02-01 | Opening Balance | 10,000.00 | ||

| 2023-02-05 | Transaction 1 | 1,000.00 | 9,000.00 | |

| 2023-02-10 | Transaction 2 | 500.00 | 9,500.00 | |

| 2023-02-15 | Transaction 3 | 2,000.00 | 7,500.00 |

Reconciliation:

| Date | Description | Debit | Credit | Balance |

|---|---|---|---|---|

| 2023-02-01 | Opening Balance | 10,000.00 | ||

| 2023-02-05 | Transaction 1 | 1,000.00 | 9,000.00 | |

| 2023-02-10 | Transaction 2 | 500.00 | 9,500.00 | |

| 2023-02-15 | Transaction 3 | 2,000.00 | 7,500.00 |

Using formulas and conditional formatting, you can compare the internal records with the bank statement records, highlighting any discrepancies or errors.

Common Bank Reconciliation Errors and How to Avoid Them

Bank reconciliation errors can be costly and time-consuming to correct. Here are some common errors and how to avoid them:

-

Incorrect Opening Balance

+ Ensure that the opening balance in your internal records matches the opening balance on your bank statement. + Verify that all transactions have been correctly recorded and accounted for. -

Missing or Duplicate Transactions

+ Regularly review your internal records and bank statements to ensure that all transactions have been recorded and accounted for. + Use reconciliation software or templates to automate the process and reduce the risk of human error. -

Incorrect Account Numbers or Routing Numbers

+ Verify that all account numbers and routing numbers are accurate and up-to-date. + Use secure and reliable payment processing systems to reduce the risk of errors or unauthorized transactions.

Best Practices for Bank Reconciliation

To ensure accurate and reliable bank reconciliation, follow these best practices:

-

Reconcile Regularly

+ Reconcile your bank statements regularly, ideally on a monthly basis. + Use reconciliation software or templates to automate the process and reduce the risk of human error. -

Verify Account Numbers and Routing Numbers

+ Verify that all account numbers and routing numbers are accurate and up-to-date. + Use secure and reliable payment processing systems to reduce the risk of errors or unauthorized transactions. -

Use Reconciliation Software or Templates

+ Use reconciliation software or templates to automate the process and reduce the risk of human error. + Take advantage of features such as automated calculations, conditional formatting, and real-time collaboration.

Conclusion

Bank reconciliation is a critical task that requires attention to detail and accuracy. By using a Google Sheets bank reconciliation template, you can simplify the process, reduce the risk of human error, and ensure that your financial statements are accurate and reliable. Remember to reconcile regularly, verify account numbers and routing numbers, and use reconciliation software or templates to automate the process. With these best practices, you can streamline your accounting tasks and make informed business decisions based on reliable financial data.

Bank Reconciliation Template Image Gallery

We hope this article has provided you with a comprehensive guide to creating a Google Sheets bank reconciliation template. Remember to share your thoughts and experiences in the comments section below.