Intro

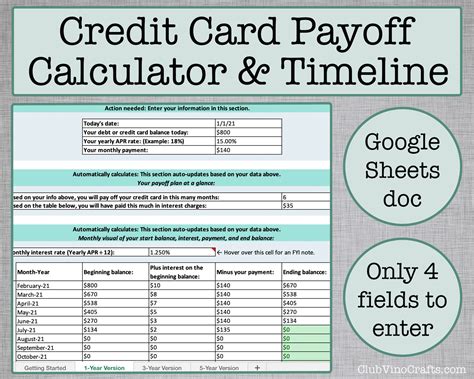

Get out of debt with our free Google Sheets Credit Card Payoff Template And Tracker. Easily track expenses, create a payoff plan, and visualize progress. Includes features for credit card consolidation, debt snowball, and avalanche methods. Say goodbye to high-interest rates and hello to financial freedom.

Managing your credit card debt can be a daunting task, but with the right tools, you can take control of your finances and achieve financial freedom. A Google Sheets credit card payoff template and tracker is a great resource to help you organize your debt, create a plan, and stay on track. In this article, we'll explore the benefits of using a Google Sheets template, how to create your own, and provide a step-by-step guide on how to use it to pay off your credit card debt.

Why Use a Google Sheets Credit Card Payoff Template?

Using a Google Sheets credit card payoff template offers several benefits:

- Organization: A template helps you keep track of multiple credit cards, due dates, interest rates, and balances in one place.

- Customization: You can tailor the template to fit your specific needs and debt repayment goals.

- Automated calculations: Google Sheets performs calculations for you, so you can focus on making payments and tracking progress.

- Accessibility: You can access your template from anywhere, at any time, and make updates in real-time.

- Free: Google Sheets is a free service, making it an affordable solution for managing your debt.

Creating Your Own Google Sheets Credit Card Payoff Template

To create your own template, follow these steps:

- Open Google Sheets and create a new spreadsheet.

- Set up the following columns:

- Credit Card Name

- Balance

- Interest Rate

- Minimum Payment

- Due Date

- Payment Amount

- Format the columns to fit your needs, and add any additional columns you want to track, such as payment history or credit score.

- Create a table or chart to visualize your debt and track progress.

How to Use a Google Sheets Credit Card Payoff Template

To get the most out of your template, follow these steps:

- Enter your credit card information: Fill in the columns with your credit card details, including balance, interest rate, and due date.

- Set your debt repayment goals: Determine how much you want to pay each month and when you want to pay off each credit card.

- Calculate your payments: Use formulas to calculate your monthly payments based on your goals and credit card details.

- Track your progress: Update your template regularly to reflect payments made and progress toward your goals.

- Adjust your plan as needed: If you encounter any setbacks or changes in your financial situation, adjust your template to reflect new information.

Benefits of Using a Google Sheets Credit Card Payoff Template

Using a Google Sheets credit card payoff template offers several benefits:

- Increased motivation: Seeing your debt progress in a visual format can help motivate you to stick to your plan.

- Improved financial organization: A template helps you keep track of multiple credit cards and due dates, reducing stress and anxiety.

- Better decision-making: With all your credit card information in one place, you can make informed decisions about your debt repayment strategy.

- Faster debt repayment: By creating a plan and tracking progress, you can pay off your credit card debt faster and save money on interest.

Common Debt Repayment Strategies

When using a Google Sheets credit card payoff template, you can choose from several debt repayment strategies:

- Snowball method: Pay off credit cards with the smallest balances first, while making minimum payments on other cards.

- Avalanche method: Pay off credit cards with the highest interest rates first, while making minimum payments on other cards.

- Debt consolidation: Combine multiple credit card balances into one loan with a lower interest rate and a single monthly payment.

Tips for Paying Off Credit Card Debt

- Make more than the minimum payment: Paying more than the minimum payment can help you pay off your debt faster and save money on interest.

- Use the 50/30/20 rule: Allocate 50% of your income toward necessities, 30% toward discretionary spending, and 20% toward debt repayment and savings.

- Consider a balance transfer: If you have good credit, consider transferring your balance to a credit card with a lower interest rate.

Google Sheets Credit Card Payoff Template Gallery

Conclusion

Using a Google Sheets credit card payoff template is a great way to take control of your debt and achieve financial freedom. By following the steps outlined in this article, you can create your own template and start tracking your progress today. Remember to stay motivated, adjust your plan as needed, and consider seeking professional help if you're struggling to pay off your debt. With the right tools and mindset, you can overcome your credit card debt and start building a brighter financial future.