Taking control of your finances and eliminating debt can be a liberating experience. With the right tools and strategies, you can pay off your debts efficiently and start building a more stable financial future. One such tool is a Google Sheets debt payoff template. In this article, we'll explore the benefits of using a debt payoff template, how to create one, and provide you with a free downloadable template to get started.

The Importance of a Debt Payoff Plan

Creating a debt payoff plan is essential for several reasons:

- It helps you understand the scope of your debt and prioritize your payments.

- It provides a clear roadmap for paying off your debts, reducing stress and anxiety.

- It allows you to track your progress and make adjustments as needed.

- It helps you stay motivated and focused on your financial goals.

A debt payoff template can be a valuable resource in this process. By using a template, you can easily organize your debt information, calculate your payments, and track your progress over time.

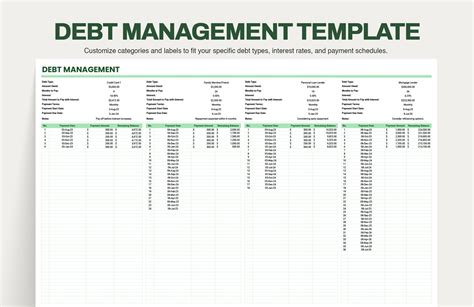

How to Create a Debt Payoff Template

While you can create a debt payoff template from scratch, it's often easier to start with a pre-designed template. Here's a step-by-step guide to creating a basic debt payoff template:

- Open Google Sheets and create a new spreadsheet.

- Set up a table with the following columns:

- Debt Name

- Current Balance

- Interest Rate

- Minimum Payment

- Payoff Goal

- Enter your debt information into the table.

- Use formulas to calculate your total debt, total interest paid, and total payments made.

- Create a chart or graph to visualize your progress.

Free Google Sheets Debt Payoff Template Download

To make it easier for you to get started, we've created a free Google Sheets debt payoff template that you can download and use. This template includes:

- A pre-designed table for entering your debt information

- Formulas for calculating your total debt, total interest paid, and total payments made

- A chart for visualizing your progress

- A section for tracking your payments and progress over time

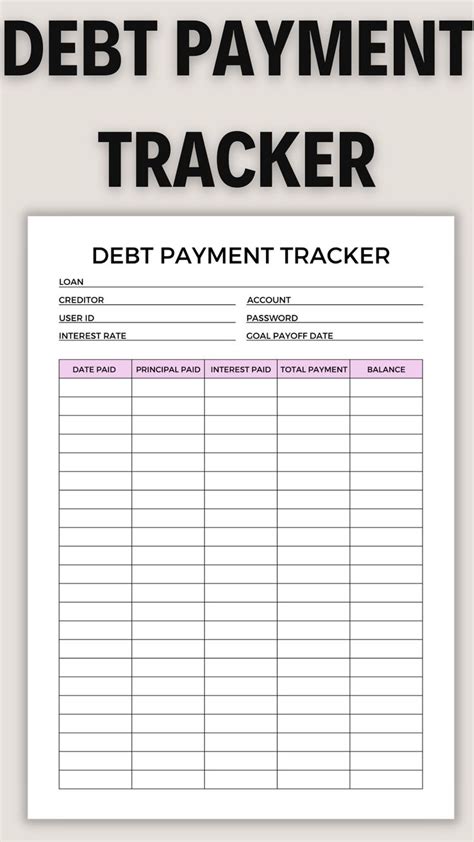

How to Use the Debt Payoff Template

Using the debt payoff template is straightforward. Here's a step-by-step guide:

- Download the template and open it in Google Sheets.

- Enter your debt information into the table, including the debt name, current balance, interest rate, and minimum payment.

- Set a payoff goal for each debt, either by choosing a specific date or a total amount to pay.

- Use the formulas to calculate your total debt, total interest paid, and total payments made.

- Track your payments and progress over time by entering the payment date and amount into the payment log.

- Use the chart to visualize your progress and stay motivated.

Tips for Paying Off Debt

In addition to using a debt payoff template, here are some tips for paying off debt:

- Prioritize your debts by focusing on the ones with the highest interest rates or the smallest balances.

- Consider consolidating your debts into a single loan with a lower interest rate.

- Make more than the minimum payment on your debts each month to pay off the principal balance faster.

- Cut expenses and increase your income to put more money towards your debt.

- Use the snowball method or avalanche method to pay off your debts.

Common Debt Payoff Strategies

There are several debt payoff strategies you can use, including:

- Debt Snowball Method: Pay off your debts in the order of smallest balance to largest, while making minimum payments on the other debts.

- Debt Avalanche Method: Pay off your debts in the order of highest interest rate to lowest, while making minimum payments on the other debts.

- Debt Consolidation: Combine multiple debts into a single loan with a lower interest rate and a single monthly payment.

- Debt Management Plan: Work with a credit counselor to create a plan for paying off your debts over time.

Conclusion

Paying off debt can be a challenging but rewarding experience. By using a debt payoff template and following a debt payoff strategy, you can take control of your finances and start building a more stable financial future. Remember to stay motivated, track your progress, and make adjustments as needed. With time and discipline, you can eliminate your debt and achieve financial freedom.

Gallery of Debt Payoff Template and Strategies

Debt Payoff Template and Strategies Image Gallery