Intro

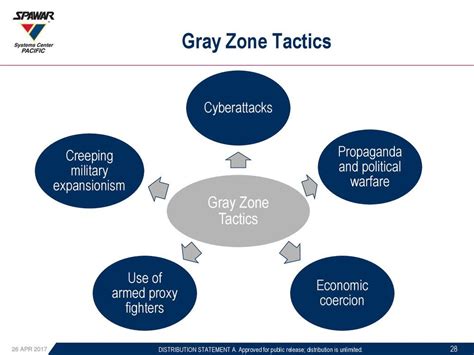

Unlock the secrets of Grayzone operations with our expert guide to the 5 Essential Grayzone Tools Of The Trade. Discover the critical instruments for navigating the blurred lines between war and peace, including disinformation, cyber warfare, and proxy forces. Boost your understanding of modern warfare and stay ahead of the curve.

As a trader, navigating the grayzone can be a daunting task. The grayzone refers to the area between support and resistance levels, where prices tend to consolidate and traders often struggle to make informed decisions. However, with the right tools and strategies, traders can capitalize on the grayzone's unique opportunities. In this article, we will explore five essential grayzone tools of the trade, helping you to improve your trading skills and increase your profitability.

Understanding the Grayzone

The grayzone is a critical area in trading, as it represents a transitional phase between trends. It's where prices adjust, and traders reassess their strategies. The grayzone can be a challenging environment, but it also offers opportunities for traders to adapt and thrive.

Grayzone Characteristics

To effectively navigate the grayzone, traders need to understand its key characteristics. These include:

- Price consolidation: The grayzone is marked by a decrease in price volatility, as buyers and sellers balance each other out.

- Trend transition: The grayzone often occurs during a trend transition, where the market is shifting from an uptrend to a downtrend or vice versa.

- Increased uncertainty: The grayzone is characterized by increased uncertainty, making it challenging for traders to make informed decisions.

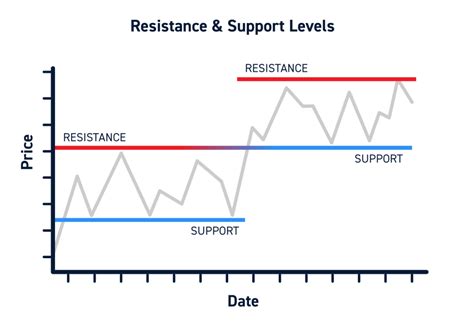

Grayzone Tool #1: Support and Resistance Levels

Support and resistance levels are crucial tools for navigating the grayzone. These levels represent areas where prices have historically bounced or reversed, providing traders with valuable insights into market behavior.

- Support levels: Support levels are areas where prices have bounced back, indicating strong buying interest.

- Resistance levels: Resistance levels are areas where prices have reversed, indicating strong selling interest.

How to Identify Support and Resistance Levels

Traders can identify support and resistance levels using various techniques, including:

- Historical price analysis: Analyzing historical price data to identify areas where prices have consistently bounced or reversed.

- Chart patterns: Identifying chart patterns, such as triangles, wedges, and channels, which can indicate support and resistance levels.

Grayzone Tool #2: Trend Lines

Trend lines are another essential tool for navigating the grayzone. Trend lines connect a series of highs or lows, providing traders with a visual representation of the market's trend.

- Uptrend lines: Uptrend lines connect a series of higher lows, indicating a bullish trend.

- Downtrend lines: Downtrend lines connect a series of lower highs, indicating a bearish trend.

How to Draw Trend Lines

Traders can draw trend lines by connecting a series of highs or lows. The key is to identify the most significant highs and lows, and then draw a line that connects them.

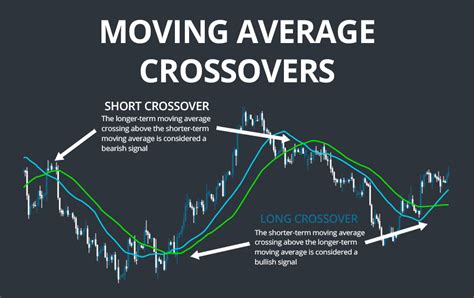

Grayzone Tool #3: Moving Averages

Moving averages are a popular tool for navigating the grayzone. Moving averages provide traders with a smoothed-out representation of price action, helping to filter out noise and identify trends.

- Simple moving averages: Simple moving averages calculate the average price over a specified period.

- Exponential moving averages: Exponential moving averages give more weight to recent prices, making them more sensitive to price changes.

How to Use Moving Averages

Traders can use moving averages in various ways, including:

- Crossover strategies: Using moving averages to identify crossovers, which can indicate trend changes.

- Support and resistance: Using moving averages as support and resistance levels.

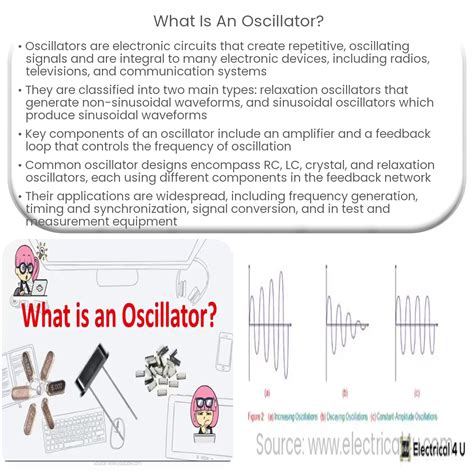

Grayzone Tool #4: Oscillators

Oscillators are a valuable tool for navigating the grayzone. Oscillators measure the speed and magnitude of price movements, helping traders to identify overbought and oversold conditions.

- Relative strength index (RSI): The RSI measures the magnitude of recent price changes, helping traders to identify overbought and oversold conditions.

- Stochastic oscillator: The stochastic oscillator measures the speed of price movements, helping traders to identify trend changes.

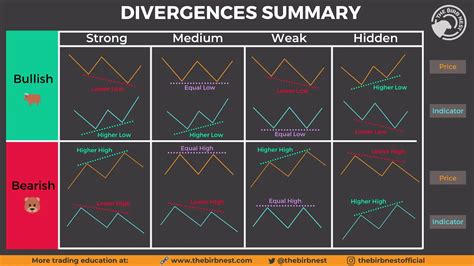

How to Use Oscillators

Traders can use oscillators in various ways, including:

- Overbought and oversold conditions: Using oscillators to identify overbought and oversold conditions, which can indicate trend changes.

- Divergence: Using oscillators to identify divergence, which can indicate a trend change.

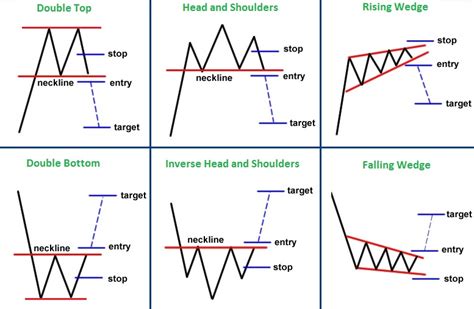

Grayzone Tool #5: Chart Patterns

Chart patterns are a valuable tool for navigating the grayzone. Chart patterns provide traders with a visual representation of market behavior, helping to identify trends and potential trading opportunities.

- Reversal patterns: Reversal patterns, such as head and shoulders and inverse head and shoulders, indicate a trend change.

- Continuation patterns: Continuation patterns, such as triangles and wedges, indicate a continuation of the trend.

How to Identify Chart Patterns

Traders can identify chart patterns by analyzing price action and looking for specific patterns. The key is to identify the most common chart patterns and understand their implications.

Grayzone Trading Image Gallery

By incorporating these five essential grayzone tools into your trading strategy, you'll be better equipped to navigate the challenges of the grayzone and capitalize on its unique opportunities. Remember to stay adaptable, and always be open to learning and improving your skills.

We encourage you to share your thoughts and experiences with grayzone trading in the comments section below. What are your favorite grayzone tools and strategies? How do you adapt to the ever-changing market conditions? Share your insights and help others improve their trading skills.