Perpetuity is a fundamental concept in finance, representing a series of cash flows that continue indefinitely. The perpetuity formula is a widely used tool in finance and accounting to calculate the present value of these infinite cash flows. Excel, being a popular spreadsheet software, provides an efficient way to calculate the perpetuity formula. In this article, we will explore the growing perpetuity formula in Excel and provide a step-by-step guide on how to use it.

Importance of Perpetuity Formula in Finance

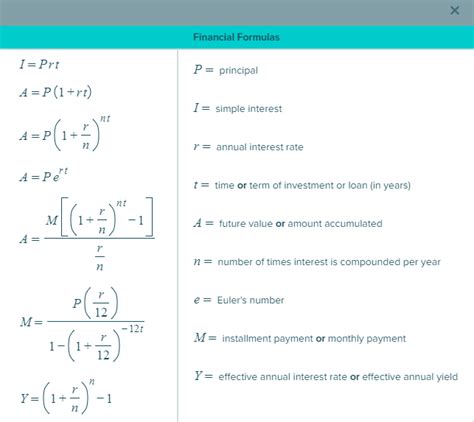

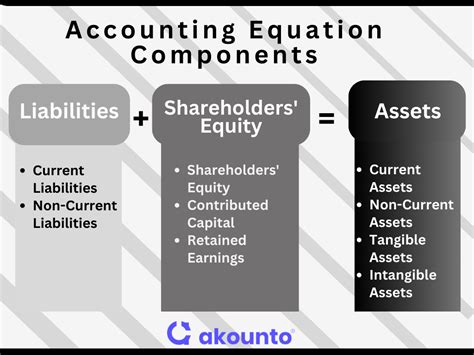

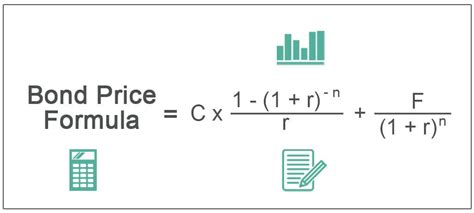

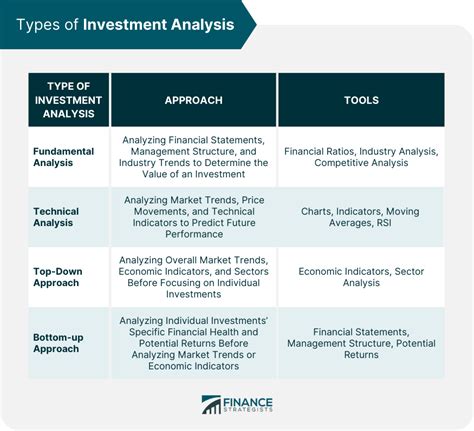

The perpetuity formula is crucial in finance as it helps investors, analysts, and businesses evaluate the present value of infinite cash flows. This formula is commonly used in stock valuation, bond pricing, and capital budgeting decisions. The growing perpetuity formula, in particular, is useful when the cash flows are expected to grow at a constant rate.

Understanding the Growing Perpetuity Formula

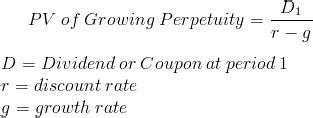

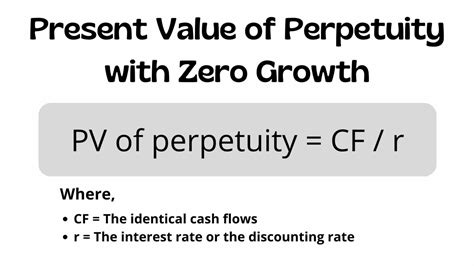

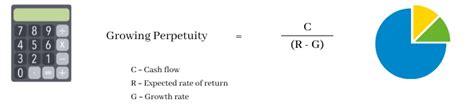

The growing perpetuity formula is represented as:

PV = PMT / (r - g)

Where: PV = Present Value PMT = Periodic Cash Flow r = Discount Rate g = Growth Rate

This formula calculates the present value of a perpetual stream of cash flows that grow at a constant rate (g).

Using the Growing Perpetuity Formula in Excel

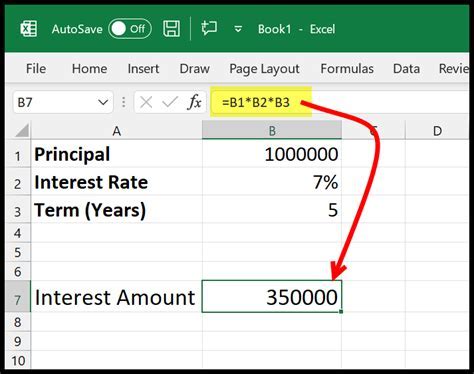

Excel provides several ways to calculate the growing perpetuity formula. Here are the steps to calculate the formula using Excel:

- Enter the periodic cash flow (PMT) in a cell.

- Enter the discount rate (r) in another cell.

- Enter the growth rate (g) in another cell.

- Use the formula: =PMT/(r-g)

Example of Growing Perpetuity Formula in Excel

Suppose we want to calculate the present value of a perpetual stream of cash flows that grow at a constant rate of 3% per annum. The periodic cash flow is $1,000, and the discount rate is 8%. We can use the growing perpetuity formula in Excel as follows:

| Cell | Value |

|---|---|

| A1 | $1,000 (PMT) |

| B1 | 8% (r) |

| C1 | 3% (g) |

| D1 | =A1/(B1-C1) |

The result in cell D1 will be the present value of the perpetual stream of cash flows.

Benefits of Using the Growing Perpetuity Formula in Excel

Using the growing perpetuity formula in Excel provides several benefits, including:

-

Easy Calculation

The formula is easy to calculate in Excel, and it saves time and effort.

-

Accuracy

The formula provides accurate results, which is essential in finance and accounting.

-

Flexibility

The formula can be used to calculate the present value of different types of cash flows, including growing perpetuities.

Common Errors in Calculating the Growing Perpetuity Formula in Excel

When calculating the growing perpetuity formula in Excel, common errors include:

-

Incorrect Formula

Using an incorrect formula or syntax can result in incorrect results.

-

Incorrect Inputs

Entering incorrect values for the periodic cash flow, discount rate, or growth rate can result in incorrect results.

Best Practices for Using the Growing Perpetuity Formula in Excel

To get the most out of the growing perpetuity formula in Excel, follow these best practices:

-

Use a Consistent Formula

Use a consistent formula and syntax to avoid errors.

-

Verify Inputs

Verify the inputs for the periodic cash flow, discount rate, and growth rate to ensure accuracy.

Perpetuity Formula Image Gallery

We hope this article has provided a comprehensive guide to the growing perpetuity formula in Excel. By following the steps and best practices outlined in this article, you can easily calculate the present value of a perpetual stream of cash flows that grow at a constant rate.