The importance of maintaining a good credit score cannot be overstated. It affects various aspects of our lives, from securing loans and credit cards to renting apartments and even getting hired for certain jobs. One of the factors that can significantly impact our credit score is the presence of hard inquiries on our credit report. These inquiries occur when a lender or creditor checks our credit report as part of the loan or credit application process. While a single hard inquiry may not drastically lower our credit score, multiple inquiries within a short period can have a more substantial negative impact. Fortunately, there are steps we can take to remove hard inquiries from our credit report, and it all starts with understanding the process and using the right strategies.

Here's what you need to know about removing hard inquiries from your credit report and a sample letter to help you get started.

Understanding Hard Inquiries

Before we dive into the process of removing hard inquiries, it's essential to understand what they are and how they affect our credit score. Hard inquiries, also known as hard pulls, occur when a lender or creditor checks our credit report as part of the loan or credit application process. This type of inquiry is usually done with our permission and can slightly lower our credit score. Soft inquiries, on the other hand, occur when we check our own credit report or when a lender checks our report without our permission. Soft inquiries do not affect our credit score.

Why Remove Hard Inquiries?

While a single hard inquiry may not significantly lower our credit score, multiple inquiries within a short period can have a more substantial negative impact. This is because credit scoring models view multiple inquiries as a sign of increased credit risk. By removing hard inquiries from our credit report, we can potentially improve our credit score and increase our chances of getting approved for loans and credit cards.

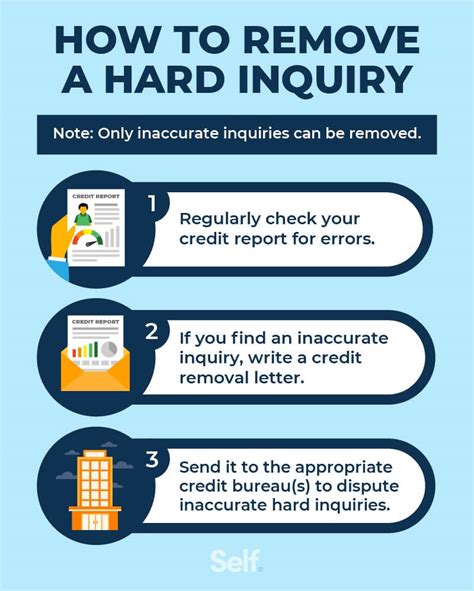

How to Remove Hard Inquiries

Removing hard inquiries from our credit report requires a strategic approach. Here are the steps we can follow:

- Obtain a copy of our credit report: We can request a free copy of our credit report from each of the three major credit reporting agencies (Experian, TransUnion, and Equifax) once a year from AnnualCreditReport.com.

- Identify the hard inquiries: Review our credit report and identify the hard inquiries we want to remove.

- Verify the inquiries: Contact the creditor or lender who made the inquiry and verify that the inquiry was indeed made.

- Dispute the inquiries: If the creditor or lender confirms that the inquiry was made, we can dispute the inquiry with the credit reporting agency.

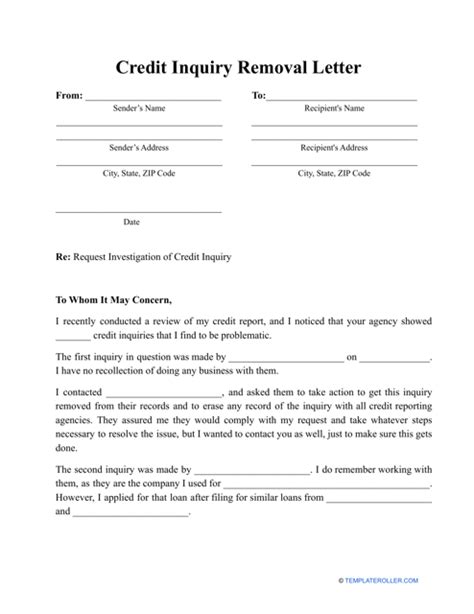

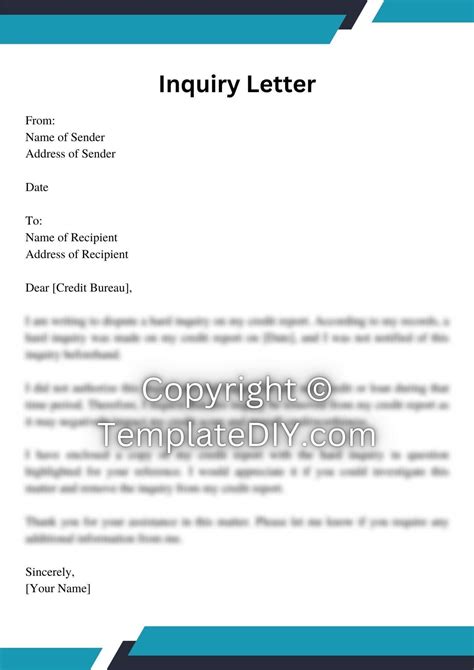

Sample Letter to Remove Hard Inquiries

Here's a sample letter we can use to remove hard inquiries from our credit report:

[Our Name] [Our Address] [City, State, Zip] [Email Address] [Date]

[Credit Reporting Agency's Name] [Credit Reporting Agency's Address] [City, State, Zip]

Dear [Credit Reporting Agency's Representative],

Re: Request to Remove Hard Inquiries from Credit Report

I am writing to request that you remove the following hard inquiries from my credit report:

- Inquiry from [Creditor's Name] on [Date of Inquiry]

- Inquiry from [Creditor's Name] on [Date of Inquiry]

- Inquiry from [Creditor's Name] on [Date of Inquiry]

I have reviewed my credit report and verified that these inquiries were made without my permission. I have contacted the creditors and they have confirmed that the inquiries were made in error.

I would appreciate it if you could remove these inquiries from my credit report as soon as possible. Please let me know if you need any additional information from me to process my request.

Thank you for your prompt attention to this matter.

Sincerely,

[Our Name]

Tips and Strategies

Here are some additional tips and strategies to help us remove hard inquiries from our credit report:

- Monitor our credit report regularly: Regularly reviewing our credit report can help us identify and dispute hard inquiries more quickly.

- Dispute multiple inquiries at once: If we have multiple hard inquiries from the same creditor or lender, we can dispute them all at once.

- Use a credit repair service: If we're not comfortable disputing hard inquiries on our own, we can consider hiring a credit repair service to do it for us.

- Avoid applying for multiple credit cards or loans: Applying for multiple credit cards or loans within a short period can lead to multiple hard inquiries, which can negatively impact our credit score.

Gallery of Removing Hard Inquiries

Removing Hard Inquiries from Credit Report Image Gallery

Final Thoughts

Removing hard inquiries from our credit report requires a strategic approach, but it can be done. By understanding the process and using the right strategies, we can potentially improve our credit score and increase our chances of getting approved for loans and credit cards. Remember to monitor our credit report regularly, dispute multiple inquiries at once, and avoid applying for multiple credit cards or loans within a short period. If we're not comfortable disputing hard inquiries on our own, we can consider hiring a credit repair service to do it for us.

We hope this article has provided you with valuable information on removing hard inquiries from your credit report. If you have any questions or comments, please feel free to share them with us below.