Intro

Raising capital for a hedge fund requires a comprehensive and well-structured Private Placement Memorandum (PPM). A PPM is a critical document that outlines the terms and conditions of the investment, including the fund's strategy, risks, and fees. In this article, we will provide a detailed guide on creating a hedge fund PPM template, including the essential sections, best practices, and regulatory requirements.

Importance of a Private Placement Memorandum

A PPM serves as a disclosure document that provides prospective investors with a clear understanding of the investment opportunity, including the potential risks and rewards. It is a critical component of the fundraising process, as it helps to establish credibility and transparency with potential investors. A well-structured PPM can also help to mitigate potential legal and regulatory risks.

Key Components of a Hedge Fund PPM Template

A typical hedge fund PPM template should include the following essential sections:

Fund Overview

- Introduction to the fund, including its investment strategy and objectives

- Overview of the fund's management team and their experience

- Description of the fund's structure, including the type of entity and jurisdiction

Investment Strategy

- Detailed description of the fund's investment approach, including the types of assets to be invested in

- Discussion of the fund's risk management strategies

- Overview of the fund's performance metrics and benchmarks

Risk Factors

- Disclosure of the potential risks associated with investing in the fund, including market risk, liquidity risk, and operational risk

- Discussion of the fund's risk management strategies and how they mitigate potential risks

Investment Terms

- Description of the investment terms, including the minimum investment requirement, subscription and redemption procedures, and any applicable fees

- Disclosure of any lock-up periods or restrictions on withdrawals

Fees and Expenses

- Description of the fund's fee structure, including management fees, performance fees, and any other expenses

- Disclosure of any conflicts of interest or potential biases

Regulatory and Tax Considerations

- Overview of the regulatory framework governing the fund, including any applicable laws and regulations

- Discussion of the tax implications of investing in the fund, including any potential tax benefits or liabilities

Offering Terms

- Description of the offering terms, including the amount of capital to be raised, the offering period, and any applicable conditions

- Disclosure of any selling restrictions or limitations on resale

Subscription and Closing Procedures

- Description of the subscription process, including the required documentation and payment procedures

- Overview of the closing procedures, including the timing and mechanics of the closing

Best Practices for Creating a Hedge Fund PPM Template

When creating a hedge fund PPM template, it is essential to keep the following best practices in mind:

- Use clear and concise language, avoiding technical jargon and complex terminology

- Ensure that the PPM is comprehensive and includes all necessary information

- Use a standardized format and structure to make it easy to read and understand

- Include all necessary disclosures and risk warnings

- Review and update the PPM regularly to ensure that it remains accurate and compliant with regulatory requirements

Regulatory Requirements

A hedge fund PPM must comply with various regulatory requirements, including:

- Securities Act of 1933: The PPM must be filed with the Securities and Exchange Commission (SEC) and must include all necessary disclosures and risk warnings.

- Securities Exchange Act of 1934: The PPM must include all necessary information regarding the fund's investment strategy, risks, and fees.

- Investment Company Act of 1940: The PPM must include all necessary information regarding the fund's structure, management, and operations.

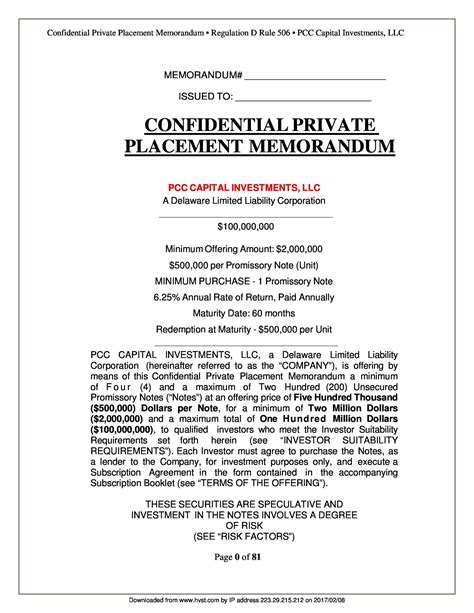

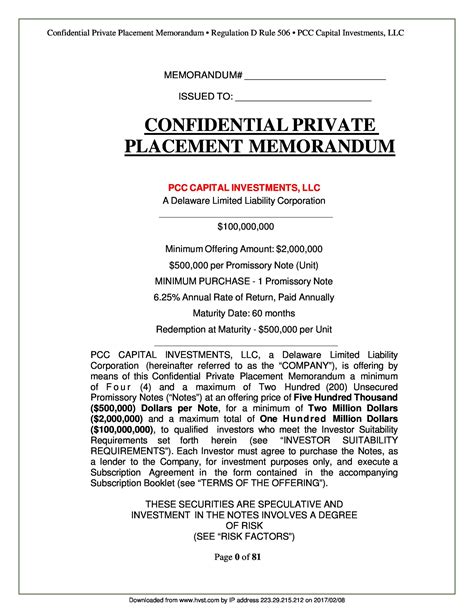

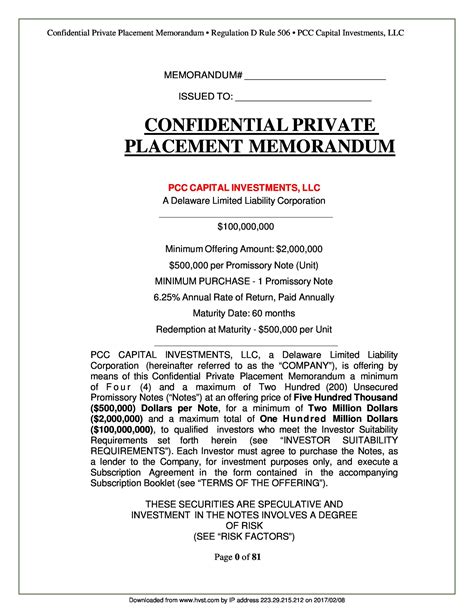

Gallery of Hedge Fund Private Placement Memorandum Templates

Hedge Fund Private Placement Memorandum Template Gallery

Conclusion

Creating a comprehensive and well-structured hedge fund PPM template is essential for raising capital and establishing credibility with potential investors. By following the best practices and regulatory requirements outlined in this article, you can create a PPM that effectively communicates your fund's investment strategy, risks, and fees, and helps to mitigate potential legal and regulatory risks.