Expert Hedge Fund Strategist Insights reveal investment trends, risk management, and portfolio optimization strategies, offering market analysis and asset allocation guidance for investors seeking alpha generation and wealth preservation.

The world of hedge funds is a complex and often mysterious realm, where high-stakes investment decisions are made with the goal of generating significant returns for investors. At the heart of this world are hedge fund strategists, experts who use their knowledge and experience to develop and implement investment strategies that aim to outperform the market. In this article, we will delve into the insights and perspectives of hedge fund strategists, exploring the key trends, challenges, and opportunities that shape their work.

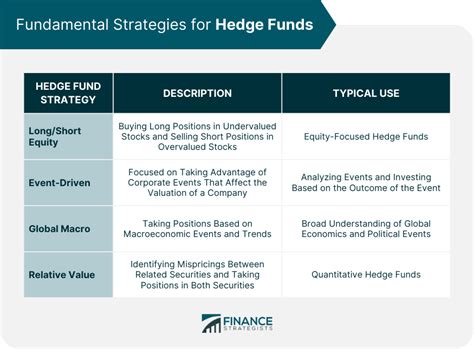

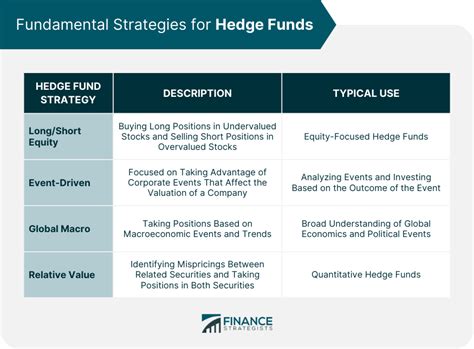

Hedge fund strategists play a critical role in the investment process, as they are responsible for identifying and capitalizing on market opportunities, managing risk, and optimizing portfolio performance. Their work involves a deep understanding of market dynamics, economic trends, and the intricacies of various asset classes. By leveraging their expertise and experience, hedge fund strategists can help investors navigate the complexities of the market and achieve their investment goals. Whether you are an institutional investor, a high-net-worth individual, or simply an investor looking to diversify your portfolio, the insights of hedge fund strategists can provide valuable guidance and perspective.

The importance of hedge fund strategist insights cannot be overstated, as they have the potential to significantly impact investment decisions and outcomes. By staying informed about the latest trends, challenges, and opportunities in the market, investors can make more informed decisions and avoid costly mistakes. Moreover, the expertise of hedge fund strategists can help investors to better understand the complexities of the market and to develop a more nuanced and effective investment strategy. In the following sections, we will explore the key aspects of hedge fund strategist insights, including the current market trends, the role of alternative data, and the importance of risk management.

Current Market Trends

Key Trends to Watch

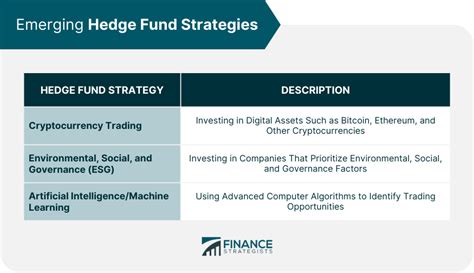

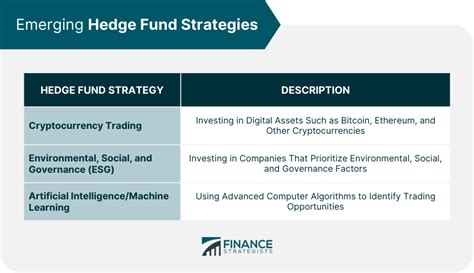

Some of the key trends to watch in the current market include: * The growth of sustainable investing, as investors increasingly prioritize environmental, social, and governance (ESG) factors in their investment decisions * The increasing importance of emerging markets, as countries such as China, India, and Brazil continue to drive global economic growth * The rising use of technology and data analytics in investment decision-making, as hedge fund strategists seek to leverage insights and opportunities from alternative data sources * The ongoing evolution of the global economic landscape, as trade tensions, monetary policy, and geopolitical events continue to shape market dynamicsThe Role of Alternative Data

Benefits of Alternative Data

Some of the benefits of alternative data include: * Enhanced insights and perspectives on market trends and opportunities * Improved risk management and portfolio optimization * Increased ability to identify and capitalize on emerging opportunities * Greater flexibility and adaptability in response to changing market conditionsRisk Management Strategies

Key Risk Management Strategies

Some of the key risk management strategies include: * Diversification, which involves spreading investments across a range of asset classes and sectors to minimize exposure to any one particular market or industry * Hedging, which involves taking positions in securities that offset potential losses in other investments * Stop-loss orders, which involve automatically selling a security when it falls below a certain price or threshold * Regular portfolio rebalancing, which involves periodically reviewing and adjusting the portfolio to ensure that it remains aligned with the client's investment objectives and risk toleranceInvestment Strategies for Success

Key Investment Strategies

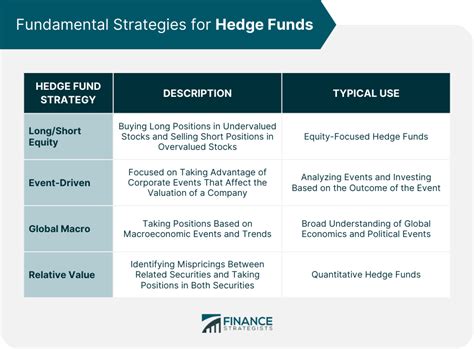

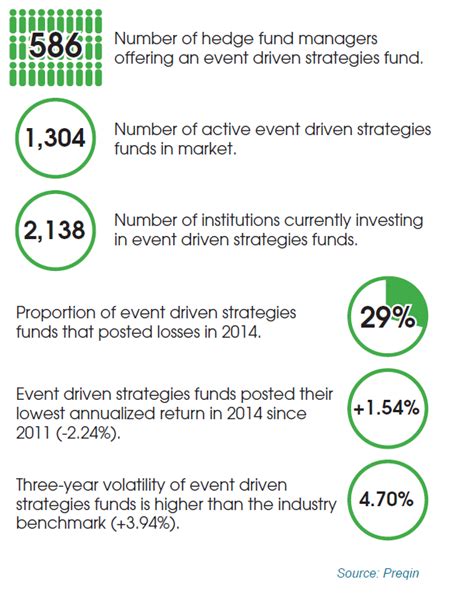

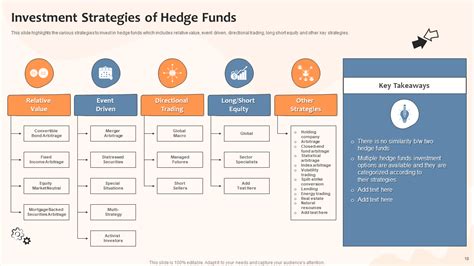

Some of the key investment strategies include: * Long-term investing, which involves taking a patient and disciplined approach to investing, with a focus on long-term growth and wealth creation * Dividend investing, which involves investing in securities that generate regular income through dividends * Value investing, which involves seeking out undervalued or misunderstood securities that have the potential for long-term growth and appreciationEmerging Trends and Opportunities

Key Emerging Trends and Opportunities

Some of the key emerging trends and opportunities include: * The growth of sustainable investing, as investors increasingly prioritize environmental, social, and governance (ESG) factors in their investment decisions * The increasing importance of emerging markets, as countries such as China, India, and Brazil continue to drive global economic growth * The rising use of technology and data analytics in investment decision-making, as hedge fund strategists seek to leverage insights and opportunities from alternative data sourcesConclusion and Future Outlook

Future Outlook

The future outlook for hedge fund strategists is bright, as they continue to play a critical role in the investment process. Some of the key trends and opportunities that are likely to shape the future of hedge fund strategists include: * The growing importance of sustainable investing and ESG factors in investment decisions * The increasing use of technology and data analytics in investment decision-making * The ongoing evolution of the global economic landscape, as trade tensions, monetary policy, and geopolitical events continue to shape market dynamicsHedge Fund Strategist Insights Image Gallery

We hope that this article has provided you with valuable insights and perspectives on the world of hedge fund strategists. Whether you are an institutional investor, a high-net-worth individual, or simply an investor looking to diversify your portfolio, the expertise of hedge fund strategists can provide valuable guidance and perspective. We invite you to share your thoughts and comments on this article, and to explore the many resources and opportunities available to investors in the world of hedge funds. By working together and staying informed, we can navigate the complexities of the market and achieve our investment goals.