Intro

Living on a budget of $100,000 can be a challenging task, especially when it comes to managing finances and making ends meet. However, with a solid plan and a clear understanding of your financial goals, you can make the most of your budget and achieve financial stability. In this article, we will provide a simple 5-step template to help you budget to $100,000.

Creating a budget is not just about cutting back on expenses, but also about making conscious financial decisions that align with your goals and values. By following these 5 simple steps, you can create a budget that works for you and helps you achieve financial success.

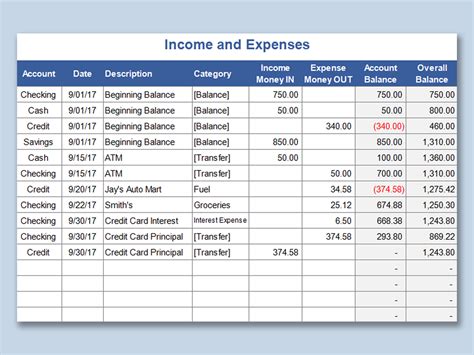

Step 1: Identify Your Income and Expenses

The first step in creating a budget is to identify your income and expenses. Start by calculating your total monthly income from all sources, including your salary, investments, and any side hustles. Next, track your expenses over a month to get a clear picture of where your money is going.

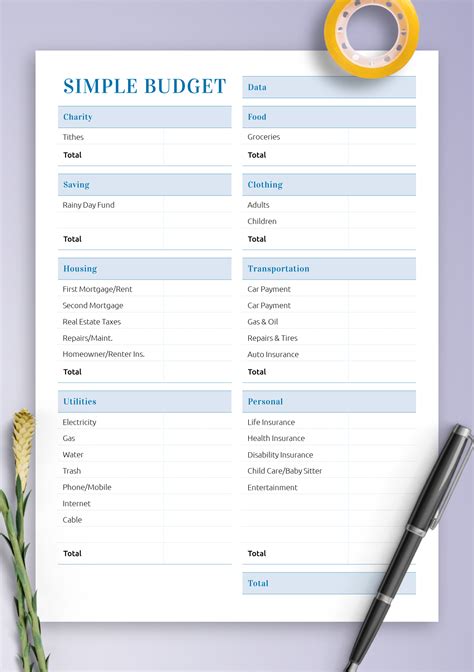

Make a list of all your expenses, including:

- Housing costs (rent/mortgage, utilities, insurance)

- Transportation costs (car loan/lease, gas, insurance)

- Food and dining expenses

- Entertainment expenses (movies, concerts, hobbies)

- Debt payments (credit cards, loans)

- Savings contributions

Step 2: Set Financial Goals

Once you have a clear picture of your income and expenses, it's time to set financial goals. What do you want to achieve with your budget? Do you want to save for a down payment on a house? Pay off debt? Build up your savings?

Make a list of your short-term and long-term financial goals, and prioritize them based on importance and urgency. This will help you allocate your resources effectively and make conscious financial decisions.

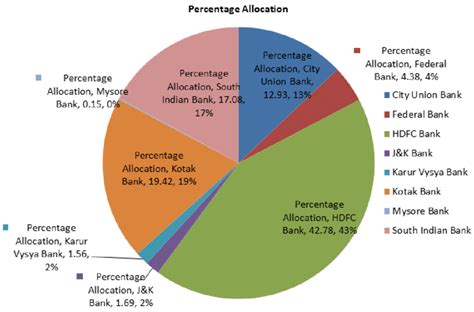

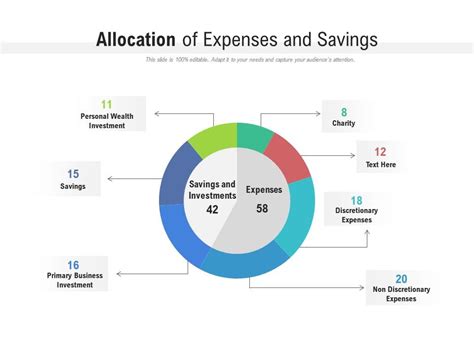

Step 3: Assign Percentages

Now that you have a clear picture of your income, expenses, and financial goals, it's time to assign percentages to each category. A general rule of thumb is to allocate:

- 30% of your income towards housing costs

- 10% towards transportation costs

- 10% towards food and dining expenses

- 5% towards entertainment expenses

- 5% towards debt payments

- 10% towards savings contributions

Adjust these percentages based on your individual circumstances and financial goals.

Step 4: Track and Adjust

Once you have created your budget, it's time to track your expenses and adjust as needed. Use a budgeting app or spreadsheet to track your income and expenses, and make adjustments based on your progress towards your financial goals.

Don't be too hard on yourself if you slip up – simply adjust your budget and move forward. Remember, budgeting is a process, and it takes time and effort to get it right.

Step 5: Review and Revise

Finally, review and revise your budget regularly to ensure it's working for you. Set a regular review schedule, such as every 3-6 months, to assess your progress towards your financial goals.

Make adjustments to your budget as needed, and celebrate your successes along the way. Remember, budgeting is a journey, and it's okay to make changes along the way.

Benefits of Budgeting to $100,000

Budgeting to $100,000 can have numerous benefits, including:

- Financial stability: By creating a budget, you can achieve financial stability and reduce stress and anxiety related to money.

- Increased savings: By allocating a portion of your income towards savings, you can build up your savings over time and achieve long-term financial goals.

- Reduced debt: By prioritizing debt payments, you can reduce your debt burden and free up more money in your budget for savings and investments.

- Improved financial literacy: By tracking your income and expenses, you can gain a better understanding of your financial situation and make more informed financial decisions.

Common Mistakes to Avoid

When budgeting to $100,000, there are several common mistakes to avoid, including:

- Underestimating expenses: Failing to account for all expenses, including irregular expenses such as car maintenance and property taxes.

- Overestimating income: Failing to account for income fluctuations, such as bonuses or overtime pay.

- Not prioritizing savings: Failing to allocate a portion of your income towards savings and investments.

- Not tracking expenses: Failing to track expenses regularly, leading to budgeting errors and overspending.

Gallery of Budgeting to 100k

Budgeting to 100k Image Gallery

Conclusion

Budgeting to $100,000 requires careful planning, discipline, and patience. By following these 5 simple steps, you can create a budget that works for you and helps you achieve financial stability and success. Remember to track your expenses regularly, adjust your budget as needed, and prioritize savings and debt reduction. With time and effort, you can achieve financial freedom and live the life you want.

Share Your Thoughts

What are your experiences with budgeting to $100,000? Share your tips and strategies in the comments below. Don't forget to share this article with your friends and family who may be struggling with budgeting.