Intro

Learn how to calculate APR in Excel with ease. Discover three simple methods to compute Annual Percentage Rate, including formulas and functions. Master financial calculations with our step-by-step guide, covering nominal interest rates, periodic payments, and effective interest rates. Get accurate results and make informed decisions with Excel APR calculations.

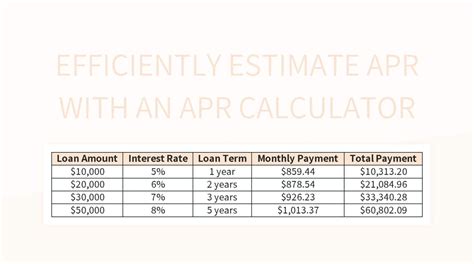

Calculating Annual Percentage Rate (APR) is a crucial step in understanding the true cost of borrowing money. Whether you're a finance professional or an individual looking to make informed decisions about loans or credit cards, knowing how to calculate APR in Excel can be incredibly useful. Here's a comprehensive guide on three ways to calculate APR in Excel, along with practical examples and step-by-step instructions.

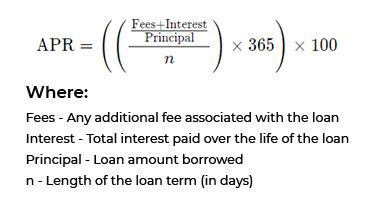

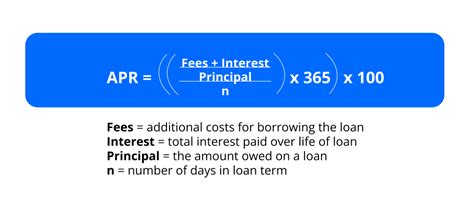

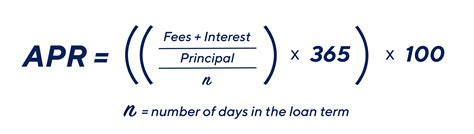

What is APR and Why is it Important?

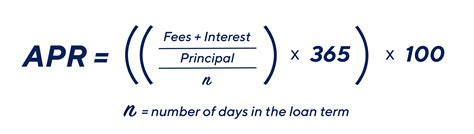

Before we dive into the calculations, let's quickly review what APR is and why it matters. APR represents the interest rate charged on a loan or credit product over a year, including fees and compound interest. It's essential to understand APR because it helps you compare different loan or credit offers and make informed decisions about borrowing money.

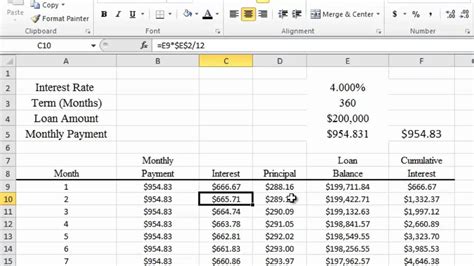

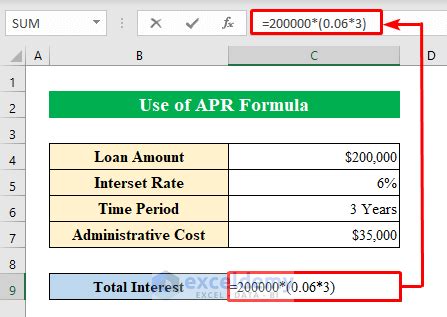

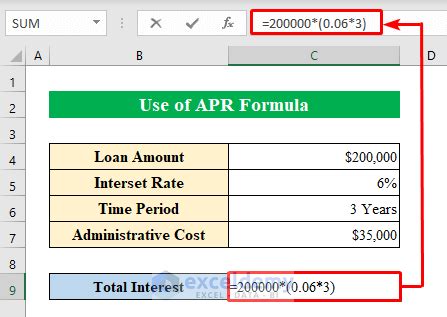

Method 1: Using the APR Formula in Excel

The APR formula in Excel is:

APR = (2 x PMT x (1 + (1 + PMT)^(-n)))^(1/n) - 1

Where:

- PMT = monthly payment

- n = number of payments (i.e., the loan term in months)

To use this formula, follow these steps:

- Enter the monthly payment (PMT) and the number of payments (n) into separate cells.

- Type the APR formula into a new cell, referencing the PMT and n cells.

- Press Enter to calculate the APR.

For example, suppose you have a loan with a monthly payment of $500 and a 5-year loan term (60 months). To calculate the APR using the formula, follow these steps:

| Cell | Formula |

|---|---|

| A1 | 500 (PMT) |

| A2 | 60 (n) |

| A3 | =(2*A1*(1+(1+A1)^(-A2)))^(1/A2)-1 |

Method 2: Using the EFFECT Function in Excel

The EFFECT function in Excel calculates the effective annual interest rate, which is equivalent to APR. The syntax for the EFFECT function is:

EFFECT(nominal_rate, npery)

Where:

- nominal_rate = the nominal interest rate (i.e., the monthly interest rate)

- npery = the number of times interest is compounded per year (i.e., 12 for monthly compounding)

To use the EFFECT function, follow these steps:

- Enter the nominal interest rate (monthly interest rate) and the number of times interest is compounded per year (12) into separate cells.

- Type the EFFECT function into a new cell, referencing the nominal interest rate and npery cells.

- Press Enter to calculate the APR.

For example, suppose you have a credit card with a monthly interest rate of 2% and monthly compounding. To calculate the APR using the EFFECT function, follow these steps:

| Cell | Formula |

|---|---|

| A1 | 0.02 (nominal_rate) |

| A2 | 12 (npery) |

| A3 | =EFFECT(A1,A2) |

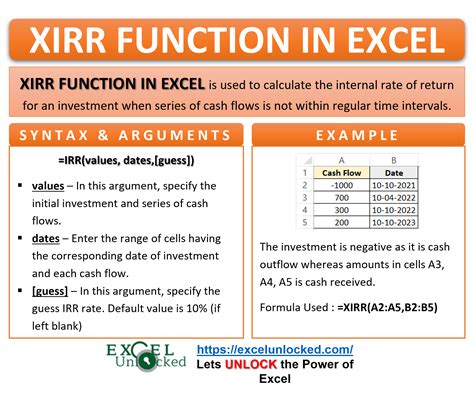

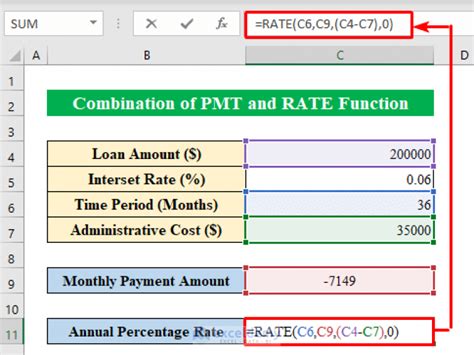

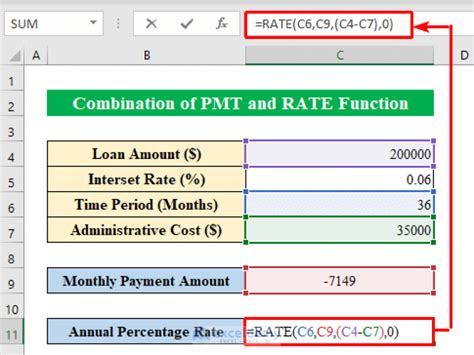

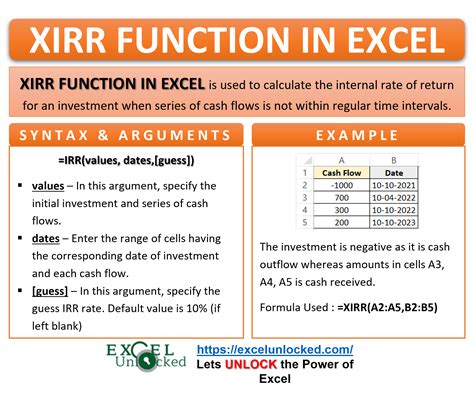

Method 3: Using the XIRR Function in Excel

The XIRR function in Excel calculates the internal rate of return (IRR) for a series of cash flows, which can be used to calculate APR. The syntax for the XIRR function is:

XIRR(values, dates)

Where:

- values = the series of cash flows (i.e., the loan payments)

- dates = the corresponding dates for each cash flow

To use the XIRR function, follow these steps:

- Create a table with the loan payments (cash flows) and corresponding dates.

- Type the XIRR function into a new cell, referencing the cash flow table.

- Press Enter to calculate the APR.

For example, suppose you have a loan with monthly payments of $500 and a 5-year loan term (60 months). To calculate the APR using the XIRR function, follow these steps:

| Cell | Formula |

|---|---|

| A1:B60 | Loan payments ($500) and corresponding dates |

| A61 | =XIRR(A1:B60) |

Conclusion

Calculating APR in Excel is a straightforward process that can be accomplished using various methods. Whether you use the APR formula, the EFFECT function, or the XIRR function, you can easily calculate the APR for a loan or credit product. By understanding how to calculate APR, you can make informed decisions about borrowing money and avoid costly financial mistakes.

We hope this article has helped you learn how to calculate APR in Excel. If you have any questions or need further assistance, please leave a comment below.

APR Calculation in Excel Image Gallery