Intro

Learn how to calculate simple interest in Excel with ease. Discover the formula and step-by-step process to compute interest rates, principal amounts, and time periods. Master the art of simple interest calculation using Excels built-in functions, such as IPMT and CUMIPMT. Get accurate results with minimal effort and boost your financial analysis skills.

Calculating simple interest in Excel is a straightforward process that can be completed with just a few steps. Whether you're a financial analyst, a business owner, or an individual looking to calculate interest on a loan or investment, Excel provides a range of tools and formulas to make the process easy and efficient.

In this article, we'll explore the concept of simple interest, how to calculate it manually, and how to use Excel formulas to calculate simple interest. We'll also cover some examples and provide tips on how to use Excel to streamline your calculations.

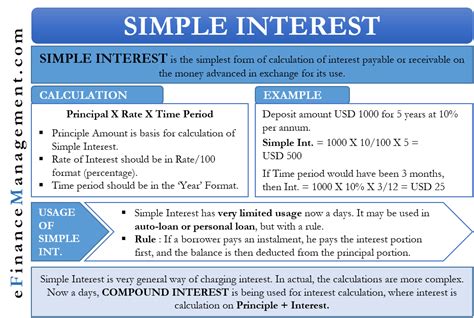

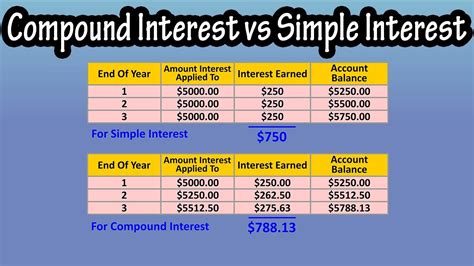

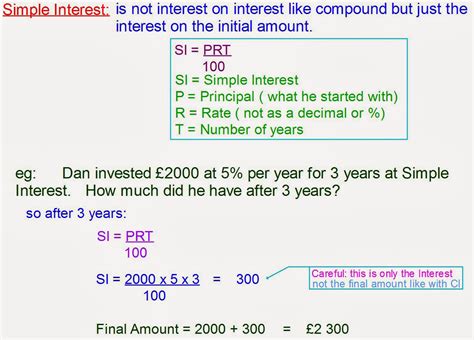

What is Simple Interest?

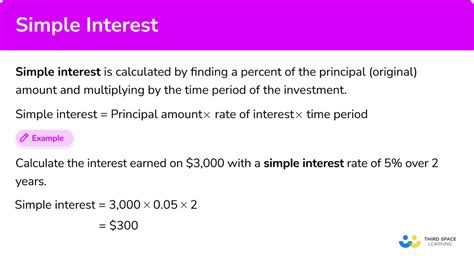

Simple interest is a type of interest calculation where the interest is calculated as a percentage of the principal amount. The interest is calculated over a fixed period of time, and the interest rate remains constant. Simple interest is commonly used in financial calculations, such as calculating interest on a loan or investment.

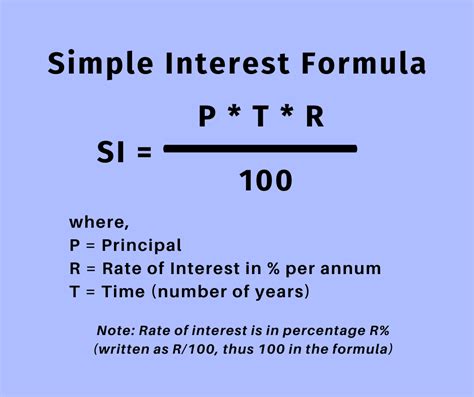

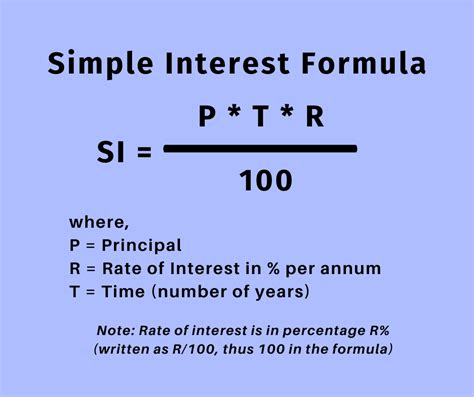

The formula for calculating simple interest is:

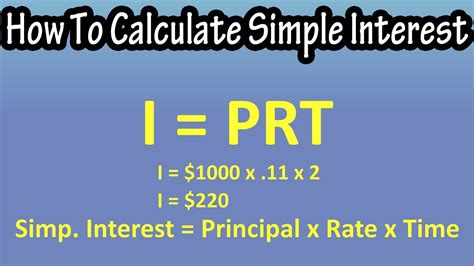

Simple Interest = (Principal x Rate x Time)

Where:

- Principal is the initial amount of money

- Rate is the interest rate as a decimal

- Time is the number of years the money is invested or borrowed for

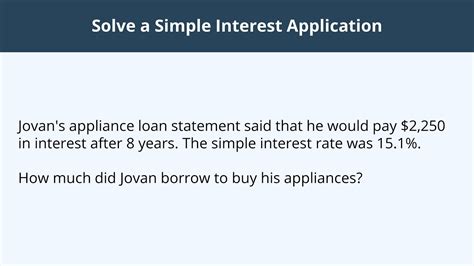

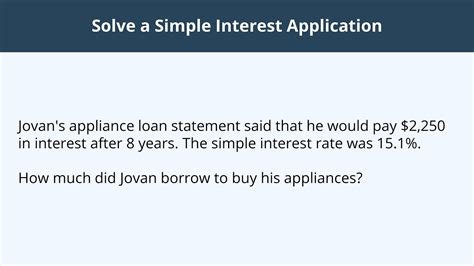

How to Calculate Simple Interest Manually

To calculate simple interest manually, you can use the formula above. For example, let's say you borrow $1,000 at an interest rate of 5% per annum for 2 years.

Simple Interest = ($1,000 x 0.05 x 2) = $100

So, the total amount you need to repay is $1,000 (principal) + $100 (interest) = $1,100.

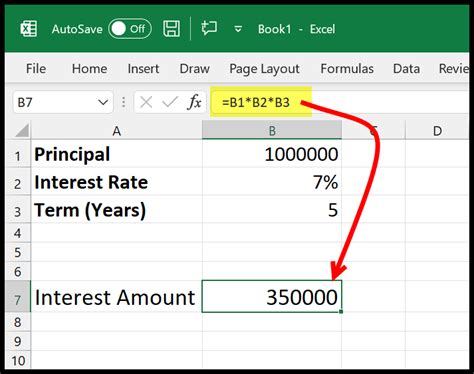

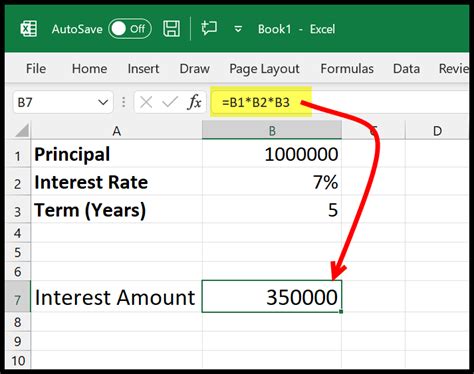

How to Calculate Simple Interest in Excel

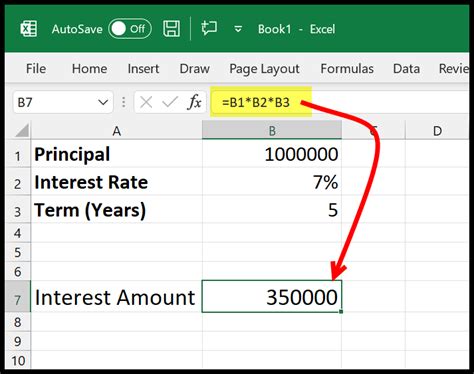

To calculate simple interest in Excel, you can use the following formula:

=Principal x Rate x Time

For example, let's say you want to calculate the simple interest on a loan of $1,000 at an interest rate of 5% per annum for 2 years.

| Principal | Rate | Time | Simple Interest |

|---|---|---|---|

| 1000 | 0.05 | 2 | =A2B2C2 |

Where A2 is the principal, B2 is the rate, and C2 is the time.

The formula will calculate the simple interest as $100.

Using the IPMT Function in Excel

Excel also provides a built-in function called IPMT (Interest Payment) that can be used to calculate simple interest. The IPMT function takes the following arguments:

IPMT(rate, per, nper, pv, [fv], [type])

Where:

- rate is the interest rate

- per is the payment period

- nper is the total number of payments

- pv is the present value (principal)

- fv is the future value (optional)

- type is the payment type (optional)

For example, to calculate the simple interest on a loan of $1,000 at an interest rate of 5% per annum for 2 years, you can use the following formula:

=IPMT(0.05, 2, 1, 1000)

The formula will calculate the simple interest as $100.

Benefits of Using Excel to Calculate Simple Interest

Using Excel to calculate simple interest provides several benefits, including:

- Accuracy: Excel formulas can help reduce errors and ensure accurate calculations.

- Efficiency: Excel formulas can save time and effort compared to manual calculations.

- Flexibility: Excel formulas can be easily modified to accommodate different interest rates, principal amounts, and time periods.

- Scalability: Excel formulas can be used to calculate simple interest on large datasets.

Common Applications of Simple Interest Calculations

Simple interest calculations have a range of applications in finance, including:

- Calculating interest on loans and credit cards

- Calculating interest on investments and savings accounts

- Calculating interest on mortgages and other types of debt

- Calculating interest on business loans and lines of credit

Conclusion

Calculating simple interest in Excel is a straightforward process that can be completed with just a few steps. By using the simple interest formula or the IPMT function, you can quickly and accurately calculate simple interest on a range of financial instruments. Whether you're a financial analyst, a business owner, or an individual looking to calculate interest on a loan or investment, Excel provides a range of tools and formulas to make the process easy and efficient.

Simple Interest Calculations Image Gallery

We hope this article has helped you understand how to calculate simple interest in Excel. If you have any questions or need further assistance, please don't hesitate to comment below.