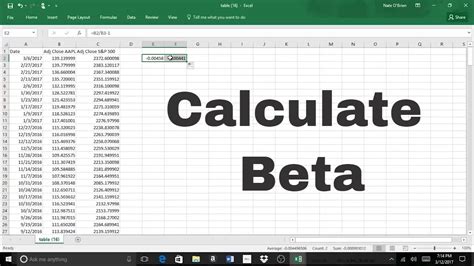

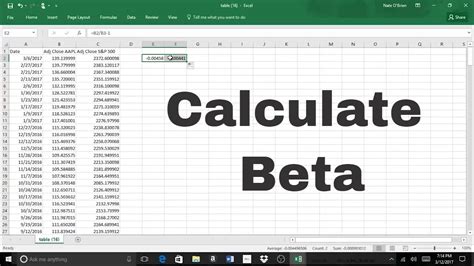

Calculating beta, a measure of a stock's volatility relative to the overall market, is a crucial task for investors and financial analysts. Excel, with its powerful tools and functions, makes it easier to calculate beta in various ways. In this article, we will explore five different methods to calculate beta using Excel, along with their respective formulas, examples, and practical applications.

Why Calculate Beta?

Before we dive into the methods, it's essential to understand why calculating beta is important. Beta measures the systematic risk of a stock, which is the risk that cannot be diversified away. A beta of 1 indicates that the stock's volatility is equal to the market's volatility, while a beta greater than 1 indicates higher volatility, and a beta less than 1 indicates lower volatility. By calculating beta, investors can make informed decisions about their investments and manage their portfolios more effectively.

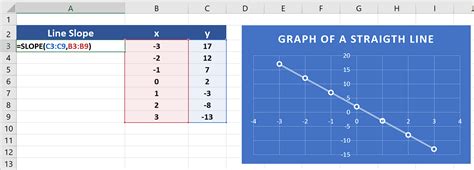

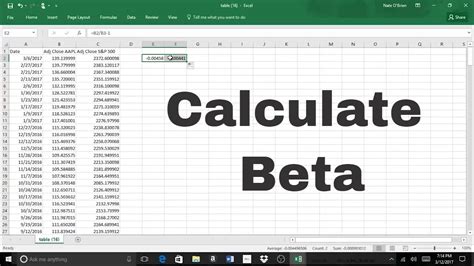

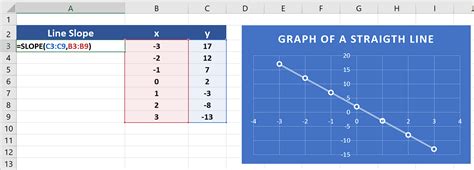

Method 1: Using the SLOPE Function

The SLOPE function in Excel calculates the slope of a linear regression line, which can be used to calculate beta. The formula is:

=SLOPE(returns_array, market_returns_array)

Where returns_array is the range of cells containing the stock's returns, and market_returns_array is the range of cells containing the market's returns.

For example, suppose we have a dataset of monthly returns for a stock and the market, as shown below:

| Stock Returns | Market Returns |

|---|---|

| 0.03 | 0.02 |

| 0.05 | 0.03 |

| 0.01 | 0.01 |

| ... | ... |

Using the SLOPE function, we can calculate the beta as follows:

=SLOPE(B2:B12, C2:C12)

Where B2:B12 contains the stock's returns, and C2:C12 contains the market's returns.

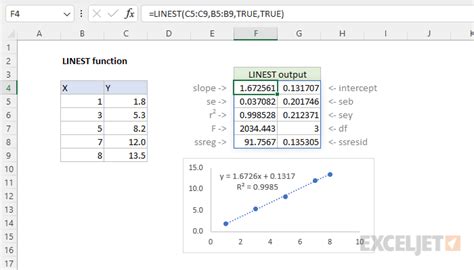

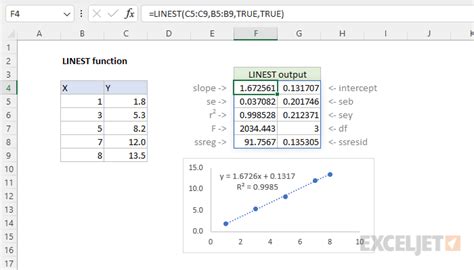

Method 2: Using the LINEST Function

The LINEST function in Excel calculates the slope and intercept of a linear regression line, which can also be used to calculate beta. The formula is:

=LINEST(returns_array, market_returns_array)

Where returns_array is the range of cells containing the stock's returns, and market_returns_array is the range of cells containing the market's returns.

For example, using the same dataset as above, we can calculate the beta as follows:

=LINEST(B2:B12, C2:C12)

The LINEST function returns an array of values, including the slope, which is the beta.

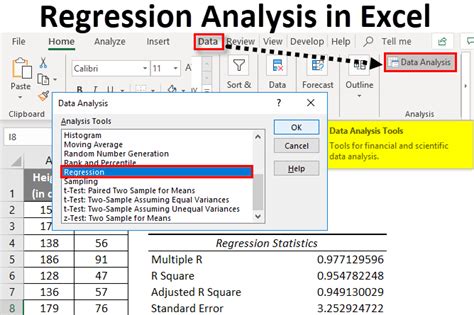

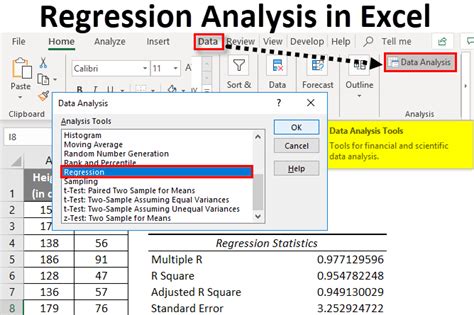

Method 3: Using the Regression Analysis Tool

Excel's Regression Analysis Tool can also be used to calculate beta. This tool performs a linear regression analysis and returns the slope, which is the beta.

To use the Regression Analysis Tool, follow these steps:

- Go to the "Data" tab in Excel.

- Click on "Data Analysis" in the Analysis group.

- Select "Regression" from the list of tools.

- Select the range of cells containing the stock's returns as the "Y" range.

- Select the range of cells containing the market's returns as the "X" range.

- Click "OK" to run the regression analysis.

The output will include the slope, which is the beta.

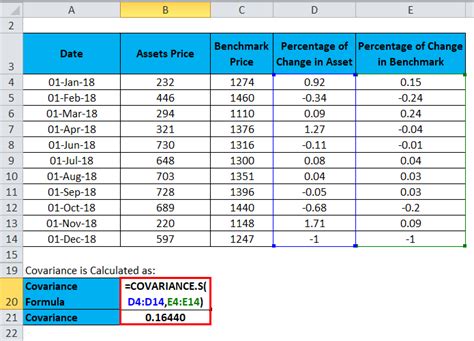

Method 4: Using the Beta Formula

The beta formula can also be used to calculate beta in Excel. The formula is:

=COVAR(returns_array, market_returns_array) / VAR(market_returns_array)

Where returns_array is the range of cells containing the stock's returns, and market_returns_array is the range of cells containing the market's returns.

For example, using the same dataset as above, we can calculate the beta as follows:

=COVAR(B2:B12, C2:C12) / VAR(C2:C12)

This formula calculates the covariance between the stock's returns and the market's returns, and then divides by the variance of the market's returns.

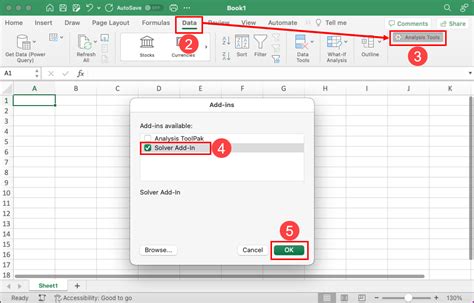

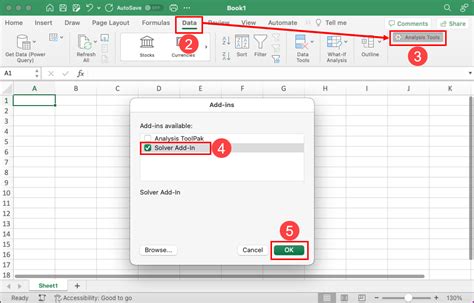

Method 5: Using the Solver Add-in

The Solver add-in in Excel can also be used to calculate beta. This add-in performs a linear regression analysis and returns the slope, which is the beta.

To use the Solver add-in, follow these steps:

- Go to the "Data" tab in Excel.

- Click on "Solver" in the Analysis group.

- Select the range of cells containing the stock's returns as the "Y" range.

- Select the range of cells containing the market's returns as the "X" range.

- Click "Solve" to run the regression analysis.

The output will include the slope, which is the beta.

Gallery of Beta Calculation Methods

Beta Calculation Methods Gallery

In conclusion, calculating beta is an essential task for investors and financial analysts, and Excel provides various methods to do so. By using the SLOPE function, LINEST function, Regression Analysis Tool, beta formula, or Solver add-in, you can calculate beta and make informed investment decisions. Remember to choose the method that best suits your needs and data.