Intro

Discover how to calculate Cash on Cash Return (CoC) in Excel with ease. Learn 5 simple methods to analyze your real estate investments using Excel formulas and functions. Boost your financial analysis skills and make informed decisions with our step-by-step guide, covering CoC calculations, ROI, and net operating income.

Real estate investing can be a lucrative venture, but it's essential to have a clear understanding of the returns on investment (ROI) to make informed decisions. One key metric used to evaluate the profitability of a real estate investment is the Cash on Cash Return (CoC). In this article, we will delve into the world of CoC calculations and explore five ways to calculate Cash on Cash Return in Excel.

The Cash on Cash Return is a metric that measures the return on investment based on the cash flow generated by a property, relative to the amount of cash invested. It's a crucial metric for real estate investors, as it helps them determine whether a property is generating sufficient cash flow to justify the investment. In this article, we will discuss the importance of CoC, its benefits, and provide a step-by-step guide on how to calculate it in Excel.

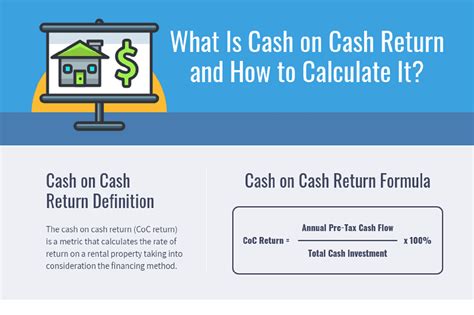

What is Cash on Cash Return?

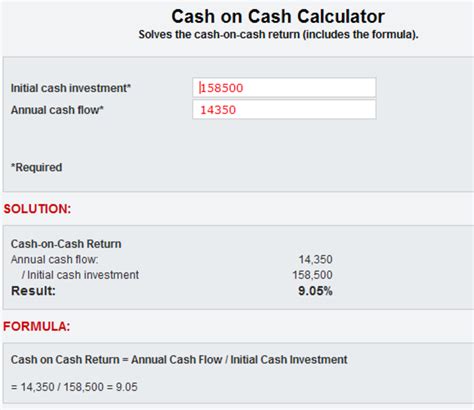

The Cash on Cash Return is a ratio that measures the annual cash flow generated by a property, divided by the total cash invested in the property. It's expressed as a percentage and represents the return on investment based on the cash flow generated by the property.

Why is Cash on Cash Return Important?

The Cash on Cash Return is essential for real estate investors because it helps them:

- Evaluate the profitability of a property

- Compare the performance of different properties

- Determine whether a property is generating sufficient cash flow to justify the investment

- Make informed decisions about property management and investment strategies

5 Ways to Calculate Cash on Cash Return in Excel

Calculating the Cash on Cash Return in Excel can be done in various ways, depending on the specific data and requirements. Here are five ways to calculate CoC in Excel:

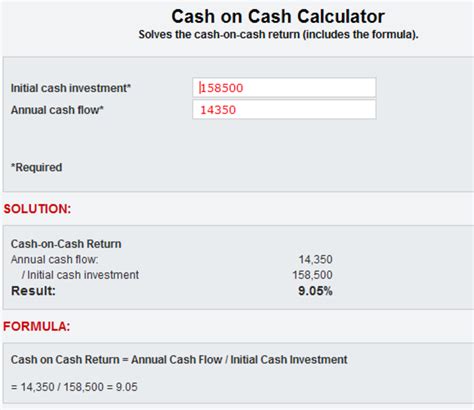

1. Basic CoC Calculation

The basic CoC calculation involves dividing the annual cash flow by the total cash invested.

Formula: = (Annual Cash Flow / Total Cash Invested) x 100

Example:

| Annual Cash Flow | Total Cash Invested | CoC |

|---|---|---|

| $10,000 | $50,000 | 20% |

2. CoC Calculation with Mortgage Financing

When mortgage financing is involved, the CoC calculation needs to take into account the mortgage payments and interest expenses.

Formula: = (Annual Cash Flow - Mortgage Payments - Interest Expenses) / (Total Cash Invested - Mortgage Amount) x 100

Example:

| Annual Cash Flow | Mortgage Payments | Interest Expenses | Total Cash Invested | Mortgage Amount | CoC |

|---|---|---|---|---|---|

| $10,000 | $5,000 | $2,000 | $50,000 | $30,000 | 15% |

3. CoC Calculation with Tax Benefits

Tax benefits, such as depreciation and interest deductions, can impact the CoC calculation.

Formula: = (Annual Cash Flow - Tax Liabilities) / Total Cash Invested x 100

Example:

| Annual Cash Flow | Tax Liabilities | Total Cash Invested | CoC |

|---|---|---|---|

| $10,000 | $2,000 | $50,000 | 18% |

4. CoC Calculation with Multiple Properties

When multiple properties are involved, the CoC calculation needs to take into account the cash flow and investment amounts for each property.

Formula: = (Total Annual Cash Flow / Total Cash Invested) x 100

Example:

| Property 1 | Property 2 | Total Annual Cash Flow | Total Cash Invested | CoC |

|---|---|---|---|---|

| $5,000 | $8,000 | $13,000 | $100,000 | 13% |

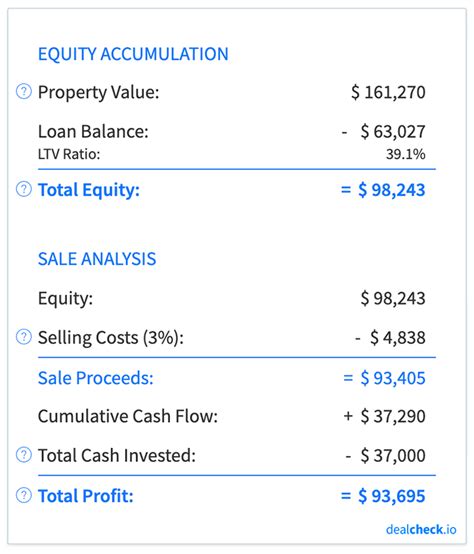

5. CoC Calculation with Future Projections

Future projections, such as expected rental income increases or expenses, can impact the CoC calculation.

Formula: = (Projected Annual Cash Flow / Total Cash Invested) x 100

Example:

| Projected Annual Cash Flow | Total Cash Invested | CoC |

|---|---|---|

| $12,000 | $50,000 | 24% |

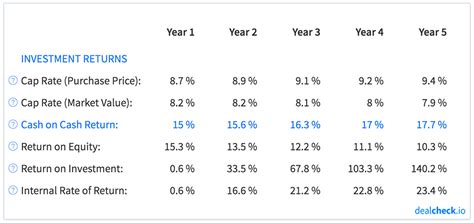

Gallery of Cash on Cash Return Examples

Cash on Cash Return Examples

Final Thoughts

Calculating the Cash on Cash Return is a crucial step in evaluating the profitability of a real estate investment. By using the five methods outlined in this article, you can accurately calculate the CoC and make informed decisions about your investment strategies. Remember to consider all the factors that impact the CoC calculation, including mortgage financing, tax benefits, and future projections. With the right tools and knowledge, you can unlock the full potential of your real estate investments and achieve success in the competitive world of real estate investing.

We hope you found this article informative and helpful. If you have any questions or need further clarification on any of the topics discussed, please don't hesitate to ask. Share your thoughts and experiences with us in the comments section below. Happy investing!