Calculating CD interest in Excel is a straightforward process that can help you understand the growth of your investments. Certificates of Deposit (CDs) are time deposits offered by banks with a fixed interest rate and maturity date. Understanding how to calculate the interest earned on a CD can help you make informed investment decisions.

In this article, we will guide you through the process of calculating CD interest in Excel using a simple and easy-to-follow method. We will also provide examples and explanations to help you grasp the concept.

Understanding CD Interest

Before we dive into the calculation process, let's quickly understand how CD interest works. When you invest in a CD, you deposit a principal amount for a fixed period, and in return, you receive a fixed interest rate. The interest rate is usually expressed as a percentage and is calculated based on the principal amount.

The interest earned on a CD is compounded over time, meaning that the interest is added to the principal amount at regular intervals, and then the interest is calculated on the new balance. This results in a snowball effect, where the interest earns interest, and the investment grows over time.

Calculating CD Interest in Excel

Now that we understand how CD interest works, let's move on to calculating it in Excel. We will use a simple formula to calculate the interest earned on a CD.

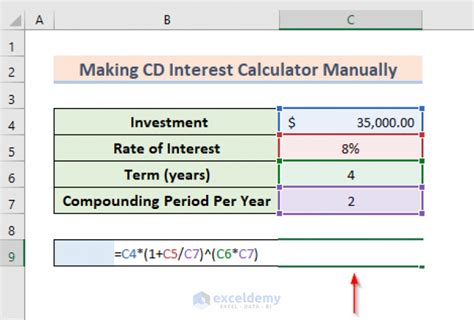

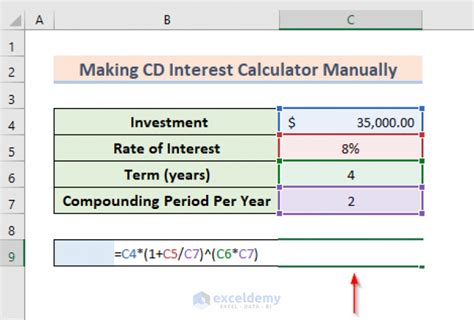

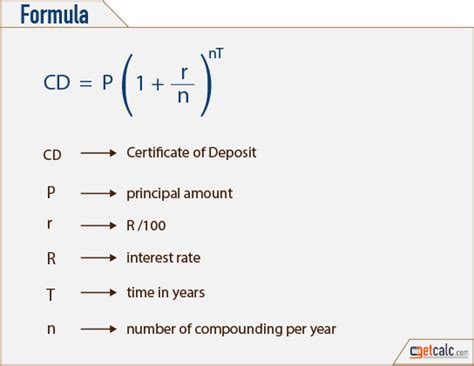

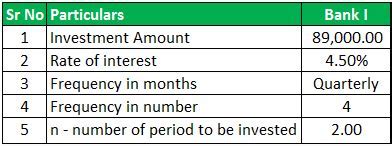

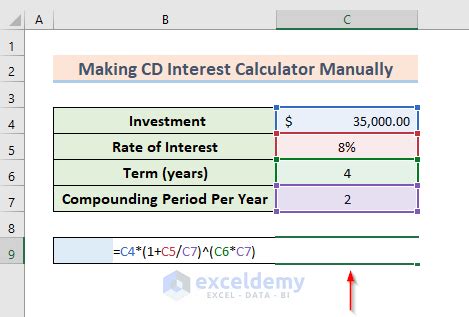

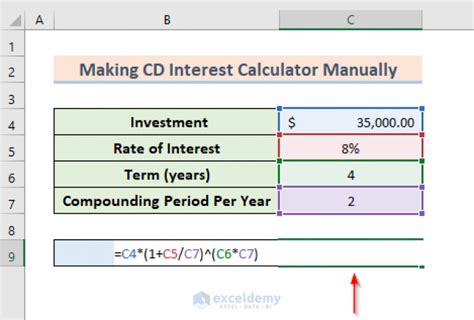

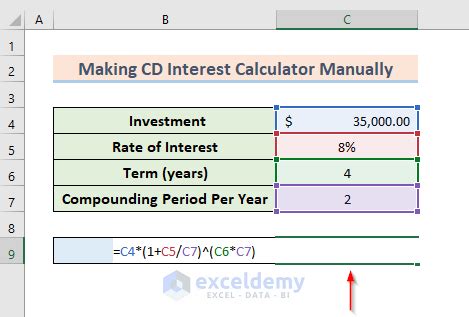

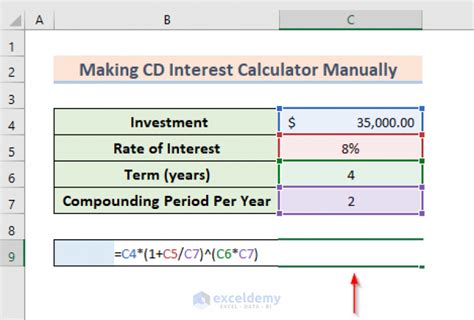

Step 1: Set up the Data

To calculate CD interest in Excel, we need to set up the data. We will need the following information:

- Principal amount (initial deposit)

- Interest rate (as a decimal)

- Time period (number of years)

- Compounding frequency (number of times interest is compounded per year)

Let's assume we have the following data:

| A | B | C | D | |

|---|---|---|---|---|

| 1 | Principal Amount | 10,000 | ||

| 2 | Interest Rate | 4.00% | ||

| 3 | Time Period | 5 | ||

| 4 | Compounding Frequency | 12 |

Step 2: Convert the Interest Rate to a Decimal

The interest rate needs to be converted to a decimal to use in the formula. To do this, divide the interest rate by 100.

| A | B | C | D | |

|---|---|---|---|---|

| 1 | Principal Amount | 10,000 | ||

| 2 | Interest Rate | 0.04 | ||

| 3 | Time Period | 5 | ||

| 4 | Compounding Frequency | 12 |

Step 3: Calculate the Number of Compounding Periods

The number of compounding periods is calculated by multiplying the time period by the compounding frequency.

| A | B | C | D | |

|---|---|---|---|---|

| 1 | Principal Amount | 10,000 | ||

| 2 | Interest Rate | 0.04 | ||

| 3 | Time Period | 5 | ||

| 4 | Compounding Frequency | 12 | ||

| 5 | Number of Compounding Periods | =B3*B4 | 60 |

Step 4: Calculate the CD Interest

Now we can calculate the CD interest using the formula:

=FV(RATE,NPER,PMT,PV,type)

Where:

- RATE is the interest rate (cell B2)

- NPER is the number of compounding periods (cell B5)

- PMT is the payment amount (0, since it's a CD)

- PV is the present value (the principal amount, cell B1)

- Type is 0 (since it's a CD)

| A | B | C | D | |

|---|---|---|---|---|

| 1 | Principal Amount | 10,000 | ||

| 2 | Interest Rate | 0.04 | ||

| 3 | Time Period | 5 | ||

| 4 | Compounding Frequency | 12 | ||

| 5 | Number of Compounding Periods | 60 | ||

| 6 | CD Interest | =FV(B2,B5,0,B1,0) | 2191.87 |

Step 5: Calculate the Maturity Value

The maturity value is the sum of the principal amount and the CD interest.

| A | B | C | D | |

|---|---|---|---|---|

| 1 | Principal Amount | 10,000 | ||

| 2 | Interest Rate | 0.04 | ||

| 3 | Time Period | 5 | ||

| 4 | Compounding Frequency | 12 | ||

| 5 | Number of Compounding Periods | 60 | ||

| 6 | CD Interest | 2191.87 | ||

| 7 | Maturity Value | =B1+B6 | 12191.87 |

And that's it! We have successfully calculated the CD interest in Excel.

Example Use Cases

Calculating CD interest in Excel can be useful in various scenarios:

- Comparing different CD offers: By calculating the CD interest for different interest rates and time periods, you can compare the offers and choose the best one.

- Understanding investment growth: By calculating the CD interest, you can understand how your investment will grow over time and make informed decisions.

- Budgeting: By calculating the CD interest, you can factor in the interest earned into your budget and plan accordingly.

Gallery of CD Interest Calculation

CD Interest Calculation Image Gallery

FAQs

Q: What is the formula to calculate CD interest in Excel? A: The formula to calculate CD interest in Excel is =FV(RATE,NPER,PMT,PV,type).

Q: What is the difference between a CD and a savings account? A: A CD is a time deposit with a fixed interest rate and maturity date, while a savings account is a liquid account with a variable interest rate.

Q: Can I withdraw my money from a CD before the maturity date? A: Yes, but you may be subject to early withdrawal penalties.

Q: How often is interest compounded on a CD? A: Interest is compounded at regular intervals, depending on the compounding frequency.

Conclusion

Calculating CD interest in Excel is a simple and straightforward process that can help you understand the growth of your investments. By following the steps outlined in this article, you can calculate the CD interest and maturity value using Excel. Remember to use the formula =FV(RATE,NPER,PMT,PV,type) and to convert the interest rate to a decimal. With this knowledge, you can make informed investment decisions and maximize your returns.

We hope this article has been helpful in explaining how to calculate CD interest in Excel. If you have any further questions or need clarification on any of the steps, please don't hesitate to ask in the comments below.