Intro

Unlock the secrets to affordable life insurance coverage with our expert guide. Learn the 5 essential ways to calculate life insurance premium formulas, including risk assessment, policy duration, and coverage amount. Discover how to optimize your premiums with riders, deductibles, and more, and make informed decisions with our comprehensive tutorial.

Determining the right life insurance premium can be a daunting task, especially for those who are new to the world of insurance. The premium you pay for your life insurance policy is influenced by a multitude of factors, including your age, health, occupation, and coverage amount, among others. Insurance companies use a complex formula to calculate the premium, taking into account various risk factors associated with the policyholder. In this article, we will explore five ways to calculate life insurance premium formulas, helping you better understand how your premium is determined.

Understanding Life Insurance Premium Formula

Life insurance premium is the amount you pay to the insurance company in exchange for the coverage they provide. The premium is calculated based on the likelihood of the insurance company having to pay out a death benefit during the policy term. The premium formula used by insurance companies is a complex algorithm that considers multiple factors, including:

- Age and health of the policyholder

- Coverage amount and policy term

- Occupation and lifestyle

- Medical history and family medical history

- Smoking status and other health-related factors

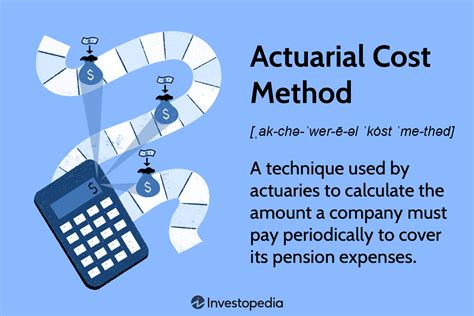

1. Actuarial Method

The actuarial method is a widely used approach to calculate life insurance premiums. This method involves analyzing statistical data and probability tables to determine the likelihood of a policyholder's death within a given timeframe. Actuaries use mortality tables, which show the probability of death at different ages, to estimate the risk of the policyholder. The premium is then calculated based on this estimated risk, taking into account the coverage amount and policy term.

2. Prospective Method

The prospective method involves estimating the future cost of insurance based on the policyholder's current age and health. This method takes into account the expected increase in mortality rates over time, as well as changes in the policyholder's health and lifestyle. The premium is calculated based on the expected future cost of insurance, taking into account the coverage amount and policy term.

3. Retrospective Method

The retrospective method involves analyzing historical data on mortality rates and policyholder behavior to estimate the premium. This method takes into account the actual experience of the insurance company's policyholders, including mortality rates, lapse rates, and other factors. The premium is calculated based on the historical data, taking into account the coverage amount and policy term.

4. Composite Method

The composite method involves combining the actuarial, prospective, and retrospective methods to calculate the premium. This method takes into account multiple factors, including mortality rates, policyholder behavior, and changes in the policyholder's health and lifestyle. The premium is calculated based on a weighted average of the estimates from each method.

5. Formula-Based Method

The formula-based method involves using a pre-defined formula to calculate the premium. This formula typically takes into account multiple factors, including age, health, occupation, and coverage amount. The formula is often based on a combination of actuarial and statistical data, and is designed to provide a quick and accurate estimate of the premium.

Factors Affecting Life Insurance Premium

While the premium formula used by insurance companies is complex and multifaceted, there are several key factors that can affect the premium. These include:

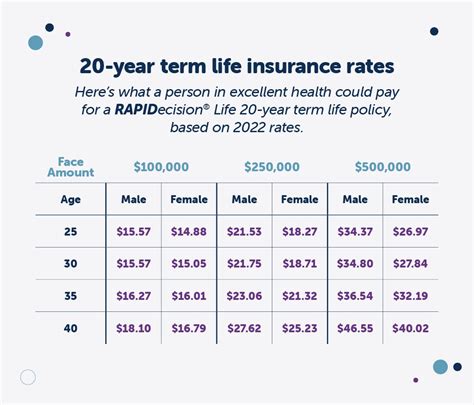

- Age: Older policyholders typically pay higher premiums, as they are more likely to die within a given timeframe.

- Health: Policyholders with pre-existing medical conditions or a history of illness may pay higher premiums, as they are more likely to die within a given timeframe.

- Occupation: Policyholders with high-risk occupations, such as pilots or firefighters, may pay higher premiums, as they are more likely to die within a given timeframe.

- Coverage amount: Higher coverage amounts typically result in higher premiums, as the insurance company is taking on more risk.

- Policy term: Longer policy terms typically result in lower premiums, as the insurance company has more time to collect premiums and earn interest on the policy.

How to Calculate Life Insurance Premium

While insurance companies use complex formulas to calculate life insurance premiums, there are several online tools and calculators that can provide an estimate of the premium. These tools typically take into account multiple factors, including age, health, occupation, and coverage amount. To calculate life insurance premium using an online tool, follow these steps:

- Determine your coverage amount and policy term.

- Enter your age, health, occupation, and other relevant information into the calculator.

- Select the type of policy you are interested in, such as term life or whole life.

- Review the estimated premium and adjust the inputs as needed to see how different factors affect the premium.

Conclusion

Calculating life insurance premium involves considering multiple factors, including age, health, occupation, and coverage amount. Insurance companies use complex formulas to estimate the premium, taking into account mortality rates, policyholder behavior, and other risk factors. By understanding the different methods used to calculate life insurance premium, you can better navigate the process of selecting a policy and determining the right coverage for your needs.

Gallery of Life Insurance Images

Life Insurance Image Gallery