Calculating the payback period is a crucial step in evaluating the feasibility of a project or investment. It helps you determine how long it will take to recover the initial investment, and it's a key metric in making informed decisions. In this article, we'll show you how to calculate the payback period in Excel, making it easy for you to get started.

Why is the Payback Period Important?

The payback period is essential in project evaluation because it helps you:

- Assess the risk of an investment: A shorter payback period indicates a lower risk, as you'll recover your investment sooner.

- Compare projects: By calculating the payback period for multiple projects, you can compare their feasibility and prioritize investments.

- Evaluate cash flow: The payback period helps you understand how quickly you'll generate cash from an investment, which is critical for businesses with limited financial resources.

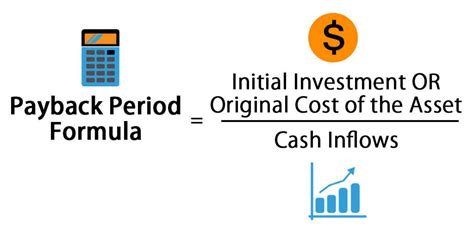

Understanding the Payback Period Formula

The payback period formula is:

Payback Period = Total Investment / Annual Cash Flow

Where:

- Total Investment is the initial investment amount

- Annual Cash Flow is the net cash inflow generated by the investment each year

For example, if you invest $10,000 and expect to generate $2,000 in annual cash flow, the payback period would be:

Payback Period = $10,000 / $2,000 = 5 years

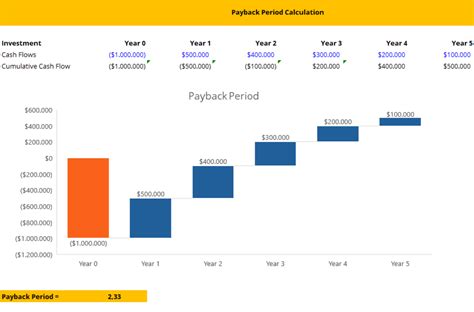

Calculating Payback Period in Excel

Now, let's see how to calculate the payback period in Excel. We'll use a simple example to illustrate the steps.

Assume you're evaluating a project with the following data:

| Year | Cash Flow |

|---|---|

| 1 | $2,000 |

| 2 | $2,500 |

| 3 | $3,000 |

| 4 | $3,500 |

| 5 | $4,000 |

To calculate the payback period in Excel, follow these steps:

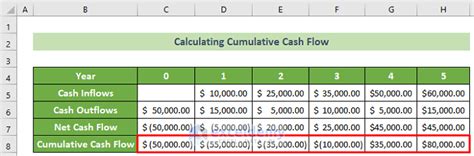

- Enter the cash flow data in a table, as shown above.

- Calculate the cumulative cash flow by adding the cash flow for each year:

| Year | Cash Flow | Cumulative Cash Flow |

|---|---|---|

| 1 | $2,000 | $2,000 |

| 2 | $2,500 | $4,500 |

| 3 | $3,000 | $7,500 |

| 4 | $3,500 | $11,000 |

| 5 | $4,000 | $15,000 |

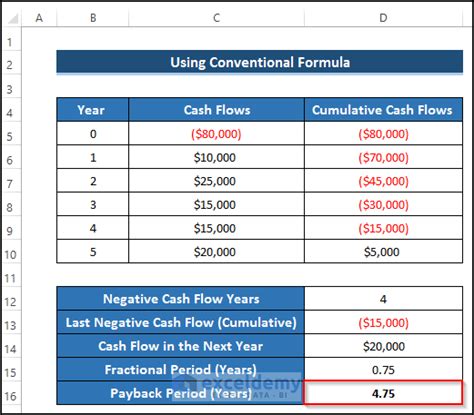

- Calculate the payback period by finding the year when the cumulative cash flow equals or exceeds the total investment.

You can use the following formula to calculate the payback period:

=SUMIFS(Cumulative Cash Flow, Cumulative Cash Flow, ">="&Total Investment)

Assuming the total investment is $10,000, the formula would return the year when the cumulative cash flow equals or exceeds $10,000.

Payback Period Calculation in Excel: Advanced Formula

If you want to make the calculation more dynamic, you can use the following formula:

=YEAR(FILTER(A:A, (SUMIF(A:A, "<="&A:A, B:B))>=$10,000)+1)

This formula uses the FILTER function to find the year when the cumulative cash flow exceeds the total investment.

Gallery of Payback Period Calculation Examples

Payback Period Calculation Examples

Conclusion

Calculating the payback period in Excel is a straightforward process that can help you evaluate the feasibility of a project or investment. By using the formulas and techniques outlined in this article, you can easily calculate the payback period and make informed decisions. Remember to use the correct formula and consider the cumulative cash flow to get an accurate result.

We hope this article has been helpful in explaining how to calculate the payback period in Excel. If you have any questions or need further clarification, please don't hesitate to ask.