Calculating portfolio standard deviation in Excel can be a straightforward process, allowing you to gauge the risk associated with your investment portfolio. Standard deviation is a key measure of volatility, indicating how much the returns of your portfolio deviate from its mean return. The higher the standard deviation, the greater the volatility and, by extension, the risk. In this article, we will walk through the steps to calculate portfolio standard deviation in Excel, providing you with a clear and comprehensive guide.

Why Calculate Portfolio Standard Deviation?

Before we dive into the calculation process, it's essential to understand the importance of portfolio standard deviation. This metric is crucial for investors because it helps in:

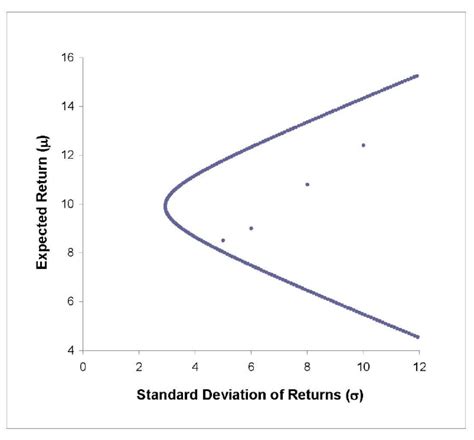

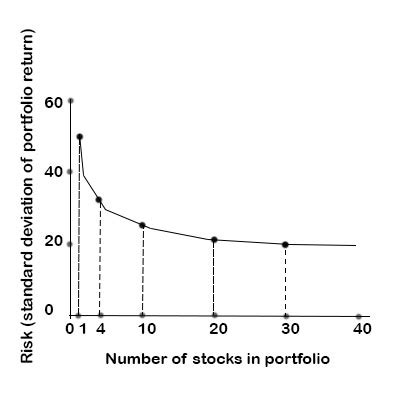

- Assessing Risk: By understanding the volatility of your portfolio, you can better assess the risk and make more informed investment decisions.

- Diversification: Knowing the standard deviation of individual assets and the portfolio as a whole can guide your diversification efforts, helping you to construct a portfolio that balances risk and return.

- Performance Evaluation: Standard deviation can be used to evaluate the performance of your portfolio, especially when compared to its historical average return or benchmark.

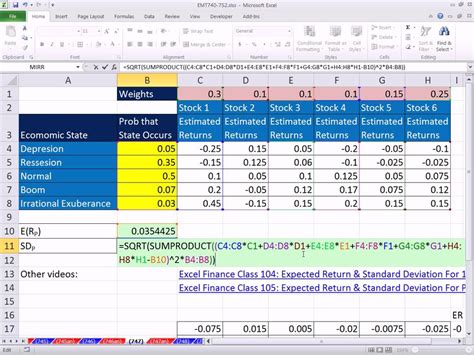

Calculating Portfolio Standard Deviation in Excel

Step 1: Prepare Your Data

To calculate the portfolio standard deviation, you first need to gather the historical returns of the assets in your portfolio. Ensure these returns are in a percentage format and are aligned in a single column or row, depending on how you structure your data.

Step 2: Calculate the Average Return

The average return of your portfolio is the first step in calculating its standard deviation.

- Select the Cell: Choose a cell where you want to display the average return.

- Use the AVERAGE Function: Input

=AVERAGE(range)whererangeis the series of cells containing your returns data.

Step 3: Calculate the Variance

The variance measures how much the individual returns deviate from the average return.

- Select a Cell: Pick a cell to display the variance.

- Use the VAR Function: Type

=VAR(range)using the same range as before. If your data includes the average return in the calculation, use=VAR.S(range)for sample variance.

Step 4: Calculate the Standard Deviation

The standard deviation is the square root of the variance.

- Select a Cell: Choose a cell to display the standard deviation.

- Use the STDEV Function: Input

=STDEV(range)for population standard deviation, or=STDEV.S(range)for sample standard deviation.

Alternative Method Using Formulas

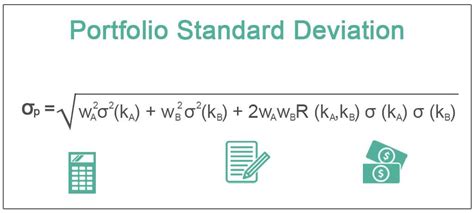

Alternatively, you can calculate the standard deviation using the formula:

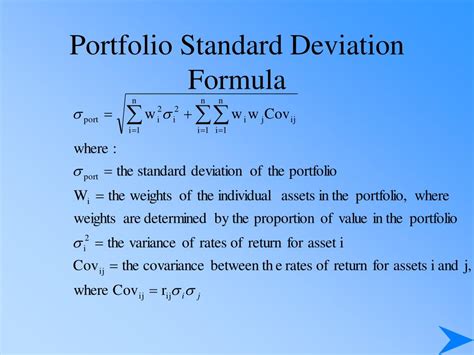

Standard Deviation = √[(Σ(xi - μ)^2) / (n - 1)]

Where:

xiis each individual return,μis the mean return,nis the number of returns.

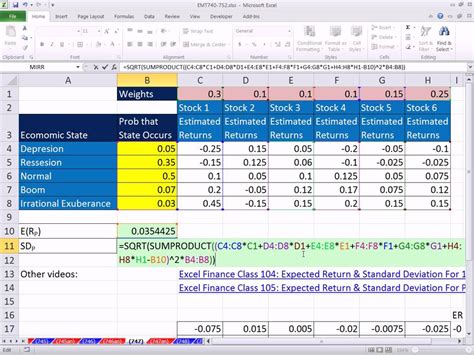

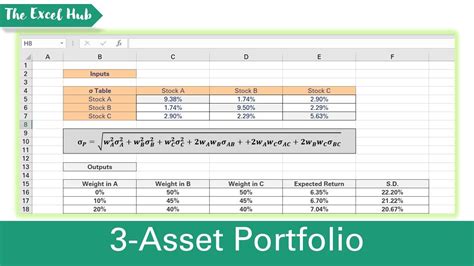

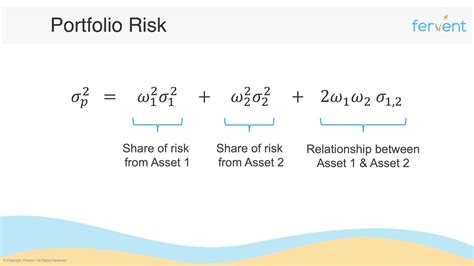

Embedding Images

Tips for Accurate Calculation

- Use Correct Data Range: Ensure you're selecting the correct range of cells for your calculations.

- Check for Errors: Double-check your formulas for errors and ensure they're applied correctly.

- Use Sample or Population Standard Deviation Appropriately: Decide whether you're working with a sample of data (use

STDEV.S) or the entire population (useSTDEV).

Gallery of Portfolio Standard Deviation Calculations

Portfolio Standard Deviation Calculation Examples

Engaging with the Content

We hope this comprehensive guide has equipped you with the knowledge and skills to calculate portfolio standard deviation in Excel confidently. This metric is a powerful tool in assessing and managing portfolio risk, aiding in the construction of a diversified investment portfolio. Share your experiences or questions regarding portfolio standard deviation calculations in the comments section below.