Intro

Calculating self-employment income for food stamps can be a bit complex, but understanding the process is crucial for individuals who are self-employed and seeking to determine their eligibility for food stamp benefits. In this article, we will delve into the details of calculating self-employment income for food stamps, providing you with the necessary information to navigate this process.

Understanding Self-Employment Income

Self-employment income refers to the income earned by individuals who are not employed by someone else, but rather work for themselves. This type of income can come from various sources, such as freelancing, consulting, running a small business, or selling products online. When it comes to food stamps, self-employment income is considered when determining an individual's eligibility for benefits.

Why is Calculating Self-Employment Income Important?

Calculating self-employment income accurately is crucial for food stamp eligibility because it directly affects the amount of benefits an individual can receive. If self-employment income is not reported correctly, it may lead to an incorrect determination of eligibility or benefit amount. This, in turn, can result in delayed or denied benefits, causing financial hardship for individuals who rely on food stamps to purchase groceries.

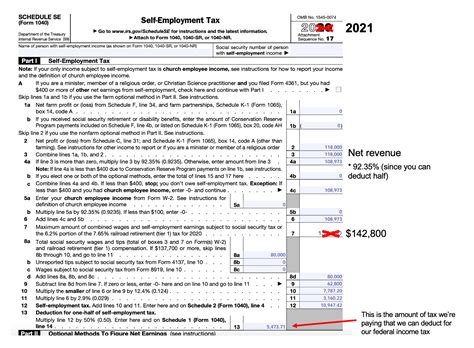

How to Calculate Self-Employment Income for Food Stamps

Calculating self-employment income for food stamps involves several steps:

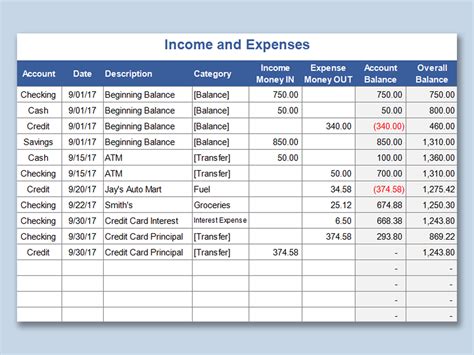

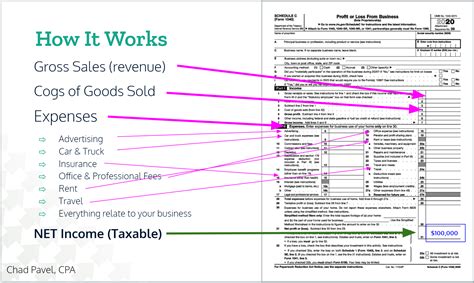

- Determine Business Expenses: Start by calculating the total business expenses incurred during the month. This includes expenses such as rent, utilities, supplies, and equipment.

- Calculate Gross Income: Calculate the total gross income earned from self-employment activities. This includes all income earned from sales, services, and other business-related activities.

- Calculate Net Income: Subtract the total business expenses from the gross income to determine the net income.

- Calculate Average Monthly Income: Calculate the average monthly income by dividing the net income by the number of months the business has been in operation.

- Apply the Self-Employment Income Deduction: Apply the self-employment income deduction, which is 50% of the net income earned from self-employment activities.

Example of Calculating Self-Employment Income

Let's consider an example to illustrate the calculation of self-employment income for food stamps:

- Gross income: $5,000

- Business expenses: $2,000

- Net income: $3,000 ($5,000 - $2,000)

- Average monthly income: $1,500 ($3,000 ÷ 2 months)

- Self-employment income deduction: 50% of $1,500 = $750

- Countable self-employment income: $750

In this example, the countable self-employment income would be $750, which would be used to determine food stamp eligibility.

Tips for Reporting Self-Employment Income for Food Stamps

When reporting self-employment income for food stamps, keep the following tips in mind:

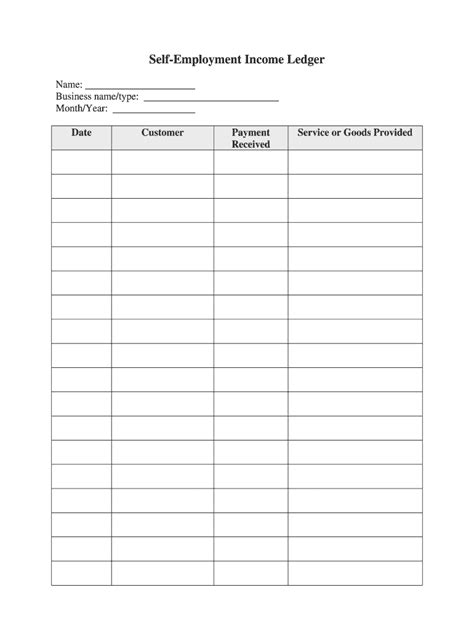

- Keep accurate records: Keep accurate records of business expenses and income to ensure accurate calculations.

- Report income regularly: Report self-employment income regularly to avoid delays or denials of benefits.

- Consult a tax professional: Consult a tax professional to ensure accurate calculations and to take advantage of all eligible deductions.

Gallery of Self-Employment Income Calculations

Self-Employment Income Calculation Images

By following these tips and accurately calculating self-employment income, individuals can ensure they receive the correct amount of food stamp benefits to support their nutritional needs.