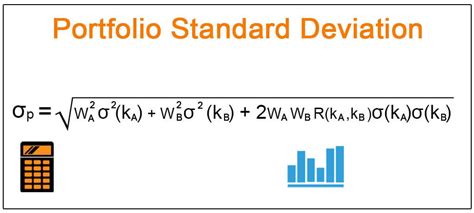

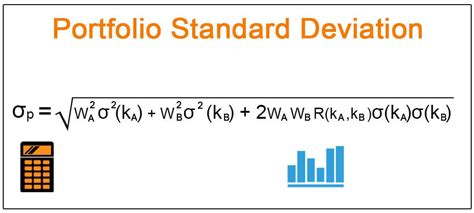

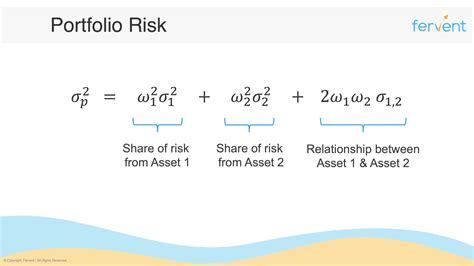

Investors and financial analysts often use portfolio standard deviation as a key metric to measure the risk of a portfolio. It represents the volatility of the portfolio's returns and helps investors understand the potential fluctuations in their investments. Calculating portfolio standard deviation in Excel can be a bit complex, but there are several methods to do so. In this article, we will explore five ways to calculate portfolio standard deviation in Excel.

Why Calculate Portfolio Standard Deviation?

Calculating portfolio standard deviation is essential for investors and financial analysts because it helps them:

- Understand the risk of their portfolio

- Compare the risk of different portfolios

- Make informed investment decisions

- Optimize their portfolio by minimizing risk and maximizing returns

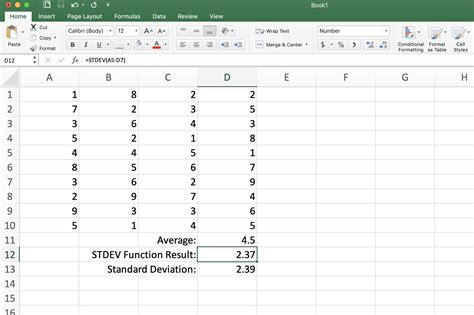

Method 1: Using the STDEV Function

The STDEV function in Excel calculates the standard deviation of a dataset. To calculate portfolio standard deviation using the STDEV function, follow these steps:

- Enter the returns of each asset in the portfolio in a column.

- Select the cell where you want to display the portfolio standard deviation.

- Type "=STDEV(range)" and press Enter.

- Replace "range" with the range of cells containing the returns.

For example, if the returns are in cells A1:A10, the formula would be "=STDEV(A1:A10)".

Method 2: Using the VAR Function

The VAR function in Excel calculates the variance of a dataset. To calculate portfolio standard deviation using the VAR function, follow these steps:

- Enter the returns of each asset in the portfolio in a column.

- Select the cell where you want to display the portfolio standard deviation.

- Type "=SQRT(VAR(range))" and press Enter.

- Replace "range" with the range of cells containing the returns.

For example, if the returns are in cells A1:A10, the formula would be "=SQRT(VAR(A1:A10))".

Method 3: Using the COVAR Function

The COVAR function in Excel calculates the covariance between two datasets. To calculate portfolio standard deviation using the COVAR function, follow these steps:

- Enter the returns of each asset in the portfolio in separate columns.

- Select the cell where you want to display the portfolio standard deviation.

- Type "=SQRT(SUM(COVAR(range1, range2)))" and press Enter.

- Replace "range1" and "range2" with the ranges of cells containing the returns of each asset.

For example, if the returns of asset 1 are in cells A1:A10 and the returns of asset 2 are in cells B1:B10, the formula would be "=SQRT(SUM(COVAR(A1:A10, B1:B10)))".

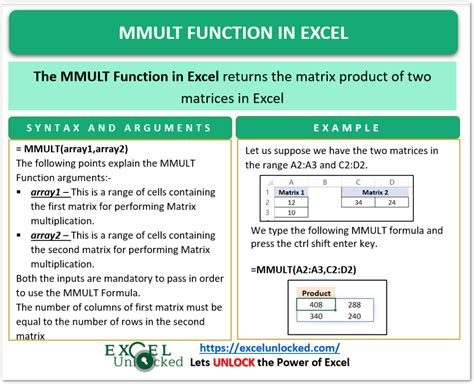

Method 4: Using the MMULT Function

The MMULT function in Excel performs matrix multiplication. To calculate portfolio standard deviation using the MMULT function, follow these steps:

- Enter the returns of each asset in the portfolio in a matrix.

- Select the cell where you want to display the portfolio standard deviation.

- Type "=SQRT(MMULT(transpose(range), range))" and press Enter.

- Replace "range" with the range of cells containing the returns.

For example, if the returns are in cells A1:A10, the formula would be "=SQRT(MMULT(transpose(A1:A10), A1:A10))".

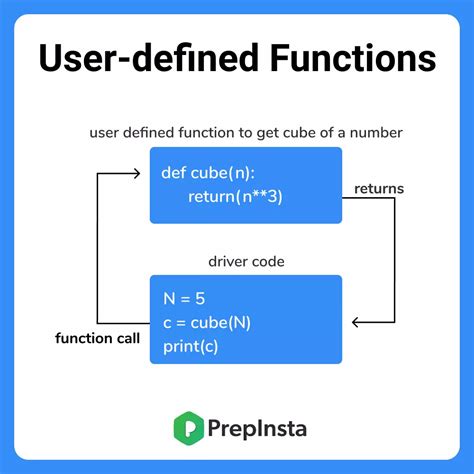

Method 5: Using a User-Defined Function

You can also create a user-defined function in Excel to calculate portfolio standard deviation. To do this, follow these steps:

- Open the Visual Basic Editor by pressing Alt+F11 or by navigating to Developer > Visual Basic.

- In the Editor, click Insert > Module to insert a new module.

- Paste the following code into the module:

Function PortfolioStdDev(returns As Range) As Double

PortfolioStdDev = Application.WorksheetFunction.StDev(returns)

End Function

- Save the module by clicking File > Save.

- Close the Editor and return to your Excel spreadsheet.

- Select the cell where you want to display the portfolio standard deviation.

- Type "=PortfolioStdDev(range)" and press Enter.

- Replace "range" with the range of cells containing the returns.

For example, if the returns are in cells A1:A10, the formula would be "=PortfolioStdDev(A1:A10)".

Gallery of Portfolio Standard Deviation

Portfolio Standard Deviation Image Gallery

In conclusion, calculating portfolio standard deviation in Excel can be done using various methods, including the STDEV function, VAR function, COVAR function, MMULT function, and a user-defined function. Each method has its advantages and disadvantages, and the choice of method depends on the specific needs and preferences of the user. By understanding these methods, investors and financial analysts can better manage their portfolios and make informed investment decisions.

We hope this article has been helpful in explaining the different ways to calculate portfolio standard deviation in Excel. If you have any questions or need further clarification, please don't hesitate to ask in the comments section below.