Intro

As a professional mechanic or technician, you understand the importance of having the right tools for the job. Snap-on tools are a staple in the industry, known for their high-quality and durability. However, they can also be a significant investment. Fortunately, there are ways to claim Snap-on tools on your taxes, which can help reduce your tax liability and increase your bottom line.

Whether you're a self-employed mechanic or the owner of a repair shop, understanding how to claim Snap-on tools on your taxes can be a game-changer. In this article, we'll explore seven ways to claim Snap-on tools on your taxes, as well as provide guidance on how to properly document and report these expenses.

Understanding Business Expenses

Before we dive into the specifics of claiming Snap-on tools on your taxes, it's essential to understand the concept of business expenses. Business expenses are costs incurred by a business to generate revenue or operate the business. These expenses can include everything from rent and utilities to equipment and supplies.

The IRS allows businesses to deduct certain expenses on their tax return, which can help reduce their taxable income and lower their tax liability. To qualify as a deductible business expense, the expense must be:

- Ordinary and necessary for the business

- Related to the business

- Not a personal expense

Qualifying Snap-on Tools as Business Expenses

Snap-on tools can be a significant investment for mechanics and technicians. Fortunately, these tools can be qualified as business expenses, making them eligible for tax deductions.

To qualify Snap-on tools as business expenses, you'll need to demonstrate that they are:

- Used for business purposes

- Necessary for the operation of the business

- Not used for personal purposes

7 Ways to Claim Snap-on Tools on Taxes

Now that we've covered the basics of business expenses and qualifying Snap-on tools, let's explore seven ways to claim Snap-on tools on your taxes.

1. Depreciation

Depreciation is the process of allocating the cost of a tangible asset, such as Snap-on tools, over its useful life. The IRS allows businesses to depreciate the cost of Snap-on tools over a period of years, which can provide a significant tax deduction.

For example, let's say you purchase a set of Snap-on tools for $10,000. You can depreciate the cost of these tools over a period of five years, which would provide a tax deduction of $2,000 per year.

2. Section 179 Deduction

The Section 179 deduction allows businesses to deduct the full cost of certain equipment and property, including Snap-on tools, in the year of purchase. This deduction can provide a significant tax savings, especially for small businesses.

For example, let's say you purchase a set of Snap-on tools for $10,000. You can deduct the full cost of these tools in the year of purchase, which would provide a tax deduction of $10,000.

3. Bonus Depreciation

Bonus depreciation is a tax incentive that allows businesses to deduct a portion of the cost of certain equipment and property, including Snap-on tools, in the year of purchase. This deduction can provide a significant tax savings, especially for small businesses.

For example, let's say you purchase a set of Snap-on tools for $10,000. You can deduct 50% of the cost of these tools in the year of purchase, which would provide a tax deduction of $5,000.

4. Business Use Percentage

If you use your Snap-on tools for both business and personal purposes, you can deduct the business use percentage of the cost of these tools. This deduction can provide a significant tax savings, especially for small businesses.

For example, let's say you use your Snap-on tools 80% for business purposes and 20% for personal purposes. You can deduct 80% of the cost of these tools, which would provide a tax deduction of $8,000.

5. Home Office Deduction

If you use your Snap-on tools in a home office, you may be eligible for the home office deduction. This deduction allows businesses to deduct a portion of their rent or mortgage interest and utilities as a business expense.

For example, let's say you use 20% of your home for business purposes. You can deduct 20% of your rent or mortgage interest and utilities as a business expense.

6. Business Expense Deduction

Snap-on tools can also be deducted as a business expense. This deduction can provide a significant tax savings, especially for small businesses.

For example, let's say you purchase a set of Snap-on tools for $10,000. You can deduct the cost of these tools as a business expense, which would provide a tax deduction of $10,000.

7. State and Local Tax Deductions

Some states and local governments offer tax deductions for businesses that purchase Snap-on tools. These deductions can provide a significant tax savings, especially for small businesses.

For example, let's say you purchase a set of Snap-on tools for $10,000. Your state offers a 5% tax deduction for businesses that purchase Snap-on tools. You can deduct 5% of the cost of these tools, which would provide a tax deduction of $500.

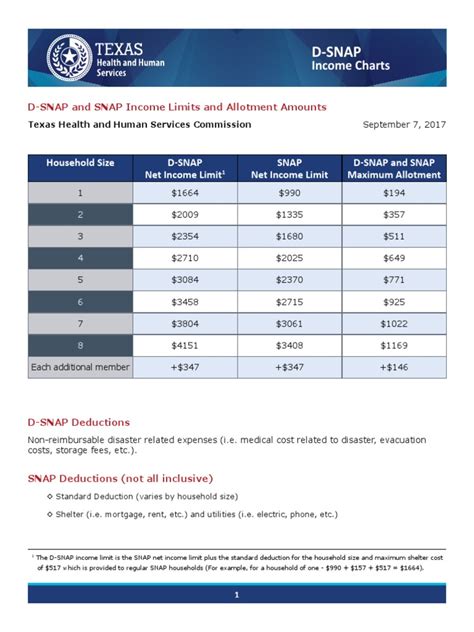

Properly Documenting and Reporting Snap-on Tool Expenses

To properly document and report Snap-on tool expenses, you'll need to keep accurate records of your purchases and expenses. This includes:

- Receipts for Snap-on tool purchases

- Invoices for Snap-on tool repairs and maintenance

- Records of business use percentage

- Records of home office use

You'll also need to report these expenses on your tax return. This includes:

- Form 1040: Business income and expenses

- Form 4562: Depreciation and amortization

- Form 8829: Expenses for business use of your home

Gallery of Snap-on Tool Images

Snap-on Tool Image Gallery

Conclusion

Claiming Snap-on tools on your taxes can be a great way to reduce your tax liability and increase your bottom line. By understanding the different ways to claim Snap-on tools, properly documenting and reporting expenses, and taking advantage of tax deductions and credits, you can save money and grow your business.Remember to always consult with a tax professional to ensure you're taking advantage of all the tax deductions and credits available to you. With the right guidance and planning, you can make the most of your Snap-on tool expenses and achieve your business goals.

We hope this article has been informative and helpful in your tax planning efforts. If you have any questions or comments, please don't hesitate to reach out. We're always here to help.

Share this article with your friends and colleagues to help them save money on their taxes!