Intro

Unlock the power of Excel to calculate effective interest rates with ease. Discover 5 simple and effective methods to determine the true cost of borrowing, including the use of formulas, functions, and shortcuts. Master the art of calculating APR, EIR, and more with these actionable tips and take your financial analysis to the next level.

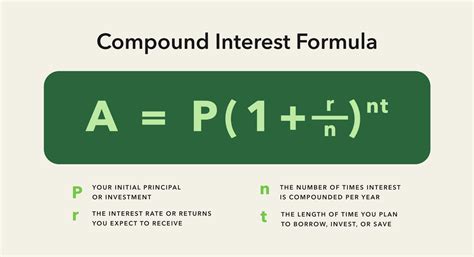

The effective interest rate is a crucial concept in finance that helps investors and borrowers understand the true cost of borrowing or the real return on investment. In this article, we will explore five ways to calculate the effective interest rate in Excel, a powerful spreadsheet software widely used in finance and accounting.

The effective interest rate takes into account the compounding effect of interest, which means that interest is earned on both the principal amount and any accrued interest. This results in a higher effective interest rate compared to the nominal interest rate. Calculating the effective interest rate is essential to make informed decisions about investments, loans, and credit cards.

Method 1: Using the EFFECT Function

The EFFECT function in Excel is a built-in function that calculates the effective interest rate. The syntax for the EFFECT function is:

=EFFECT(nominal_rate, npery)

Where:

- nominal_rate is the nominal interest rate

- npery is the number of compounding periods per year

For example, if the nominal interest rate is 6% and the interest is compounded monthly, the effective interest rate can be calculated using the following formula:

=EFFECT(0.06, 12)

This formula returns the effective interest rate, which is approximately 6.17%.

Advantages of Using the EFFECT Function

Using the EFFECT function is a straightforward and efficient way to calculate the effective interest rate. It eliminates the need to create complex formulas or use multiple functions.

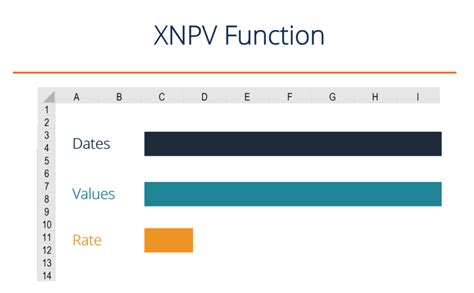

Method 2: Using the XNPV Function

The XNPV function in Excel calculates the present value of a series of cash flows. However, it can also be used to calculate the effective interest rate. The syntax for the XNPV function is:

=XNPV(rate, dates, cash flows)

Where:

- rate is the nominal interest rate

- dates is the array of dates for the cash flows

- cash flows is the array of cash flows

To calculate the effective interest rate using the XNPV function, we need to create a series of cash flows that represent the interest payments. For example, if the nominal interest rate is 6% and the interest is compounded monthly, the effective interest rate can be calculated using the following formula:

=XNPV(0.06/12, {1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12}, {-100, 5, 5, 5, 5, 5, 5, 5, 5, 5, 5, 105})

This formula returns the present value of the cash flows, which can be used to calculate the effective interest rate.

Advantages of Using the XNPV Function

Using the XNPV function provides more flexibility in calculating the effective interest rate, especially when dealing with complex cash flow scenarios.

Method 3: Using the FV Function

The FV function in Excel calculates the future value of an investment. It can also be used to calculate the effective interest rate. The syntax for the FV function is:

=FV(rate, nper, pmt, [pv], [type])

Where:

- rate is the nominal interest rate

- nper is the number of periods

- pmt is the periodic payment

- [pv] is the present value (optional)

- [type] is the type of payment (optional)

To calculate the effective interest rate using the FV function, we need to create a scenario where the future value of an investment is equal to the principal amount plus the interest earned. For example, if the nominal interest rate is 6% and the interest is compounded monthly, the effective interest rate can be calculated using the following formula:

=FV(0.06/12, 12, -100, 100, 0)

This formula returns the future value of the investment, which can be used to calculate the effective interest rate.

Advantages of Using the FV Function

Using the FV function provides a more intuitive way to calculate the effective interest rate, especially when dealing with investments and loans.

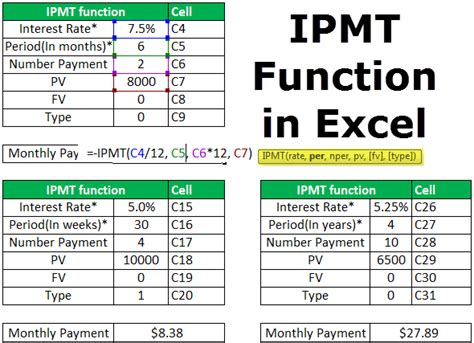

Method 4: Using the IPMT Function

The IPMT function in Excel calculates the interest portion of a payment. It can also be used to calculate the effective interest rate. The syntax for the IPMT function is:

=IPMT(rate, per, nper, pv, [fv], [type])

Where:

- rate is the nominal interest rate

- per is the period for which the interest is calculated

- nper is the number of periods

- pv is the present value

- [fv] is the future value (optional)

- [type] is the type of payment (optional)

To calculate the effective interest rate using the IPMT function, we need to create a scenario where the interest portion of a payment is equal to the interest earned. For example, if the nominal interest rate is 6% and the interest is compounded monthly, the effective interest rate can be calculated using the following formula:

=IPMT(0.06/12, 1, 12, 100, 0, 0)

This formula returns the interest portion of the payment, which can be used to calculate the effective interest rate.

Advantages of Using the IPMT Function

Using the IPMT function provides a more detailed way to calculate the effective interest rate, especially when dealing with complex payment scenarios.

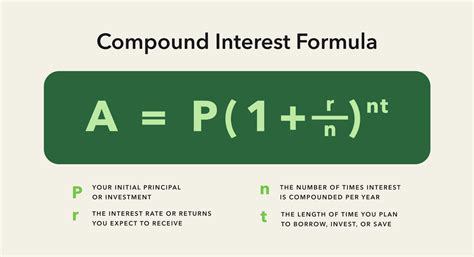

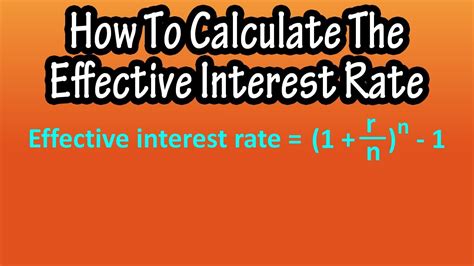

Method 5: Using a Formula

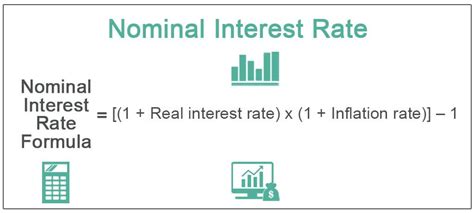

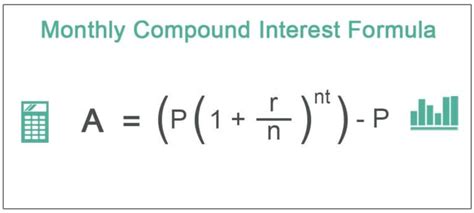

The final method to calculate the effective interest rate is by using a formula. The formula is:

=(1 + (nominal_rate / npery)) ^ npery - 1

Where:

- nominal_rate is the nominal interest rate

- npery is the number of compounding periods per year

For example, if the nominal interest rate is 6% and the interest is compounded monthly, the effective interest rate can be calculated using the following formula:

=(1 + (0.06 / 12)) ^ 12 - 1

This formula returns the effective interest rate, which is approximately 6.17%.

Advantages of Using a Formula

Using a formula provides a more flexible way to calculate the effective interest rate, especially when dealing with complex scenarios.

Effective Interest Rate Image Gallery

Now that you have learned five ways to calculate the effective interest rate in Excel, you can choose the method that best suits your needs. Whether you use a built-in function or a formula, calculating the effective interest rate is an essential step in making informed financial decisions. We hope this article has helped you to better understand the concept of effective interest rate and how to calculate it in Excel. If you have any questions or need further clarification, please feel free to ask in the comments below.