Intro

Managing finances efficiently requires accurate and organized record-keeping. One crucial document in personal and business finance is the bank statement. However, manually entering data from a bank statement into a spreadsheet can be time-consuming and prone to errors. Fortunately, there are several methods to convert a bank statement to Excel easily and quickly, making financial management more streamlined.

The Importance of Converting Bank Statements to Excel

Converting bank statements to Excel offers several benefits. It allows for easier tracking of financial transactions, identification of spending patterns, and creation of budgets. Excel also provides various tools for data analysis, enabling users to gain deeper insights into their financial situation. Moreover, automating the process saves time and reduces the likelihood of manual entry errors.

Methods to Convert Bank Statements to Excel

1. Manual Entry

Although manual entry is the most basic method, it's also the most time-consuming and error-prone. This involves typing each transaction from the bank statement into an Excel spreadsheet. To minimize errors, it's essential to double-check each entry.

2. Bank Statement Upload

Some banks offer the option to download bank statements in Excel format or to upload them directly to Excel. This method is quicker and more accurate than manual entry. However, the availability of this feature depends on the bank's services.

3. Optical Character Recognition (OCR) Software

OCR software can read and convert text from images or scanned documents into editable text. This method is particularly useful for paper bank statements. Users can scan the statement, use OCR software to convert it into text, and then copy and paste the data into Excel.

4. Automated Transaction Import

Several personal finance software programs and apps, such as Mint, Quicken, or YNAB (You Need a Budget), allow users to link their bank accounts and automatically import transactions into a database that can be exported to Excel.

Step-by-Step Guide to Converting Bank Statements to Excel

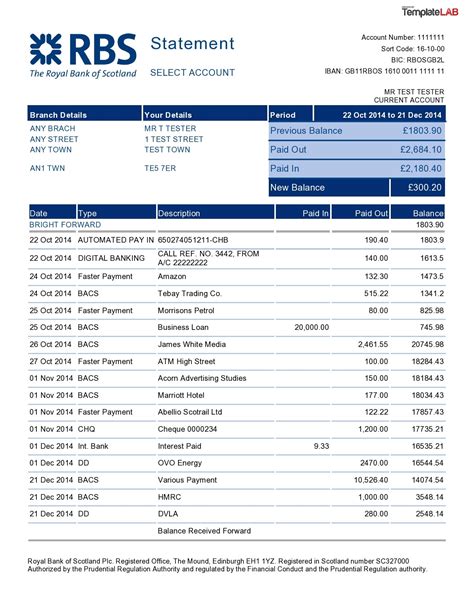

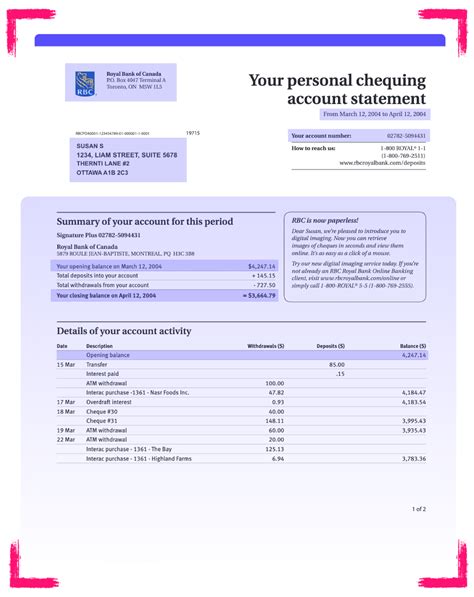

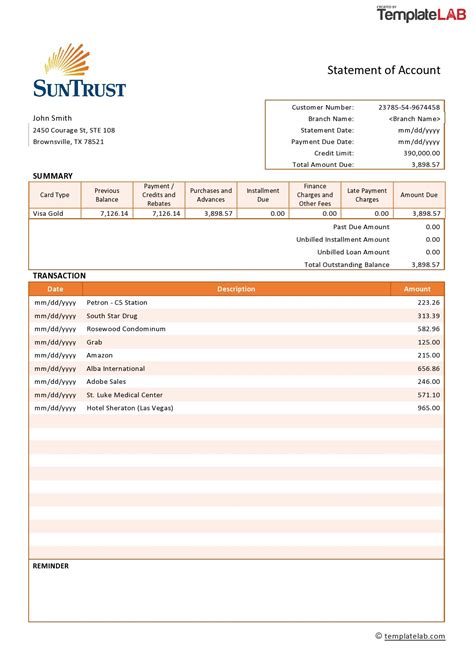

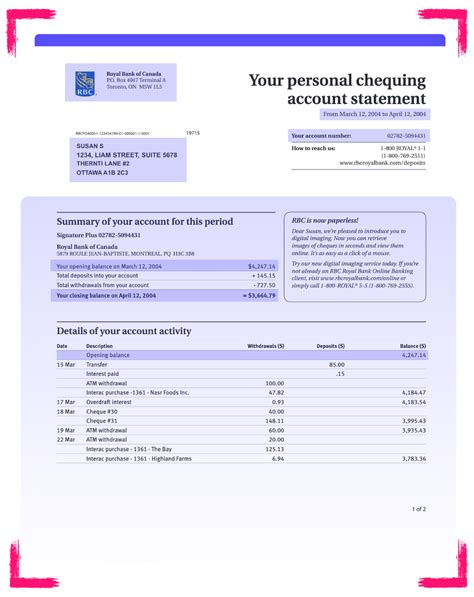

Step 1: Gather Bank Statements

Collect all bank statements, whether they are physical, digital, or online.

Step 2: Choose Conversion Method

Decide which conversion method best suits your needs based on the tools and resources available.

Step 3: Implement Conversion

Follow the specific steps for the chosen method, whether it involves manual entry, bank statement upload, OCR software, or automated transaction import.

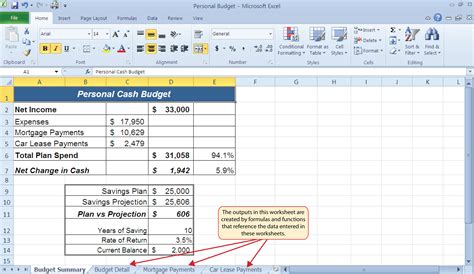

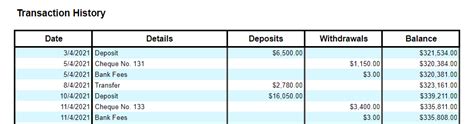

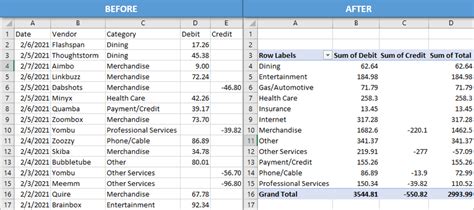

Step 4: Organize and Analyze

Once the data is in Excel, organize it into a usable format and use Excel's tools to analyze and gain insights from the data.

Tips and Tricks for Efficient Conversion

1. Use Bank Statement Templates

Excel offers templates for bank statements that can streamline the process.

2. Utilize Excel Formulas

Excel formulas can automate calculations and data manipulation, saving time and reducing errors.

3. Regularly Update Records

Regular updates ensure accuracy and allow for timely financial decisions.

Common Challenges and Solutions

1. Data Accuracy

Manual entry errors can be minimized by double-checking entries or using automated methods.

2. Software Compatibility

Ensure that any software used for conversion is compatible with your bank's statement format.

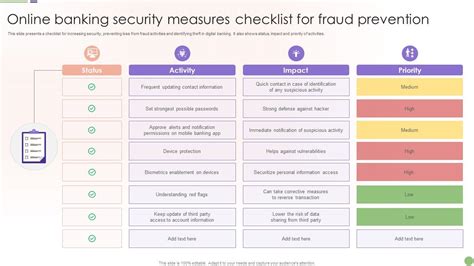

3. Data Security

Always prioritize data security by using secure and trusted software and services.

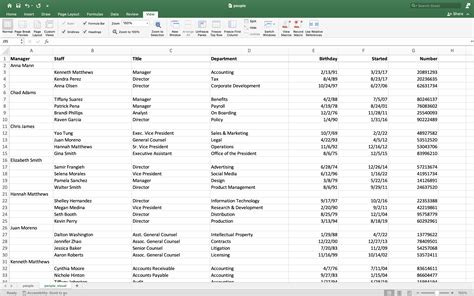

Gallery of Bank Statement to Excel Conversion

Bank Statement to Excel Conversion

FAQs

Q: What is the most accurate method to convert a bank statement to Excel?

A: The most accurate method is often using automated transaction import through personal finance software or apps, as it minimizes manual entry errors.

Q: Can I use OCR software to convert paper bank statements?

A: Yes, OCR software can convert text from scanned or photographed bank statements into editable text that can be imported into Excel.

Q: How can I ensure data security during the conversion process?

A: Use trusted software and services, and keep your Excel files password-protected to ensure data security.

Q: What are some common challenges when converting bank statements to Excel?

A: Common challenges include ensuring data accuracy, software compatibility, and maintaining data security.

Conclusion and Next Steps

Converting bank statements to Excel can significantly enhance financial management and analysis. By choosing the most suitable conversion method and following the provided tips and tricks, users can efficiently and accurately move their financial data into a versatile and powerful tool like Excel. Whether for personal finance or business accounting, mastering the process of converting bank statements to Excel is a valuable skill that can lead to better financial decision-making and a more streamlined financial management process.

We invite you to share your experiences or ask questions about converting bank statements to Excel in the comments below. Your insights can help others navigate this process more effectively.