Intro

Master cost analysis in Excel with our 5 easy steps guide. Learn how to create a cost-benefit analysis, calculate total cost of ownership, and make data-driven decisions. Discover the power of Excel formulas and functions for cost estimation, financial modeling, and budgeting. Boost your financial analysis skills and make informed business decisions.

In today's fast-paced business environment, making informed decisions quickly is crucial for success. One of the most effective ways to do this is by conducting a cost analysis. Cost analysis is the process of evaluating the costs associated with a particular project, product, or business decision. By doing so, businesses can identify areas where costs can be optimized, leading to increased profitability and competitiveness. Microsoft Excel is an ideal tool for conducting cost analysis due to its powerful analytical capabilities and ease of use. In this article, we will outline 5 easy steps to cost analysis in Excel.

Why Cost Analysis is Important

Cost analysis is essential for businesses as it helps them make informed decisions about investments, pricing, and resource allocation. By understanding the costs associated with a particular project or product, businesses can identify areas where costs can be reduced or optimized, leading to increased profitability. Cost analysis also helps businesses to evaluate the feasibility of a project, identify potential risks, and develop strategies to mitigate them.

Step 1: Define the Scope of the Analysis

The first step in conducting a cost analysis in Excel is to define the scope of the analysis. This involves identifying the specific costs that need to be analyzed, such as labor costs, material costs, or overhead costs. It also involves determining the time period for which the costs need to be analyzed, such as a month, quarter, or year.

Identifying Costs

To identify the costs, you can use the following categories:

- Direct costs: These are costs that are directly related to the production of a product or service, such as labor costs, material costs, and equipment costs.

- Indirect costs: These are costs that are not directly related to the production of a product or service, such as overhead costs, administrative costs, and marketing costs.

- Fixed costs: These are costs that remain the same even if the level of production changes, such as rent, salaries, and insurance.

- Variable costs: These are costs that vary with the level of production, such as labor costs, material costs, and energy costs.

Step 2: Gather Data

The next step is to gather data on the costs that need to be analyzed. This can involve collecting data from various sources, such as:

- Financial statements: These include balance sheets, income statements, and cash flow statements.

- Accounting records: These include ledgers, journals, and invoices.

- Operational data: This includes data on production levels, labor hours, and material usage.

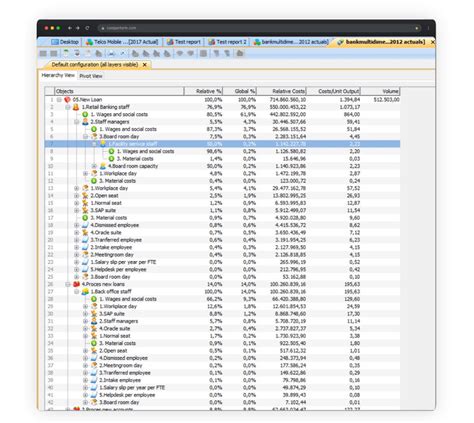

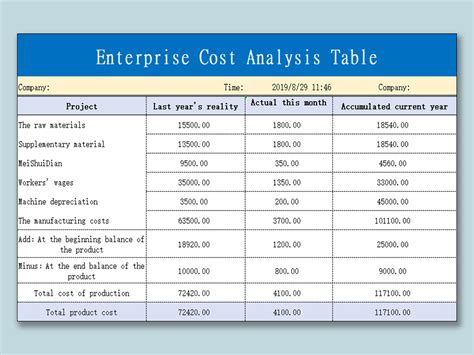

Organizing Data

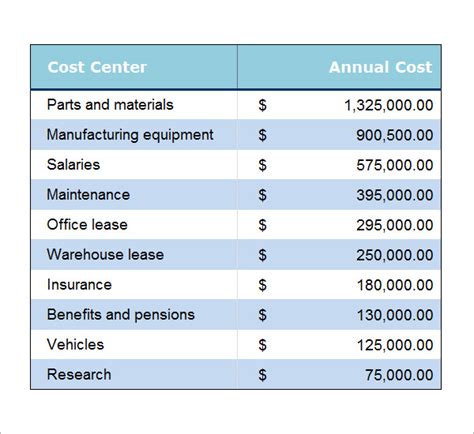

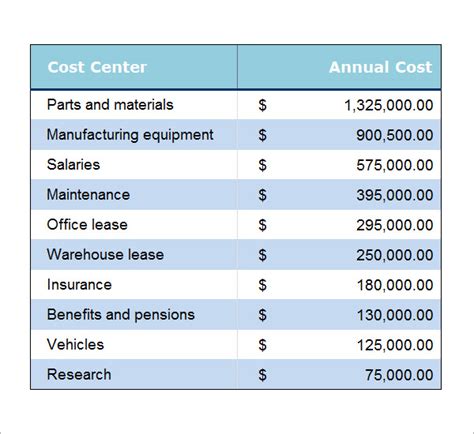

Once the data is collected, it needs to be organized in a way that makes it easy to analyze. This can involve creating a table or spreadsheet with the following columns:

- Cost category: This includes the type of cost, such as labor, material, or overhead.

- Cost amount: This includes the actual amount of the cost.

- Cost driver: This includes the factor that drives the cost, such as production level or labor hours.

Step 3: Analyze Costs

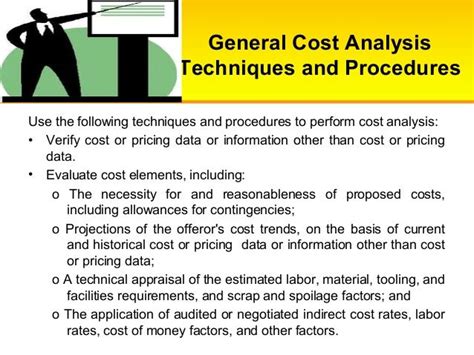

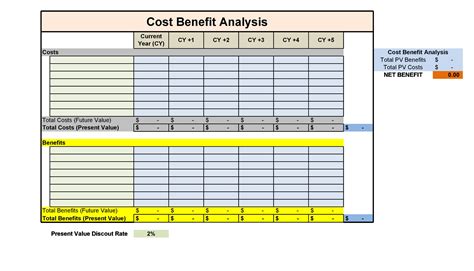

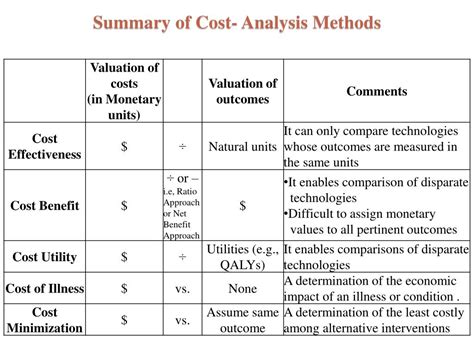

The next step is to analyze the costs using various techniques, such as:

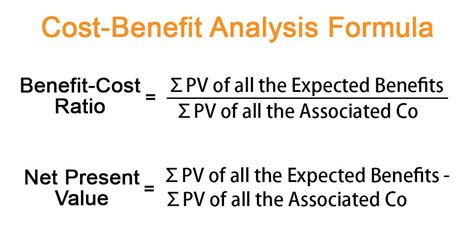

- Break-even analysis: This involves calculating the point at which the total revenue equals the total cost.

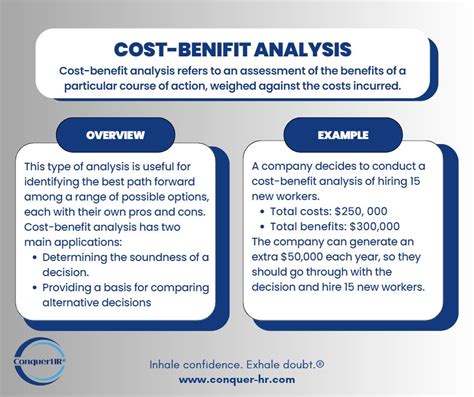

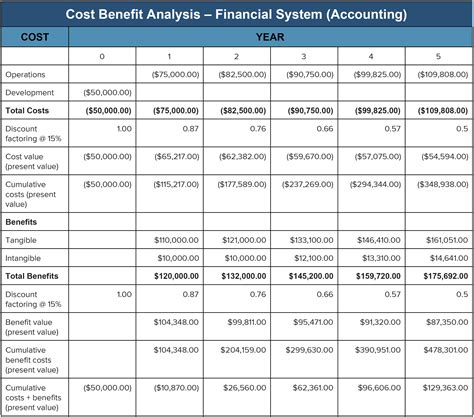

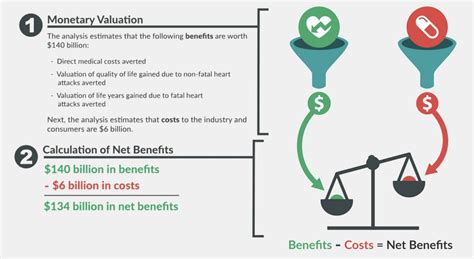

- Cost-benefit analysis: This involves comparing the costs and benefits of a particular project or decision.

- Sensitivity analysis: This involves analyzing how changes in costs affect the overall profitability of a project or decision.

Using Excel Formulas

Excel has various formulas that can be used to analyze costs, such as:

- SUMIF: This formula is used to sum up costs based on certain criteria.

- AVERAGEIF: This formula is used to calculate the average cost based on certain criteria.

- INDEX/MATCH: This formula is used to look up costs in a table based on certain criteria.

Step 4: Interpret Results

The next step is to interpret the results of the cost analysis. This involves analyzing the data to identify trends, patterns, and anomalies. It also involves drawing conclusions based on the analysis and making recommendations for future action.

Identifying Cost Reduction Opportunities

One of the main goals of cost analysis is to identify opportunities for cost reduction. This can involve:

- Identifying areas where costs are high and exploring ways to reduce them.

- Analyzing the cost structure of similar companies or industries.

- Developing strategies to optimize costs, such as outsourcing or streamlining processes.

Step 5: Present Findings

The final step is to present the findings of the cost analysis to stakeholders. This can involve:

- Creating a report that summarizes the findings and recommendations.

- Developing a presentation that highlights the key results and insights.

- Creating a dashboard that displays the data in a visual format.

Best Practices for Presenting Findings

When presenting the findings, it's essential to follow best practices, such as:

- Using clear and concise language.

- Using visual aids, such as charts and graphs.

- Focusing on the key results and insights.

- Providing recommendations for future action.

Cost Analysis in Excel Image Gallery

By following these 5 easy steps, you can conduct a cost analysis in Excel that helps you make informed decisions about your business. Remember to define the scope of the analysis, gather data, analyze costs, interpret results, and present findings in a clear and concise manner.