Intro

Master derivatives in Excel with ease! Learn how to calculate options, futures, and forwards using simple formulas and functions. Discover the power of derivatives modeling in Excel, from basic concepts to advanced techniques. Get step-by-step guides, examples, and expert tips to simplify your derivatives analysis and boost your financial modeling skills.

Derivatives are a crucial concept in finance, and Excel is an essential tool for calculating and analyzing them. In this article, we will explore the world of derivatives in Excel, making it easy for you to understand and apply these concepts in your financial modeling and analysis.

Derivatives are financial instruments that derive their value from an underlying asset, such as stocks, bonds, or commodities. They can be used to manage risk, speculate on price movements, or generate returns. Excel provides various functions and formulas to calculate derivatives, making it an essential tool for finance professionals.

Understanding Derivatives in Excel

Before diving into the calculations, it's essential to understand the types of derivatives and their characteristics. The most common types of derivatives are:

- Options: Give the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price.

- Futures: Obligate the buyer and seller to trade an underlying asset at a specified price on a specific date.

- Forwards: Similar to futures, but they are over-the-counter contracts and not traded on an exchange.

- Swaps: Exchange cash flows based on different underlying assets, such as interest rates or currencies.

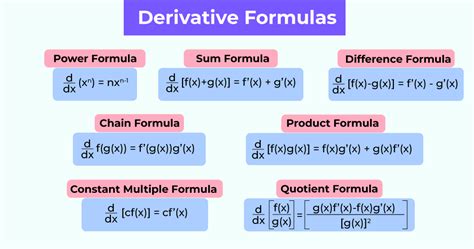

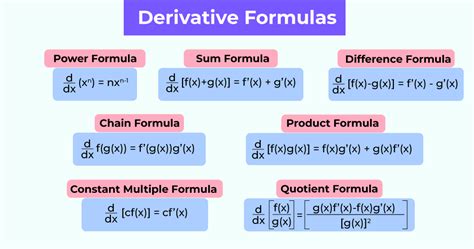

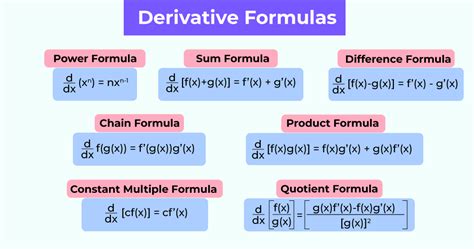

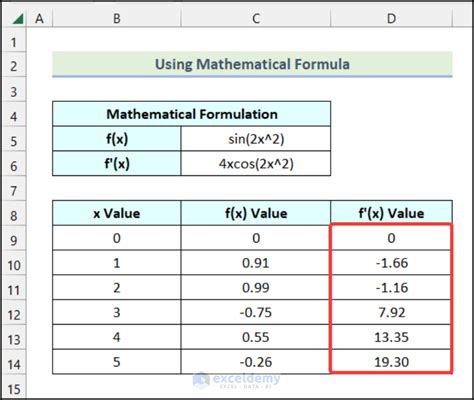

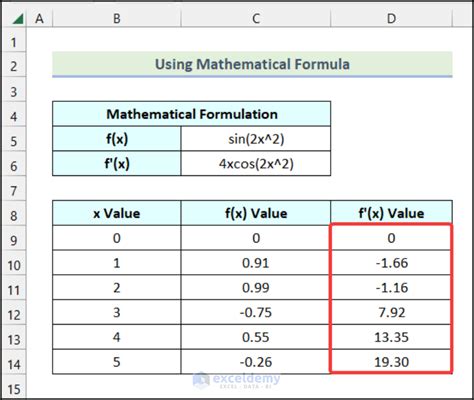

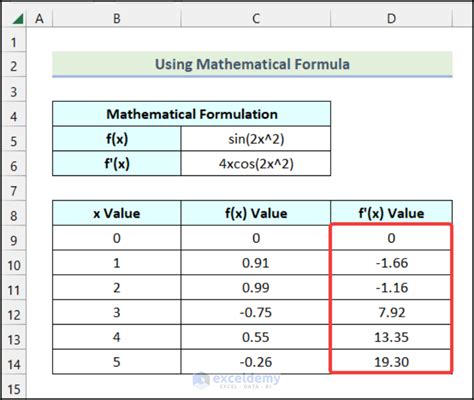

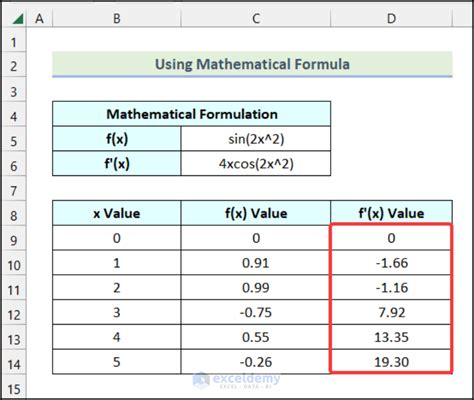

Calculating Derivatives in Excel

Excel provides various functions and formulas to calculate derivatives. Here are some of the most commonly used:

- Black-Scholes Model: This model is used to calculate the value of European-style options. The formula is:

- =BSM(Arg1, Arg2, Arg3, Arg4, Arg5, Arg6, Arg7, Arg8)

- Where:

- Arg1: Underlying price

- Arg2: Strike price

- Arg3: Time to maturity

- Arg4: Risk-free interest rate

- Arg5: Volatility

- Arg6: Dividend yield

- Arg7: Type of option (Call or Put)

- Arg8: Type of calculation ( European or American)

- Binomial Model: This model is used to calculate the value of American-style options. The formula is:

- =BINOM(Arg1, Arg2, Arg3, Arg4, Arg5, Arg6, Arg7)

- Where:

- Arg1: Underlying price

- Arg2: Strike price

- Arg3: Time to maturity

- Arg4: Risk-free interest rate

- Arg5: Volatility

- Arg6: Dividend yield

- Arg7: Type of option (Call or Put)

Using Excel Functions for Derivatives

Excel provides several built-in functions for calculating derivatives. Here are some of the most commonly used:

- OPTION PRICE: This function calculates the value of an option using the Black-Scholes model.

- =OPTIONPRICE(Arg1, Arg2, Arg3, Arg4, Arg5, Arg6, Arg7, Arg8)

- FUTURES PRICE: This function calculates the value of a futures contract.

- =FUTURESPRICE(Arg1, Arg2, Arg3, Arg4, Arg5)

- SWAP RATE: This function calculates the swap rate for a swap contract.

- =SWAPRATE(Arg1, Arg2, Arg3, Arg4, Arg5)

Derivatives Analysis in Excel

Derivatives analysis involves calculating and analyzing the sensitivity of derivatives to various factors, such as underlying price, volatility, and interest rates. Excel provides various tools and techniques for performing derivatives analysis, including:

- Sensitivity Analysis: This involves calculating the sensitivity of a derivative to a specific factor, such as underlying price or volatility.

- Scenario Analysis: This involves analyzing the behavior of a derivative under different scenarios, such as changes in interest rates or volatility.

- Monte Carlo Simulation: This involves simulating the behavior of a derivative using random sampling techniques.

Derivatives Modeling in Excel

Derivatives modeling involves creating a model to calculate the value of a derivative. Excel provides various tools and techniques for building derivatives models, including:

- Financial Modeling: This involves creating a financial model to calculate the value of a derivative.

- Stochastic Processes: This involves modeling the behavior of a derivative using stochastic processes, such as Brownian motion.

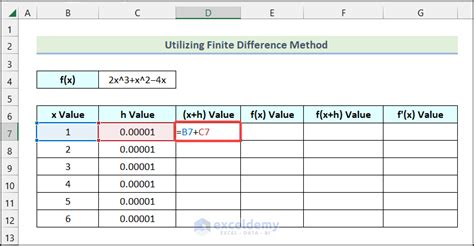

- Finite Difference Methods: This involves solving partial differential equations to calculate the value of a derivative.

Derivatives Trading Strategies in Excel

Derivatives trading strategies involve using derivatives to manage risk, speculate on price movements, or generate returns. Excel provides various tools and techniques for building derivatives trading strategies, including:

- Options Trading: This involves using options to manage risk or speculate on price movements.

- Futures Trading: This involves using futures contracts to manage risk or speculate on price movements.

- Swap Trading: This involves using swap contracts to manage risk or generate returns.

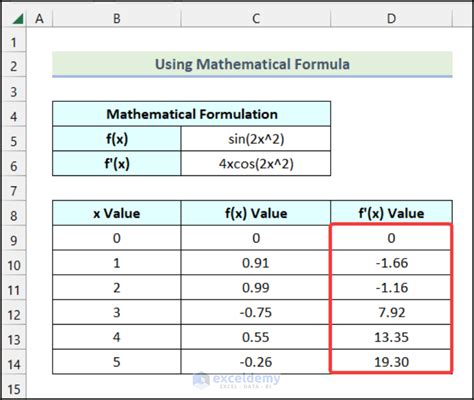

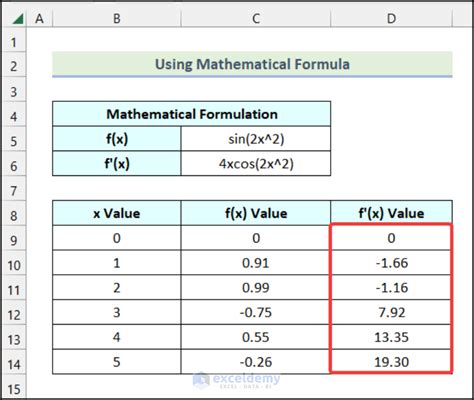

Derivatives in Excel Image Gallery

In conclusion, derivatives in Excel are a powerful tool for finance professionals to calculate, analyze, and model derivatives. By understanding the concepts and using the various functions and formulas provided by Excel, you can become proficient in derivatives analysis and trading strategies. Remember to practice and explore the various tools and techniques available in Excel to become a master of derivatives. Share your thoughts and experiences with derivatives in Excel in the comments below!