Intro

Unlock the power of risk-adjusted returns with our expert guide on calculating the Sharpe Ratio in Excel. Discover 5 easy methods to calculate Sharpe Ratio, including formulas, examples, and step-by-step instructions. Master risk management, portfolio optimization, and performance evaluation with this essential finance metric.

Investors and financial analysts widely use the Sharpe Ratio to evaluate the performance of investment portfolios. The Sharpe Ratio is a risk-adjusted measure that helps investors understand the relationship between risk and return. In this article, we will discuss the Sharpe Ratio, its importance, and five ways to calculate it in Excel.

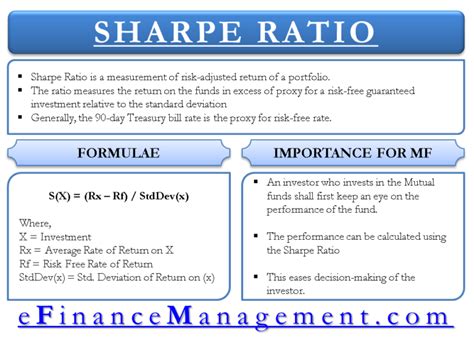

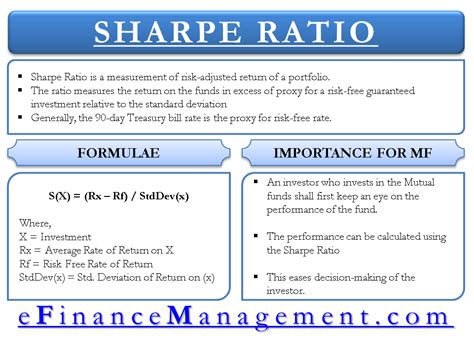

Understanding the Sharpe Ratio

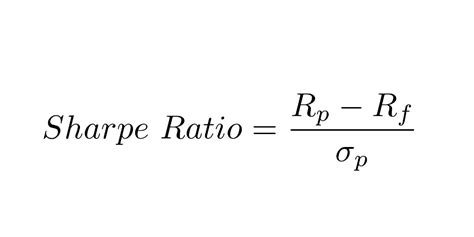

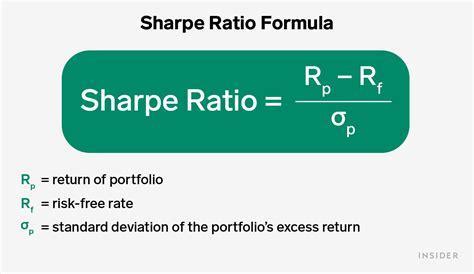

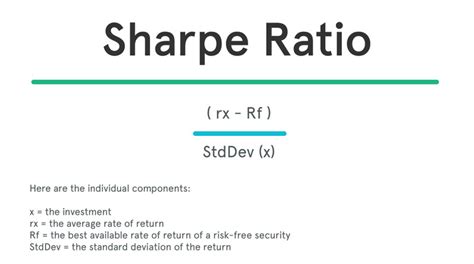

The Sharpe Ratio is named after William F. Sharpe, who developed it in the 1960s. The ratio measures the excess return of an investment over the risk-free rate, relative to its volatility. The Sharpe Ratio is calculated as the average return of the investment minus the risk-free rate, divided by the standard deviation of the investment's returns.

The Sharpe Ratio helps investors to:

- Evaluate the performance of different investments

- Compare the risk-adjusted returns of various portfolios

- Identify investments that offer higher returns for a given level of risk

Calculating the Sharpe Ratio in Excel

Excel provides several ways to calculate the Sharpe Ratio. Here are five methods:

Method 1: Using the SHARPE Function

Excel has a built-in function called SHARPE, which calculates the Sharpe Ratio. The syntax for the SHARPE function is:

SHARPE(returns, risk_free_rate)

Where:

- returns is the range of cells containing the investment returns

- risk_free_rate is the risk-free rate of return

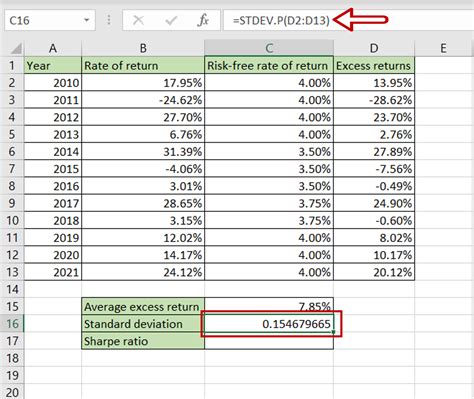

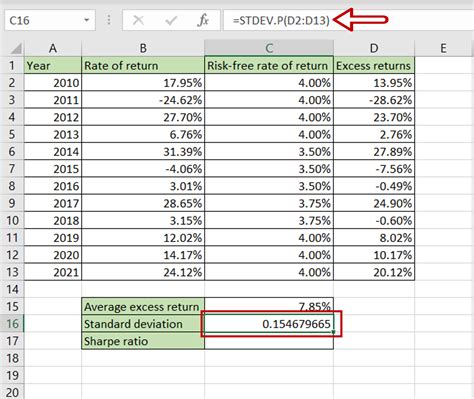

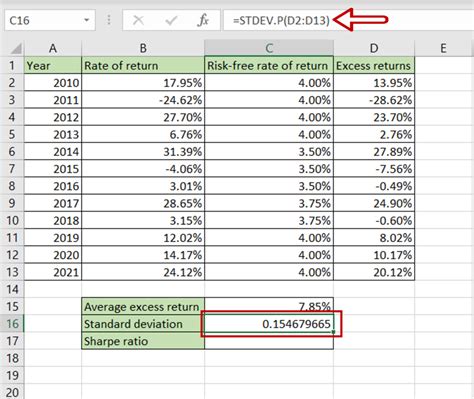

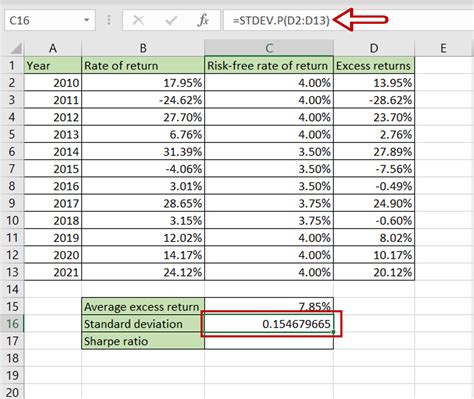

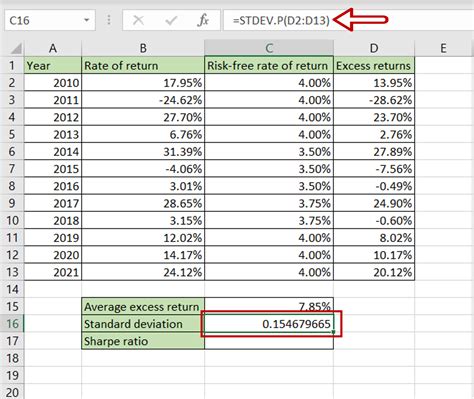

Method 2: Using the AVERAGE and STDEV Functions

You can also calculate the Sharpe Ratio using the AVERAGE and STDEV functions. The formula is:

(AVERAGE(returns) - risk_free_rate) / STDEV(returns)

Where:

- returns is the range of cells containing the investment returns

- risk_free_rate is the risk-free rate of return

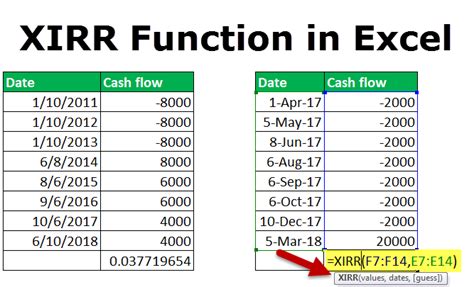

Method 3: Using the XIRR Function

The XIRR function calculates the internal rate of return of an investment. You can use the XIRR function to calculate the Sharpe Ratio as follows:

XIRR(returns, risk_free_rate)

Where:

- returns is the range of cells containing the investment returns

- risk_free_rate is the risk-free rate of return

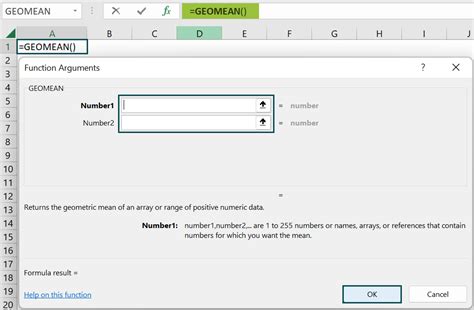

Method 4: Using the GEOMEAN Function

The GEOMEAN function calculates the geometric mean of a range of cells. You can use the GEOMEAN function to calculate the Sharpe Ratio as follows:

(GEOMEAN(returns) - risk_free_rate) / STDEV(returns)

Where:

- returns is the range of cells containing the investment returns

- risk_free_rate is the risk-free rate of return

Method 5: Using VBA

You can also calculate the Sharpe Ratio using VBA (Visual Basic for Applications) macros. The code is:

Function SharpeRatio(returns As Range, riskFreeRate As Double) As Double

SharpeRatio = (Application.Average(returns) - riskFreeRate) / Application.StDev(returns)

End Function

Interpretation of the Sharpe Ratio

The Sharpe Ratio is a dimensionless number that can be positive, negative, or zero. A higher Sharpe Ratio indicates that an investment has generated excess returns relative to its risk. A negative Sharpe Ratio indicates that an investment has underperformed the risk-free rate.

Here are some general guidelines for interpreting the Sharpe Ratio:

- A Sharpe Ratio greater than 1 indicates that an investment has generated excess returns relative to its risk.

- A Sharpe Ratio between 0 and 1 indicates that an investment has generated returns that are comparable to its risk.

- A Sharpe Ratio less than 0 indicates that an investment has underperformed the risk-free rate.

Gallery of Sharpe Ratio Calculation

Sharpe Ratio Calculation Gallery

We hope this article has provided you with a comprehensive understanding of the Sharpe Ratio and its calculation in Excel. Whether you are an investor, financial analyst, or portfolio manager, the Sharpe Ratio is an essential tool for evaluating investment performance and managing risk. By following the methods outlined in this article, you can calculate the Sharpe Ratio with ease and make informed investment decisions.

We invite you to share your thoughts and experiences with calculating the Sharpe Ratio in the comments section below. How do you use the Sharpe Ratio in your investment decisions? What methods do you prefer for calculating the Sharpe Ratio in Excel? Let's discuss!