Calculating the payback period is a crucial step in evaluating the feasibility of a project or investment. It helps you determine how long it will take to recover the initial cost of the investment through cash inflows. In this article, we will explore the concept of payback period, its importance, and how to calculate it easily in Excel.

The payback period is the time it takes for an investment to generate cash inflows that are equal to the initial cost of the investment. It is an important metric used in capital budgeting to evaluate the feasibility of a project. A shorter payback period indicates that the investment will recover its costs quickly, making it a more attractive option.

Why is Payback Period Important?

The payback period is important because it helps investors and businesses make informed decisions about investments. It provides a clear picture of the time it will take to recover the initial cost of the investment, which can be crucial in evaluating the feasibility of a project.

Here are some reasons why payback period is important:

- Risk assessment: A shorter payback period indicates lower risk, as the investment will recover its costs quickly.

- Cash flow management: Understanding the payback period helps businesses manage their cash flows effectively.

- Comparing investments: Payback period can be used to compare different investment options and choose the one with the shortest payback period.

How to Calculate Payback Period in Excel

Calculating payback period in Excel is easy and straightforward. Here's a step-by-step guide:

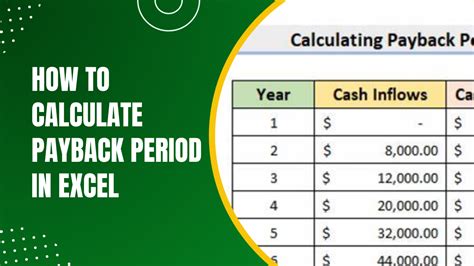

Step 1: Gather Data

To calculate the payback period, you need to gather the following data:

- Initial investment (cost)

- Cash inflows (revenue) per period (year, month, etc.)

- Number of periods (years, months, etc.)

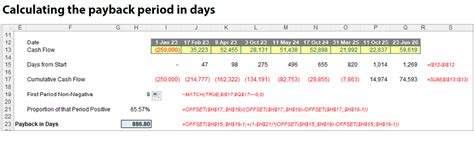

Step 2: Create a Table

Create a table in Excel with the following columns:

- Period (year, month, etc.)

- Cash Inflow (revenue)

- Cumulative Cash Inflow

- Payback Period

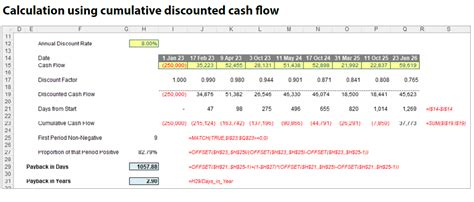

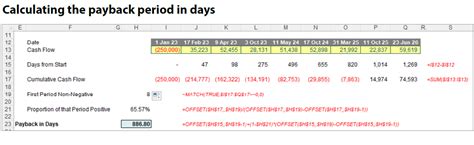

Step 3: Calculate Cumulative Cash Inflow

Calculate the cumulative cash inflow by adding the cash inflow for each period to the previous cumulative cash inflow.

=C2+B2

Where:

- C2 is the cumulative cash inflow for the current period

- B2 is the cash inflow for the current period

Step 4: Calculate Payback Period

Calculate the payback period by using the following formula:

=IF(C2>=A2, C2/A2, "")

Where:

- C2 is the cumulative cash inflow for the current period

- A2 is the initial investment (cost)

The formula checks if the cumulative cash inflow is greater than or equal to the initial investment. If true, it returns the payback period; otherwise, it returns a blank.

Step 5: Visualize the Data

Visualize the data using a chart or graph to get a clear picture of the payback period.

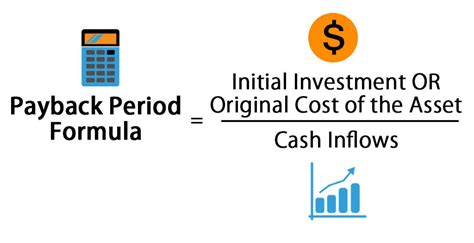

Payback Period Formula in Excel

Here is the complete payback period formula in Excel:

=IF(CUMIPMT(B2:B10, A2, 1, 1, 0, 1)>0,

(A2 + SUM(B2:B10)) / SUM(B2:B10),

IF(CUMIPMT(B2:B10, A2, 1, 1, 0, 1)<0,

A2 / SUM(B2:B10),

""))

Where:

- B2:B10 is the range of cash inflows

- A2 is the initial investment (cost)

This formula calculates the payback period using the cumulative cash inflow and the initial investment.

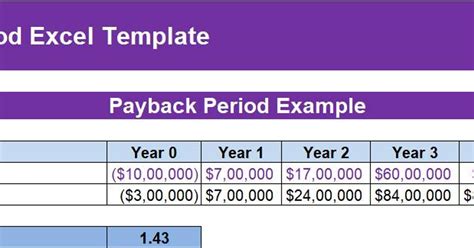

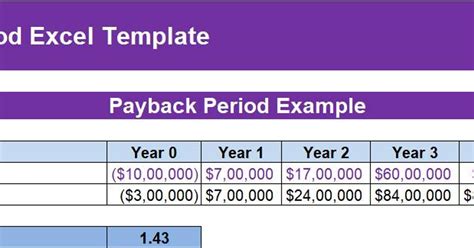

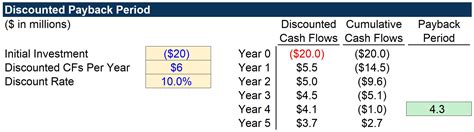

Payback Period Example in Excel

Here is an example of calculating the payback period in Excel:

| Period | Cash Inflow | Cumulative Cash Inflow | Payback Period |

|---|---|---|---|

| 1 | 1000 | 1000 | |

| 2 | 1200 | 2200 | |

| 3 | 1500 | 3700 | 3 |

| 4 | 1800 | 5500 | |

| 5 | 2000 | 7500 |

In this example, the payback period is 3 years, indicating that the investment will recover its costs in 3 years.

Payback Period Calculator in Excel

You can create a payback period calculator in Excel using the following steps:

Step 1: Create a Table

Create a table with the following columns:

- Initial Investment

- Cash Inflow per Period

- Number of Periods

- Payback Period

Step 2: Add Formulas

Add the following formulas to the table:

- Cumulative Cash Inflow:

=SUM(B2:B10) - Payback Period:

=IF(C2>=A2, C2/A2, "")

Where:

- C2 is the cumulative cash inflow

- A2 is the initial investment

Step 3: Visualize the Data

Visualize the data using a chart or graph to get a clear picture of the payback period.

Advantages of Using Payback Period in Excel

Using the payback period in Excel has several advantages:

- Easy to calculate: The payback period is easy to calculate in Excel using simple formulas.

- Quick results: Excel provides quick results, allowing you to make informed decisions about investments.

- Visual representation: Excel provides a visual representation of the payback period, making it easier to understand and analyze.

Conclusion

In conclusion, calculating the payback period in Excel is a straightforward process that provides valuable insights into the feasibility of an investment. By following the steps outlined in this article, you can easily calculate the payback period in Excel and make informed decisions about investments.

Final Thoughts

The payback period is an essential metric in capital budgeting, and Excel provides an easy and efficient way to calculate it. By using the formulas and techniques outlined in this article, you can calculate the payback period in Excel and make informed decisions about investments.

We hope this article has provided you with a comprehensive understanding of how to calculate the payback period in Excel. If you have any questions or need further clarification, please feel free to comment below.

Payback Period Image Gallery