Having a child with a medical condition that requires formula as a primary source of nutrition can be a significant financial burden on families. However, many insurance plans cover the cost of formula, but navigating the process can be complex and overwhelming. In this article, we will guide you through the essential steps to get formula covered by insurance.

Understanding Your Insurance Coverage

Before starting the process, it's essential to understand your insurance coverage. Review your policy documents or contact your insurance provider to determine if they cover formula costs. Check if there are any specific requirements or limitations, such as:

- Pre-authorization needed for formula coverage

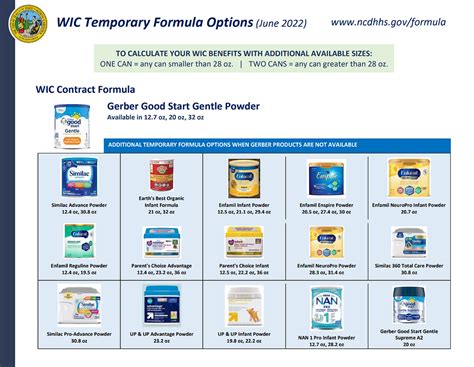

- Specific formula brands or types covered

- Maximum coverage limits or dollar amounts

- Co-pays or deductibles associated with formula coverage

Step 1: Determine the Type of Formula Needed

The type of formula required will significantly impact the insurance coverage process. Different formulas are designed for specific medical conditions, such as:

- Elemental formulas for severe food allergies or gastrointestinal issues

- Hydrolyzed formulas for mild to moderate allergies

- Amino acid-based formulas for severe allergies or eosinophilic esophagitis

Consult with your child's healthcare provider to determine the type of formula needed. They will help you choose the most suitable formula and provide documentation to support your insurance claim.

Gathering Necessary Documents

To get formula covered by insurance, you'll need to gather the necessary documents, including:

- A letter of medical necessity from your child's healthcare provider

- A detailed diagnosis and treatment plan

- Proof of formula purchase or a prescription

- Insurance policy documents and identification numbers

Ensure that all documents are accurate, up-to-date, and clearly state the medical necessity of the formula.

Step 2: Contact Your Insurance Provider

Reach out to your insurance provider to initiate the coverage process. Provide them with the necessary documents and information about the formula, including:

- Formula type and brand

- Quantity and frequency of use

- Medical necessity documentation

- Healthcare provider's contact information

Insurance providers may require additional information or clarification. Be prepared to answer questions and provide further documentation as needed.

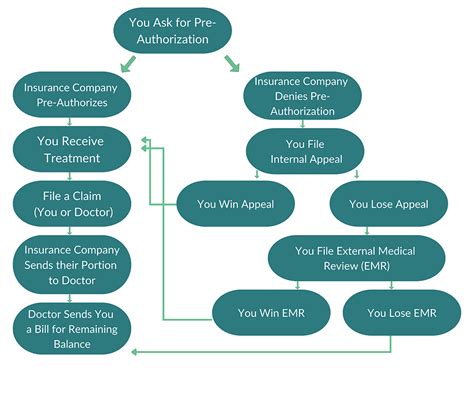

Pre-Authorization and Approval

If pre-authorization is required, submit the necessary documents and wait for the insurance provider's response. This process can take several days to several weeks.

Once the pre-authorization is approved, you'll receive a confirmation letter or email with the coverage details, including:

- Coverage period and duration

- Covered formula type and brand

- Quantity and frequency of use

- Co-pays or deductibles

Step 3: Purchase the Formula

After receiving approval, you can purchase the formula from a pharmacy, online retailer, or the manufacturer's website. Ensure that you follow the approved quantity and frequency of use to avoid any coverage issues.

Monitoring and Re-authorization

Regularly monitor your formula coverage to ensure that you're within the approved limits. Keep track of:

- Formula usage and quantity

- Expiration dates of coverage and pre-authorization

- Changes in your child's medical condition or formula needs

Re-authorization may be required periodically, usually every 3-6 months. Be prepared to provide updated documentation and information to maintain continuous coverage.

Step 4: Appeals and Disputes

If your insurance claim is denied or partially covered, don't hesitate to appeal or dispute the decision. Gather additional documentation and information to support your claim, and:

- Contact your insurance provider's customer service or appeals department

- Submit a written appeal or dispute letter

- Follow up with your healthcare provider for additional support

Additional Resources and Support

Navigating the insurance coverage process can be challenging. Don't hesitate to seek additional resources and support, such as:

- Patient advocacy groups and organizations

- Formula manufacturers' customer support

- Online forums and communities

Step 5: Staying Organized and Informed

To ensure continuous coverage and minimize disruptions, stay organized and informed throughout the process. Keep track of:

- Important dates and deadlines

- Coverage details and pre-authorization

- Formula usage and quantity

- Changes in your child's medical condition or formula needs

By following these essential steps and staying proactive, you can successfully navigate the insurance coverage process and ensure that your child receives the necessary formula for their medical condition.

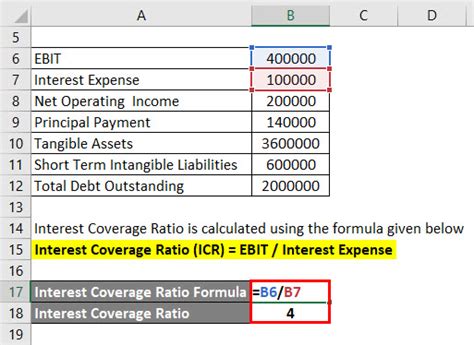

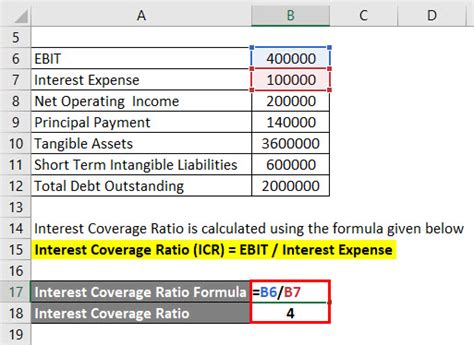

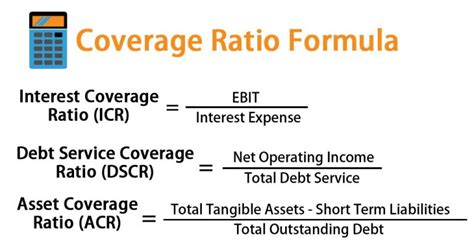

Gallery of Formula Coverage

We hope this article has provided you with a comprehensive guide to getting formula covered by insurance. Remember to stay proactive, organized, and informed throughout the process. If you have any questions or concerns, please don't hesitate to comment below or share this article with others who may benefit from this information.