Intro

Learn how to tackle your student loan debt with our expert guide. Discover 5 effective ways to pay back student loans, including income-driven repayment plans, loan forgiveness programs, and strategies to reduce monthly payments. Get back on track with your finances and kickstart your debt-free future with our actionable tips.

Paying back student loans can be a daunting task, but with the right strategies and mindset, it can be manageable. If you're struggling to make payments or simply want to pay off your loans quickly, there are several options to consider. In this article, we'll explore five ways to pay back student loans, including income-driven repayment plans, refinancing, and more.

Understand Your Student Loan Options

Before we dive into the different ways to pay back student loans, it's essential to understand the types of loans you have and the repayment options available to you. Federal student loans, for example, offer several repayment plans, including the Standard Repayment Plan, Graduated Repayment Plan, and Extended Repayment Plan. Private student loans, on the other hand, may have fewer repayment options.

Types of Student Loans

- Federal student loans (e.g., Direct Subsidized and Unsubsidized Loans, Federal Family Education Loans)

- Private student loans (e.g., bank loans, credit union loans)

- Consolidation loans (combines multiple loans into one loan)

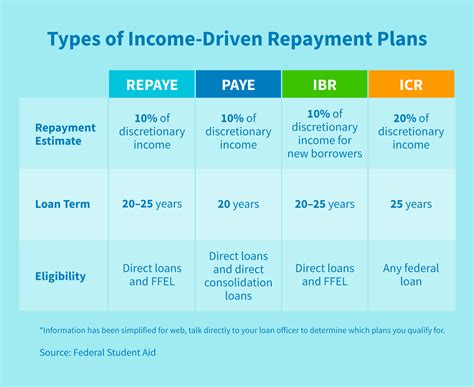

1. Income-Driven Repayment Plans

Income-driven repayment plans can help make your monthly payments more manageable by capping your payments at a certain percentage of your discretionary income. There are four main types of income-driven repayment plans:

- Income-Based Repayment (IBR) Plan

- Pay As You Earn (PAYE) Plan

- Revised Pay As You Earn (REPAYE) Plan

- Income-Contingent Repayment (ICR) Plan

To qualify for an income-driven repayment plan, you'll need to meet certain eligibility requirements, such as having a partial financial hardship and being a borrower of a qualifying federal student loan.

Benefits of Income-Driven Repayment Plans

- Lower monthly payments

- Potential for loan forgiveness after 20 or 25 years

- May be eligible for Public Service Loan Forgiveness (PSLF)

2. Refinancing Your Student Loans

Refinancing your student loans can help you save money on interest and lower your monthly payments. By refinancing, you're essentially replacing your old loan with a new one that has a lower interest rate and more favorable terms.

Benefits of Refinancing Your Student Loans

- Lower interest rates

- Lower monthly payments

- Simplified repayment process (e.g., single monthly payment)

However, refinancing may not be the best option for everyone, especially if you have federal student loans and want to take advantage of income-driven repayment plans or loan forgiveness programs.

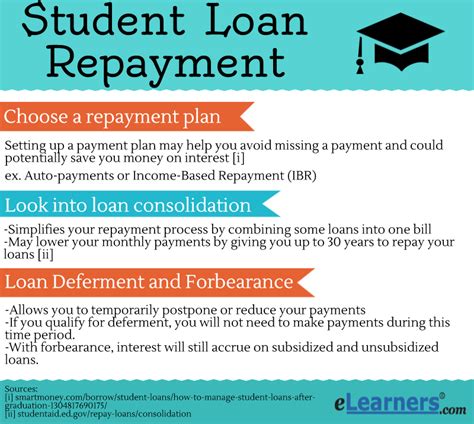

3. Consolidating Your Student Loans

Consolidating your student loans can help simplify your repayment process by combining multiple loans into one loan. This can be especially helpful if you have multiple federal student loans with different interest rates and repayment terms.

Benefits of Consolidating Your Student Loans

- Simplified repayment process (e.g., single monthly payment)

- Lower monthly payments (may be eligible for a longer repayment period)

- Fixed interest rate (may be beneficial if you have variable-rate loans)

However, consolidating your student loans may not always be the best option, especially if you have private student loans or want to take advantage of loan forgiveness programs.

4. Making Extra Payments

Making extra payments on your student loans can help you pay off your debt faster and save money on interest. You can make extra payments by:

- Paying more than the minimum payment each month

- Making lump-sum payments

- Using tax refunds or bonuses to make extra payments

Benefits of Making Extra Payments

- Pay off your debt faster

- Save money on interest

- Build credit by making timely payments

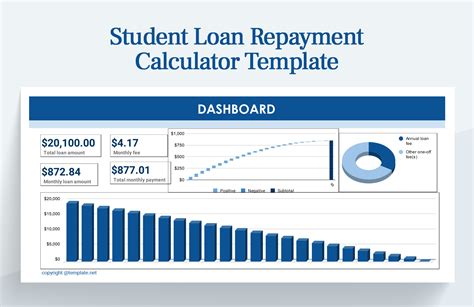

5. Using a Student Loan Repayment Calculator

Using a student loan repayment calculator can help you determine the best repayment strategy for your situation. These calculators can help you:

- Estimate your monthly payments

- Determine how long it'll take to pay off your debt

- Compare different repayment scenarios

Benefits of Using a Student Loan Repayment Calculator

- Get a clear picture of your repayment options

- Make informed decisions about your repayment strategy

- Save time and money by finding the best repayment plan for your situation

Conclusion: Take Control of Your Student Loans

Paying back student loans can be a daunting task, but with the right strategies and mindset, it can be manageable. By understanding your student loan options, income-driven repayment plans, refinancing, consolidating, making extra payments, and using a student loan repayment calculator, you can take control of your student loans and achieve financial freedom.

What's Next?

- Share your student loan repayment story with us

- Comment below with any questions or concerns you may have

- Take the first step towards paying off your student loans today

Student Loan Repayment Image Gallery