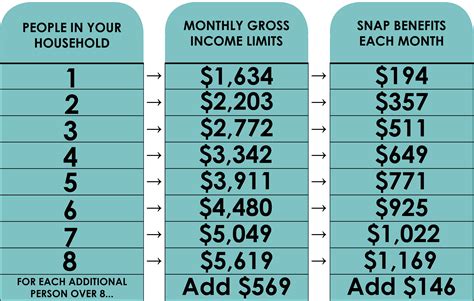

Proving self-employment income can be a challenging task, especially when it comes to applying for government assistance programs like food stamps. The process can be overwhelming, but it's essential to provide accurate and detailed documentation to ensure you receive the benefits you're eligible for. In this article, we'll explore five ways to prove self-employment income for food stamps and provide valuable tips to help you navigate the process.

Understanding Self-Employment Income and Food Stamps

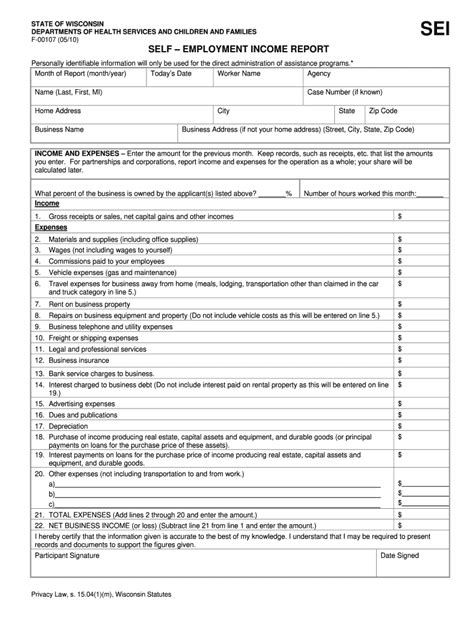

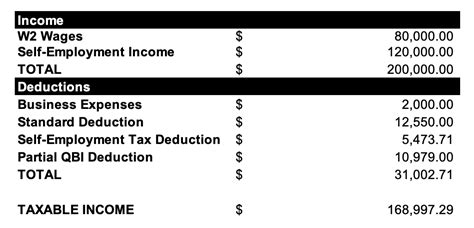

Before we dive into the ways to prove self-employment income, it's essential to understand how self-employment income affects your food stamp eligibility. Self-employment income is considered taxable income, and it's subject to the same income limits as other types of income. However, the process of calculating self-employment income can be complex, and it requires careful documentation.

1. Business Tax Returns

One of the most common ways to prove self-employment income is by providing business tax returns. This includes your Schedule C (Form 1040) and any additional schedules or forms that support your business income. Make sure to provide detailed records, including:

- Business name and address

- Business type and description

- Gross income and expenses

- Net profit or loss

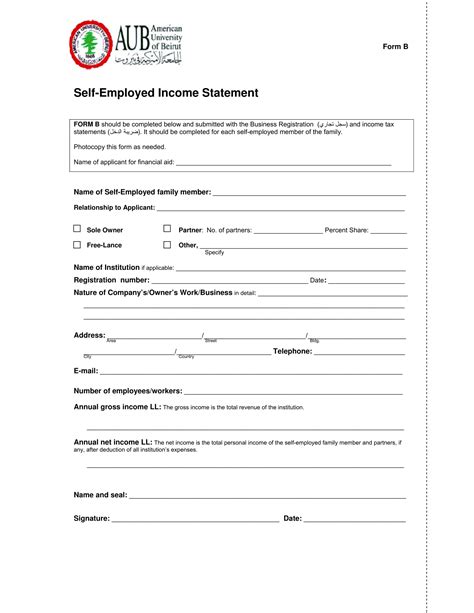

2. Financial Statements

Another way to prove self-employment income is by providing financial statements, such as:

- Balance sheets

- Income statements

- Cash flow statements

These statements provide a detailed picture of your business's financial health and can help support your self-employment income claims. Make sure to include:

- Business name and address

- Date range of the financial statements

- Detailed income and expense records

3. Invoices and Receipts

Invoices and receipts are essential documents that can help prove your self-employment income. Make sure to keep accurate records of:

- Invoices sent to clients or customers

- Receipts for business expenses

- Payments received from clients or customers

These documents can help support your self-employment income claims and demonstrate your business's financial activity.

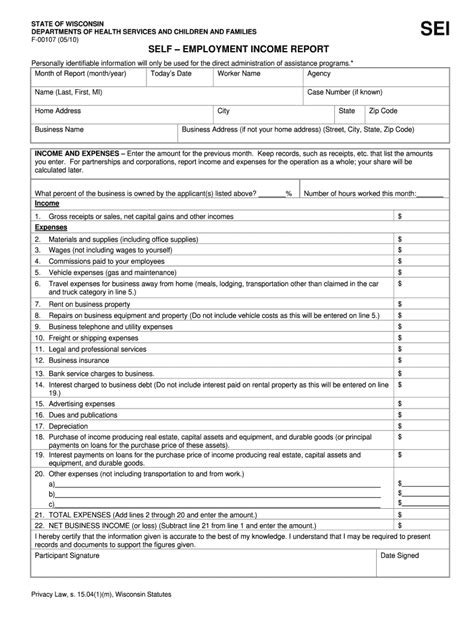

4. Bank Statements

Bank statements can provide valuable information about your business's financial activity and help prove your self-employment income. Make sure to provide:

- Business bank statements

- Personal bank statements (if your business is a sole proprietorship)

These statements can help demonstrate your business's income and expenses, as well as your personal income.

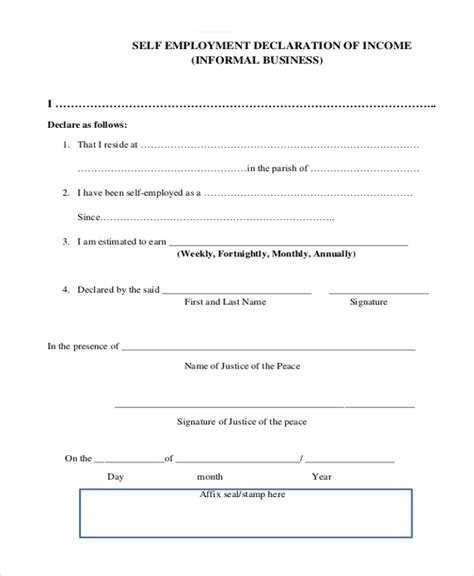

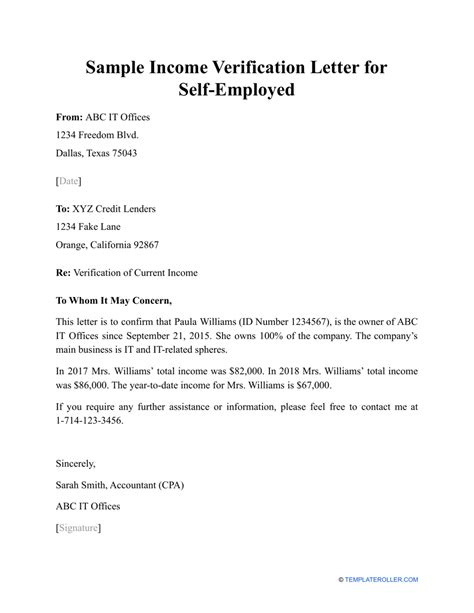

5. Letter from Your Accountant or Bookkeeper

If you have an accountant or bookkeeper who helps you manage your business finances, you can ask them to provide a letter that verifies your self-employment income. This letter should include:

- Business name and address

- Date range of the income verification

- Detailed income and expense records

This letter can provide additional support for your self-employment income claims and help demonstrate your business's financial activity.

Tips for Proving Self-Employment Income

Here are some valuable tips to help you prove self-employment income for food stamps:

- Keep accurate and detailed records of your business income and expenses.

- Provide all required documentation, including tax returns, financial statements, invoices, receipts, and bank statements.

- Make sure to include your business name and address on all documentation.

- Keep records of any changes to your business, including changes to your business structure or ownership.

- Be prepared to provide additional documentation or information to support your self-employment income claims.

Gallery of Proving Self-Employment Income

Proving Self-Employment Income Image Gallery

Get Involved

Proving self-employment income for food stamps requires careful documentation and attention to detail. By following these five ways to prove self-employment income, you can ensure that you receive the benefits you're eligible for. If you have any questions or concerns, feel free to comment below or share this article with others who may be struggling with the process. Remember to keep accurate records and provide all required documentation to support your self-employment income claims.