Excel is a powerful tool for financial calculations, and one of its most useful functions is the CUMIPMT function, which calculates the interest payments made on a loan or investment. In this article, we will explore the Excel CUMIPMT function, its syntax, and how to use it to calculate interest payments.

What is the CUMIPMT Function?

The CUMIPMT function in Excel calculates the cumulative interest paid on a loan or investment between two specified periods. It takes into account the principal amount, interest rate, and the number of periods. This function is particularly useful for calculating the interest paid on a loan or investment over a specific period.

Syntax of the CUMIPMT Function

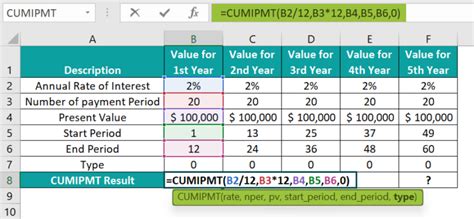

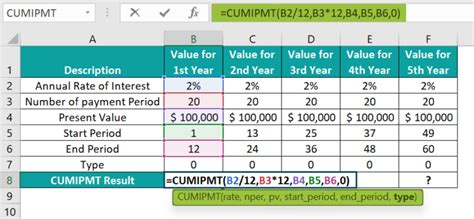

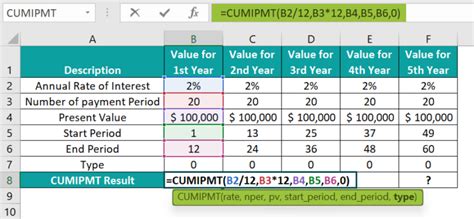

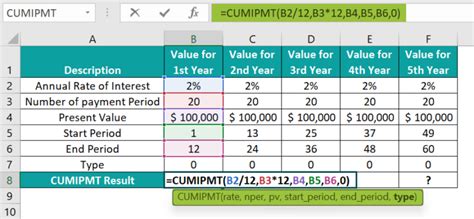

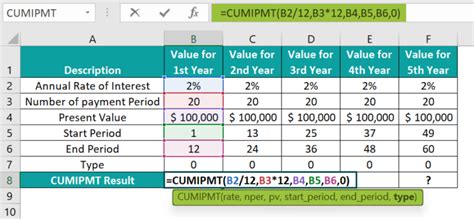

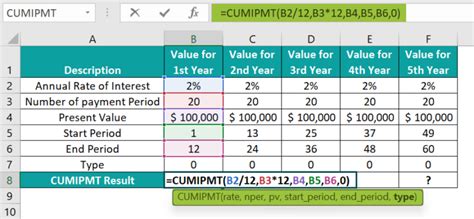

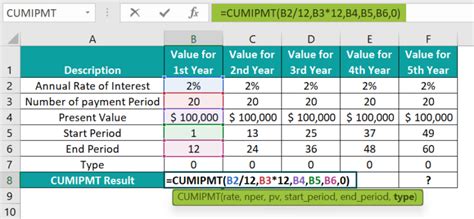

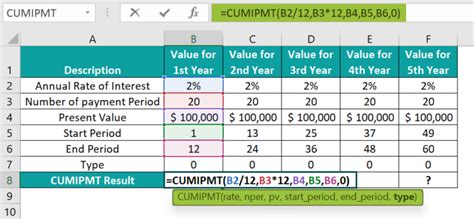

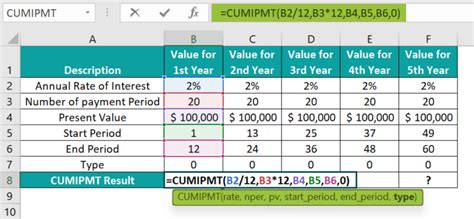

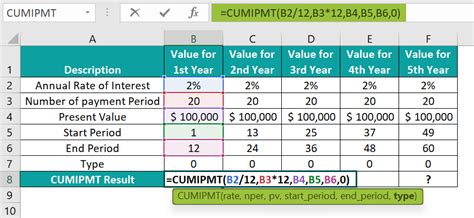

The syntax of the CUMIPMT function is as follows:

CUMIPMT(rate, nper, pv, start_period, end_period, type)

- rate: The interest rate per period.

- nper: The total number of payment periods.

- pv: The present value (the initial amount of the loan or investment).

- start_period: The starting period for which you want to calculate the cumulative interest.

- end_period: The ending period for which you want to calculate the cumulative interest.

- type: The type of payment (0 = end of period, 1 = beginning of period).

How to Use the CUMIPMT Function

To use the CUMIPMT function, follow these steps:

- Open a new Excel spreadsheet or open an existing one.

- Enter the following values:

- rate: Enter the interest rate per period (e.g., 6% = 0.06).

- nper: Enter the total number of payment periods (e.g., 12 months).

- pv: Enter the present value (the initial amount of the loan or investment).

- start_period: Enter the starting period for which you want to calculate the cumulative interest (e.g., 1).

- end_period: Enter the ending period for which you want to calculate the cumulative interest (e.g., 12).

- type: Enter the type of payment (0 = end of period, 1 = beginning of period).

- Enter the CUMIPMT function in a cell: =CUMIPMT(rate, nper, pv, start_period, end_period, type).

- Press Enter to calculate the cumulative interest.

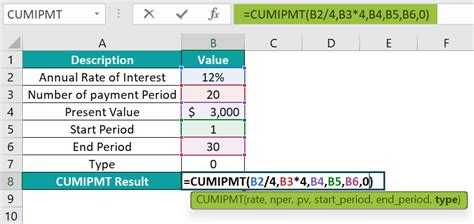

Example of Using the CUMIPMT Function

Suppose you have a loan of $10,000 with an annual interest rate of 6% and a repayment period of 12 months. You want to calculate the cumulative interest paid over the first 6 months. Here's how you can use the CUMIPMT function:

| Cell | Value |

|---|---|

| A1 | =0.06 (interest rate) |

| A2 | =12 (number of periods) |

| A3 | =10000 (present value) |

| A4 | =1 (starting period) |

| A5 | =6 (ending period) |

| A6 | =0 (type) |

Enter the CUMIPMT function in a cell: =CUMIPMT(A1, A2, A3, A4, A5, A6).

Press Enter to calculate the cumulative interest. The result is $294.84, which is the cumulative interest paid over the first 6 months.

Benefits of Using the CUMIPMT Function

The CUMIPMT function has several benefits, including:

- Easy calculation: The CUMIPMT function makes it easy to calculate the cumulative interest paid on a loan or investment.

- Accurate results: The function provides accurate results, taking into account the principal amount, interest rate, and the number of periods.

- Flexibility: The function allows you to calculate the cumulative interest over a specific period, making it useful for financial planning and analysis.

Common Errors When Using the CUMIPMT Function

Here are some common errors to avoid when using the CUMIPMT function:

- Incorrect syntax: Make sure to enter the correct syntax for the function, including all the required arguments.

- Incorrect values: Ensure that you enter the correct values for the interest rate, number of periods, present value, starting period, ending period, and type.

- Incorrect type: Make sure to enter the correct type (0 = end of period, 1 = beginning of period).

Gallery of Excel CUMIPMT Function Examples

Excel CUMIPMT Function Examples

Conclusion

The Excel CUMIPMT function is a powerful tool for calculating the cumulative interest paid on a loan or investment. By understanding the syntax and using the function correctly, you can easily calculate the cumulative interest over a specific period. We hope this article has helped you understand the CUMIPMT function and how to use it in your financial calculations.

Final Thoughts

We would love to hear from you! Have you used the CUMIPMT function in your financial calculations? Share your experiences and examples with us in the comments below. If you have any questions or need further clarification, feel free to ask.