Intro

Discover the flexibility of HTF Cancel for Any Reason travel insurance. Learn how this policy allows you to cancel your trip for any reason, without restrictions. Understand the benefits, coverage, and limitations of this type of insurance, and how it can protect your travel investment from unforeseen circumstances and unexpected events.

Traveling is an exciting experience, but unexpected events can sometimes ruin the plans. Trip cancellations or interruptions can be costly, and that's where travel insurance comes into play. One type of coverage that's gaining popularity is "Cancel For Any Reason" (CFAR) travel insurance. In this article, we'll delve into the world of CFAR travel insurance, exploring its benefits, how it works, and what you need to know before purchasing.

What is Cancel For Any Reason (CFAR) Travel Insurance?

CFAR travel insurance is a type of coverage that allows you to cancel your trip for any reason, whether it's due to unforeseen circumstances, personal reasons, or simply a change of heart. This type of insurance provides reimbursement for non-refundable trip expenses, such as flights, accommodations, and tour packages, if you need to cancel your trip.

How Does CFAR Travel Insurance Work?

CFAR travel insurance typically requires you to purchase the policy within a certain timeframe, usually 14-21 days, after making your initial trip deposit. The policy will then cover you for cancellations or interruptions that occur after the policy's effective date.

To qualify for CFAR benefits, you'll typically need to meet certain conditions, such as:

- Purchasing the policy within the specified timeframe

- Insuring the full cost of your trip

- Canceling your trip at least 48 hours prior to departure

- Not having any other travel insurance coverage for the same trip

Benefits of CFAR Travel Insurance

CFAR travel insurance offers several benefits, including:

- Flexibility: With CFAR, you can cancel your trip for any reason, whether it's due to personal or professional reasons, illness, or simply a change of heart.

- Financial Protection: CFAR reimburses you for non-refundable trip expenses, which can be a significant financial burden.

- Reduced Stress: Knowing that you have CFAR coverage can reduce stress and anxiety when planning a trip.

What's Covered Under CFAR Travel Insurance?

CFAR travel insurance typically covers non-refundable trip expenses, such as:

- Flights

- Accommodations

- Tour packages

- Cruise fares

- Travel agency fees

However, CFAR policies may not cover all trip expenses, so it's essential to review your policy carefully to understand what's included.

What's Not Covered Under CFAR Travel Insurance?

While CFAR travel insurance provides broad coverage, there are some exclusions and limitations. These may include:

- Pre-existing Medical Conditions: CFAR policies may not cover trip cancellations or interruptions due to pre-existing medical conditions.

- Known Events: If you cancel your trip due to a known event, such as a natural disaster or travel warning, you may not be eligible for CFAR benefits.

- Carrier-Imposed Cancellations: If your trip is canceled by the carrier, you may not be eligible for CFAR benefits.

How Much Does CFAR Travel Insurance Cost?

The cost of CFAR travel insurance varies depending on the provider, policy details, and your individual circumstances. On average, CFAR policies can cost anywhere from 5-15% of your total trip cost.

Tips for Purchasing CFAR Travel Insurance

When purchasing CFAR travel insurance, keep the following tips in mind:

- Read Policy Details Carefully: Understand what's covered, what's not, and any exclusions or limitations.

- Choose a Reputable Provider: Research the insurance provider and read reviews to ensure you're working with a reputable company.

- Purchase Within the Specified Timeframe: Make sure to purchase the policy within the specified timeframe to ensure you're eligible for CFAR benefits.

CFAR Travel Insurance Providers

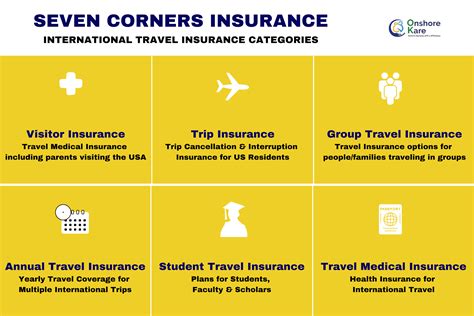

Several travel insurance providers offer CFAR policies. Some popular options include:

- Travelex: Travelex offers a range of CFAR policies, including their popular Travel Select policy.

- Allianz Travel Insurance: Allianz offers CFAR coverage as part of their OneTrip Premier policy.

- AXA Travel Insurance: AXA offers CFAR coverage as part of their Gold and Platinum policies.

Gallery of Cancel For Any Reason Travel Insurance

Cancel For Any Reason Travel Insurance Gallery

Conclusion

Cancel For Any Reason (CFAR) travel insurance provides flexibility and financial protection for travelers. While it's essential to understand the policy details, exclusions, and limitations, CFAR coverage can be a valuable addition to your travel plans. By choosing a reputable provider and purchasing the policy within the specified timeframe, you can ensure a stress-free trip and avoid costly cancellations or interruptions.

Share Your Thoughts

Have you ever had to cancel a trip due to unforeseen circumstances? Share your experiences and thoughts on CFAR travel insurance in the comments below.