Intro

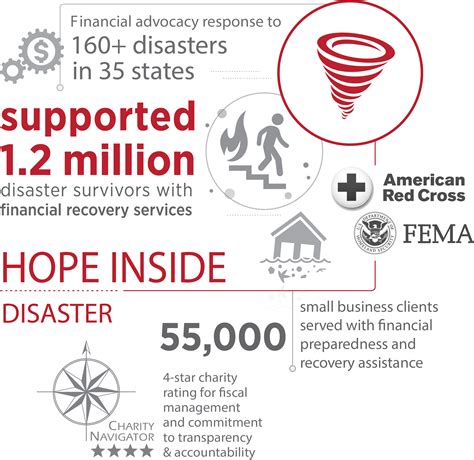

Recover from financial disaster with expert-approved hacks. Learn how to bounce back from template disasters, navigating financial turmoil with ease. Discover key strategies for rebuilding credit, managing debt, and optimizing finances. Get back on track with these actionable financial recovery tips and emerge stronger than ever.

In today's fast-paced business world, having a solid financial plan in place is crucial for success. However, even with the best-laid plans, financial disasters can still occur. Whether it's due to a sudden market downturn, a major client loss, or a series of unexpected expenses, financial setbacks can be devastating to any business.

When disaster strikes, it's essential to have a clear plan of action to get your finances back on track. In this article, we'll explore some essential financial recovery hacks to help you navigate even the most challenging financial situations.

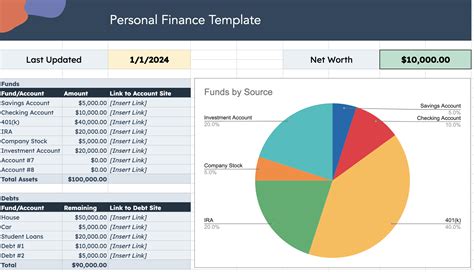

Assessing the Damage

Before you can start rebuilding, you need to assess the damage. Take a close look at your financial situation, including your income, expenses, assets, and debts. Identify the areas where you've been hit the hardest and prioritize your recovery efforts accordingly.

Here are some key questions to ask yourself during the assessment phase:

- What are my essential expenses, and how can I reduce them?

- What debts do I need to prioritize, and how can I pay them off?

- What assets can I liquidate to generate cash flow?

- What are my long-term financial goals, and how can I adjust them in light of the current situation?

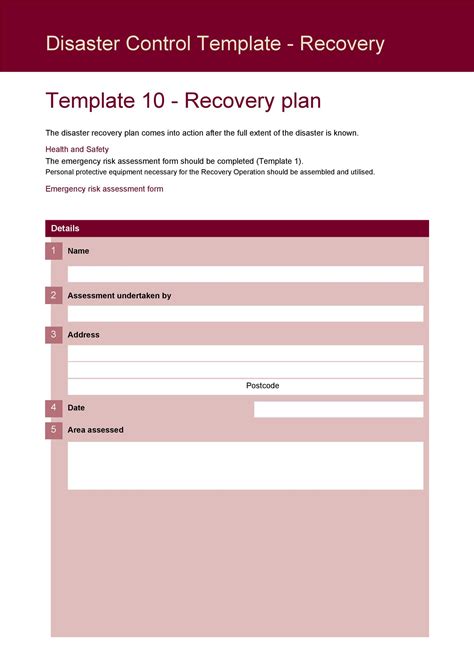

Creating a Recovery Plan

Once you've assessed the damage, it's time to create a recovery plan. This plan should include specific, achievable goals, as well as a timeline for reaching them. Here are some steps to follow:

- Identify your short-term and long-term goals, such as paying off debts, rebuilding your emergency fund, or increasing your income.

- Develop a budget that prioritizes your essential expenses and debt repayment.

- Explore ways to generate additional income, such as taking on a side hustle, selling assets, or negotiating with creditors.

- Consider seeking the help of a financial advisor or credit counselor to provide guidance and support.

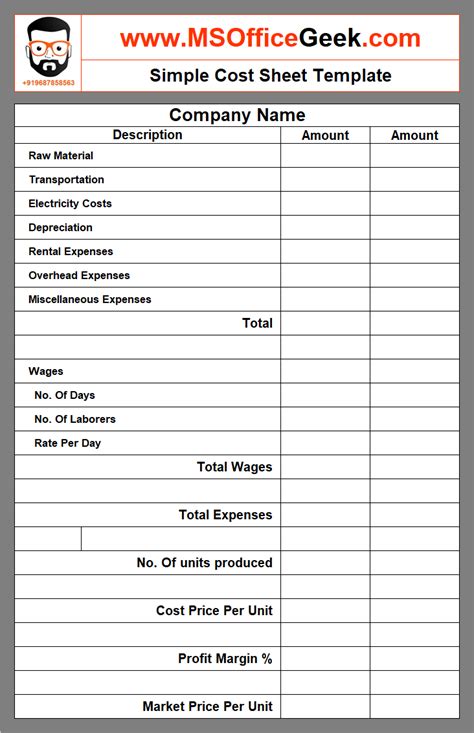

Cutting Costs and Increasing Income

One of the most effective ways to recover from a financial disaster is to cut costs and increase income. Here are some strategies to consider:

- Reduce your essential expenses by negotiating with service providers, canceling subscription services, and finding ways to save on household expenses.

- Increase your income by taking on a side hustle, selling assets, or pursuing additional education or training.

- Consider downsizing or selling assets that are no longer necessary or that can be replaced with more affordable alternatives.

- Explore ways to save on taxes, such as itemizing deductions or taking advantage of tax credits.

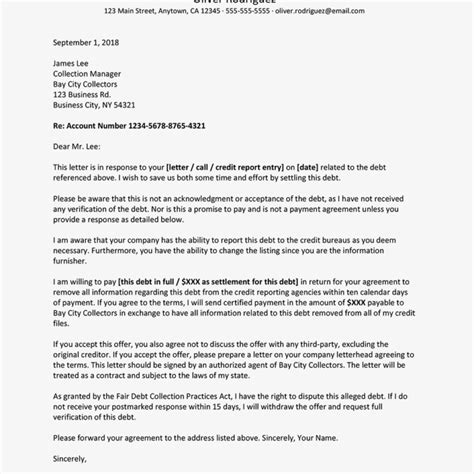

Negotiating with Creditors

If you're struggling with debt, it's essential to negotiate with creditors to reach a mutually beneficial agreement. Here are some tips to keep in mind:

- Communicate openly and honestly with your creditors to explain your situation and provide documentation to support your claims.

- Offer a realistic proposal for repayment, such as a temporary reduction in payments or a lump-sum settlement.

- Consider working with a credit counselor or debt management company to help facilitate negotiations.

- Be prepared to walk away if the terms are not favorable, and be willing to seek alternative solutions, such as debt consolidation or bankruptcy.

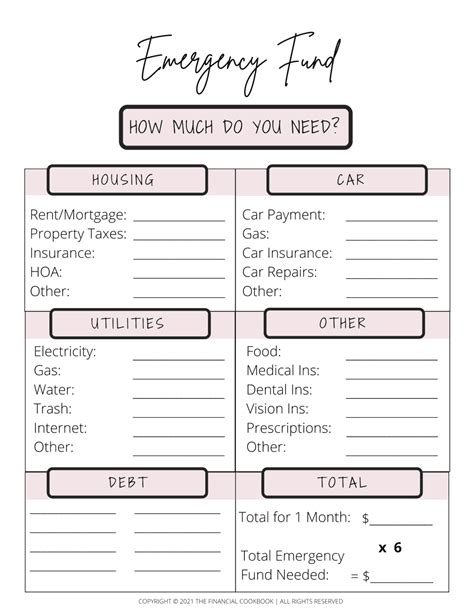

Rebuilding Your Emergency Fund

Having a solid emergency fund in place is crucial for weathering financial storms. Here are some tips to help you rebuild your emergency fund:

- Set a realistic goal for your emergency fund, such as saving 3-6 months' worth of expenses.

- Develop a plan to reach your goal, such as setting aside a fixed amount each month or using windfalls to boost your savings.

- Consider opening a separate savings account specifically for your emergency fund to keep it separate from your everyday spending money.

- Automate your savings by setting up automatic transfers from your checking account to your emergency fund.

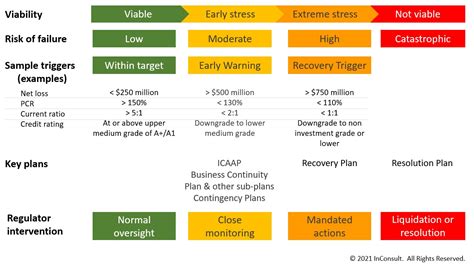

Avoiding Future Disasters

Once you've recovered from a financial disaster, it's essential to take steps to avoid future disasters. Here are some strategies to consider:

- Develop a long-term financial plan that includes regular check-ins and adjustments.

- Build multiple income streams to reduce your reliance on a single source of income.

- Diversify your investments to reduce risk and increase returns.

- Consider purchasing insurance to protect against unexpected events, such as disability or death.

Financial Recovery Hacks Image Gallery

In conclusion, recovering from a financial disaster requires a solid plan, discipline, and patience. By following the financial recovery hacks outlined in this article, you can get back on track and build a stronger financial future. Remember to stay focused, adapt to changing circumstances, and seek help when needed.