Intro

Unlock financial freedom with Ramit Sethis I Will Teach You To Be Rich worksheet. Learn how to manage your money, pay off debt, and invest wisely. This comprehensive guide provides actionable tips on automating finances, saving on big purchases, and negotiating a higher salary. Achieve financial stability and prosperity with this expert-approved roadmap.

Managing your finances effectively is a crucial life skill that can greatly impact your overall well-being and future prospects. One of the most popular and effective resources for learning how to manage your finances is Ramit Sethi's "I Will Teach You To Be Rich" book and worksheet.

What is "I Will Teach You To Be Rich"?

"I Will Teach You To Be Rich" is a comprehensive guide to personal finance written by Ramit Sethi, a renowned expert in the field. The book focuses on practical, actionable advice for young adults who want to take control of their financial lives. The accompanying worksheet is a valuable tool that helps readers apply the concepts and strategies outlined in the book to their own financial situations.

The Importance of Financial Literacy

Financial literacy is the foundation of achieving financial stability and success. It involves understanding how to manage your money effectively, make informed financial decisions, and avoid common pitfalls that can derail your financial progress. By using the "I Will Teach You To Be Rich" worksheet, readers can develop a deeper understanding of their financial situation and create a personalized plan for achieving their financial goals.

How to Use the "I Will Teach You To Be Rich" Worksheet

The worksheet is designed to be a hands-on, interactive tool that helps readers apply the concepts and strategies outlined in the book to their own financial situations. Here's a step-by-step guide to using the worksheet:

- Gather Your Financial Documents: Start by gathering all your financial documents, including bank statements, credit card statements, loan documents, and investment accounts.

- Assess Your Income and Expenses: Use the worksheet to track your income and expenses over a period of time. This will help you identify areas where you can cut back and allocate your money more effectively.

- Create a Budget: Based on your income and expenses, create a budget that allocates your money towards your financial goals.

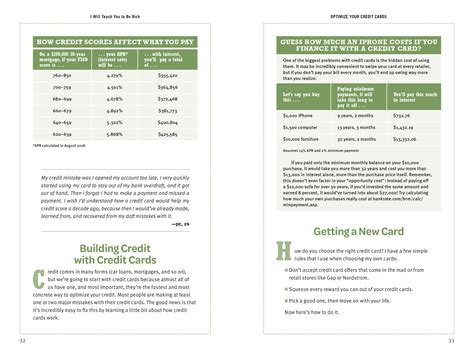

- Prioritize Your Debts: If you have any high-interest debts, prioritize them and create a plan to pay them off as quickly as possible.

- Invest for the Future: Once you've paid off your high-interest debts, focus on investing for the future. The worksheet provides guidance on how to get started with investing.

The Benefits of Using the "I Will Teach You To Be Rich" Worksheet

Using the "I Will Teach You To Be Rich" worksheet can have numerous benefits, including:

- Improved Financial Literacy: The worksheet helps readers develop a deeper understanding of their financial situation and the concepts and strategies outlined in the book.

- Increased Financial Confidence: By creating a personalized plan for achieving their financial goals, readers can feel more confident and in control of their financial lives.

- Better Money Management: The worksheet provides practical tools and strategies for managing your money effectively, including tracking your income and expenses, creating a budget, and prioritizing your debts.

Understanding the "I Will Teach You To Be Rich" Philosophy

Ramit Sethi's "I Will Teach You To Be Rich" philosophy is centered around the idea that managing your finances effectively is not just about cutting back on expenses, but also about making conscious financial decisions that align with your values and goals.

The 50/30/20 Rule

One of the core principles of the "I Will Teach You To Be Rich" philosophy is the 50/30/20 rule. This rule suggests that 50% of your income should go towards necessary expenses, such as rent and utilities, 30% towards discretionary spending, and 20% towards saving and debt repayment.

Avoiding Lifestyle Creep

Another key concept in the "I Will Teach You To Be Rich" philosophy is avoiding lifestyle creep. Lifestyle creep refers to the tendency to inflate your lifestyle by spending more money as your income increases. By avoiding lifestyle creep, readers can ensure that they're not overspending and are instead allocating their money towards their financial goals.

Conclusion

The "I Will Teach You To Be Rich" worksheet is a valuable resource for anyone looking to take control of their financial lives. By using the worksheet and applying the concepts and strategies outlined in the book, readers can develop a deeper understanding of their financial situation, create a personalized plan for achieving their financial goals, and improve their overall financial literacy.

Gallery of "I Will Teach You To Be Rich" Worksheet

I Will Teach You To Be Rich Worksheet Gallery

FAQs

-

What is the "I Will Teach You To Be Rich" worksheet? The "I Will Teach You To Be Rich" worksheet is a hands-on, interactive tool that helps readers apply the concepts and strategies outlined in Ramit Sethi's book to their own financial situations.

-

How do I use the "I Will Teach You To Be Rich" worksheet? To use the worksheet, gather your financial documents, assess your income and expenses, create a budget, prioritize your debts, and invest for the future.

-

What are the benefits of using the "I Will Teach You To Be Rich" worksheet? The benefits of using the worksheet include improved financial literacy, increased financial confidence, and better money management.

-

What is the 50/30/20 rule? The 50/30/20 rule suggests that 50% of your income should go towards necessary expenses, 30% towards discretionary spending, and 20% towards saving and debt repayment.

-

How can I avoid lifestyle creep? To avoid lifestyle creep, focus on allocating your money towards your financial goals rather than inflating your lifestyle by spending more money as your income increases.