Intro

Learn how to create a perfect income statement in 5 easy steps. Master the art of financial reporting and accurately track your businesss revenue, expenses, and profits. Improve financial clarity and decision-making with a well-structured income statement, including key components, formats, and analysis techniques for small businesses and entrepreneurs.

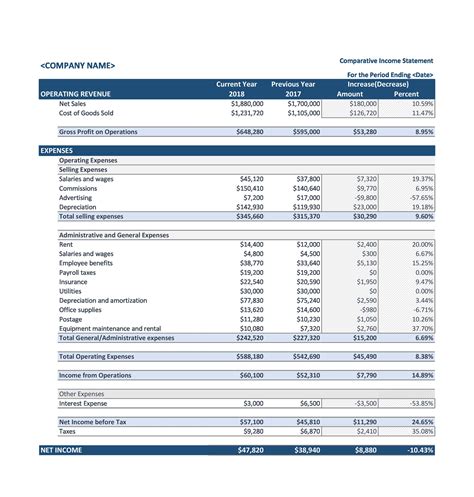

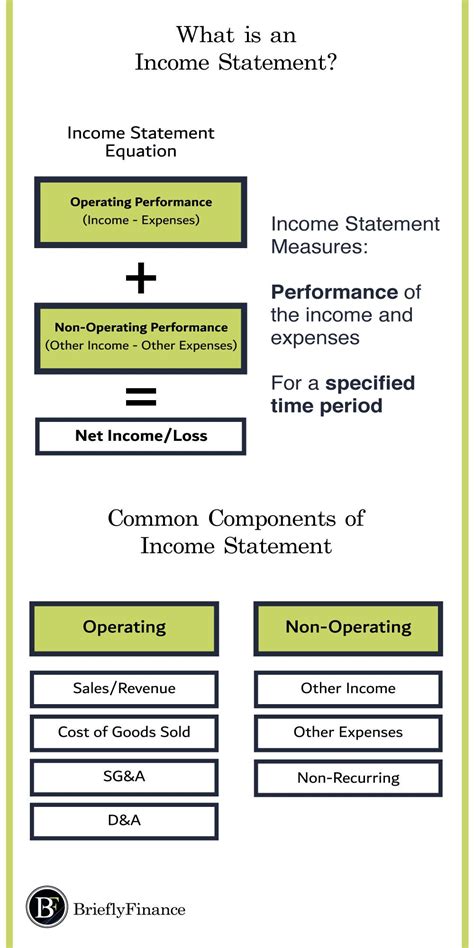

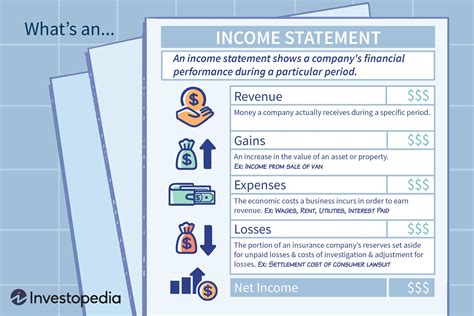

As a business owner, creating an accurate and informative income statement is crucial for understanding your company's financial health and making informed decisions. An income statement, also known as a profit and loss statement, provides a snapshot of your business's revenues and expenses over a specific period of time. In this article, we will guide you through the process of creating a perfect income statement in 5 easy steps.

Step 1: Identify Your Business's Revenue Streams

The first step in creating an income statement is to identify your business's revenue streams. Revenue represents the income earned by your business from its normal operations, such as sales of goods or services. Common revenue streams include:

- Sales revenue

- Service revenue

- Rental income

- Interest income

- Dividend income

To accurately identify your revenue streams, review your business's financial records, such as invoices, receipts, and bank statements. You can also use accounting software to track and categorize your revenue.

Types of Revenue

There are two types of revenue: operating revenue and non-operating revenue.

- Operating revenue is earned from the sale of goods or services, and it is the primary source of income for most businesses.

- Non-operating revenue, on the other hand, is earned from sources outside of the business's normal operations, such as interest income or rental income.

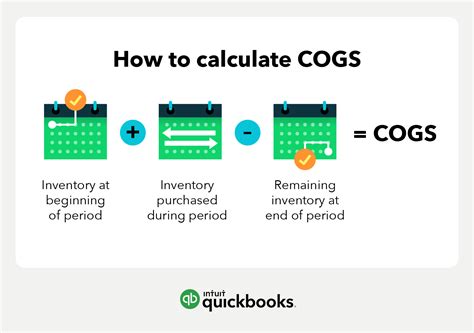

Step 2: Calculate Your Cost of Goods Sold

The cost of goods sold (COGS) represents the direct costs associated with producing and selling your business's products or services. COGS includes the cost of materials, labor, and overhead. To calculate COGS, you will need to identify the following:

- Direct materials cost

- Direct labor cost

- Overhead cost

You can use the following formula to calculate COGS:

COGS = Direct Materials Cost + Direct Labor Cost + Overhead Cost

Example of COGS Calculation

Let's say you own a bakery, and you want to calculate the COGS for a batch of bread. The direct materials cost is $100, the direct labor cost is $150, and the overhead cost is $50. Using the formula above, the COGS would be:

COGS = $100 + $150 + $50 = $300

Step 3: Calculate Your Gross Profit

The gross profit represents the difference between your business's revenue and COGS. To calculate gross profit, you will need to subtract COGS from revenue.

Gross Profit = Revenue - COGS

Example of Gross Profit Calculation

Let's say your bakery generates $1,000 in revenue from the sale of bread, and the COGS is $300. Using the formula above, the gross profit would be:

Gross Profit = $1,000 - $300 = $700

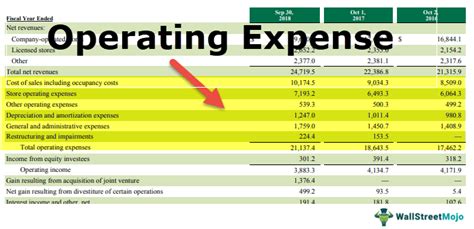

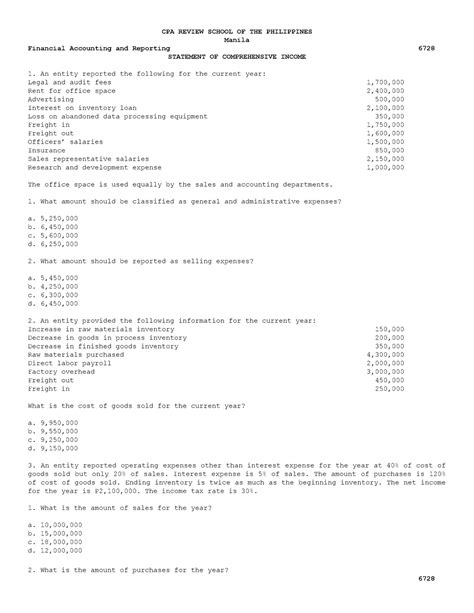

Step 4: Calculate Your Operating Expenses

Operating expenses represent the costs associated with running your business, excluding COGS. Common operating expenses include:

- Salaries and wages

- Rent

- Utilities

- Marketing expenses

- Insurance

To calculate operating expenses, you will need to identify and categorize your business's expenses.

Example of Operating Expenses Calculation

Let's say your bakery has the following operating expenses:

- Salaries and wages: $500

- Rent: $1,000

- Utilities: $200

- Marketing expenses: $300

- Insurance: $100

Total operating expenses would be:

Total Operating Expenses = $500 + $1,000 + $200 + $300 + $100 = $2,100

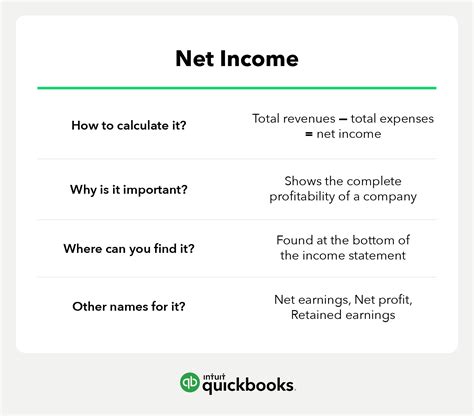

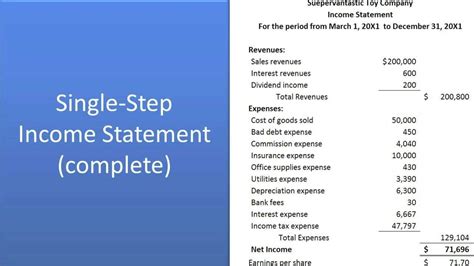

Step 5: Calculate Your Net Income

The net income represents the business's earnings after deducting all expenses, including operating expenses and taxes. To calculate net income, you will need to subtract total operating expenses from gross profit.

Net Income = Gross Profit - Total Operating Expenses

Example of Net Income Calculation

Let's say your bakery has a gross profit of $700 and total operating expenses of $2,100. Using the formula above, the net income would be:

Net Income = $700 - $2,100 = -$1,400

In this example, the bakery has a net loss of $1,400.

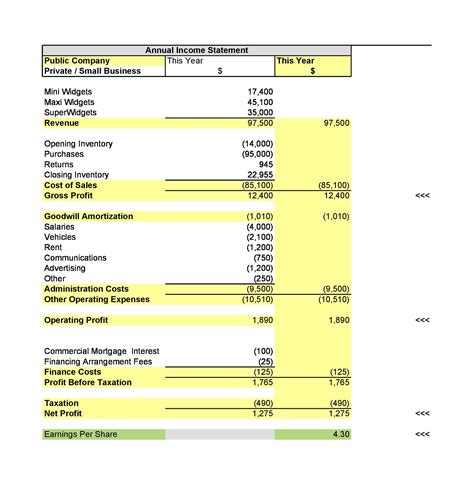

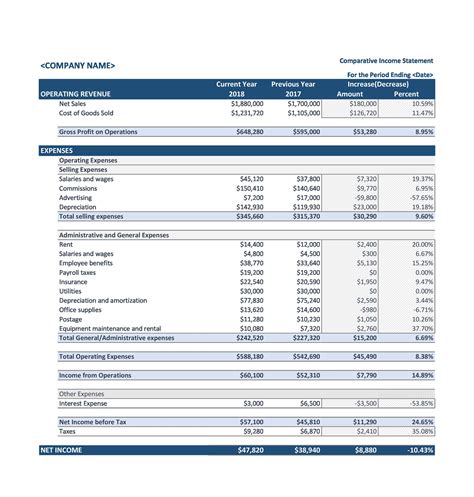

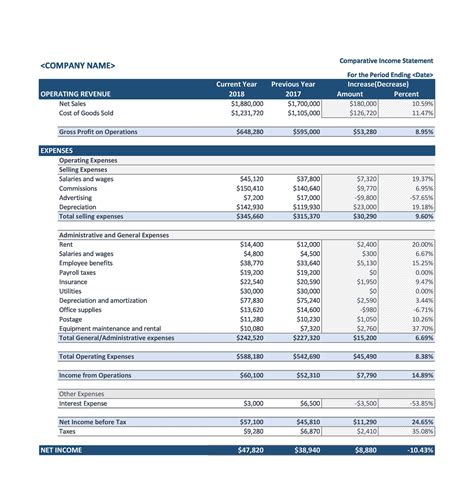

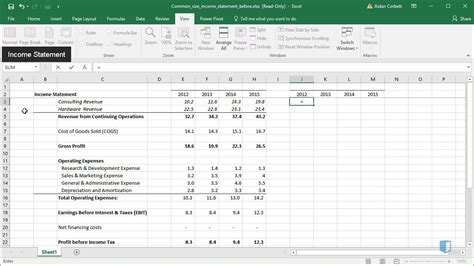

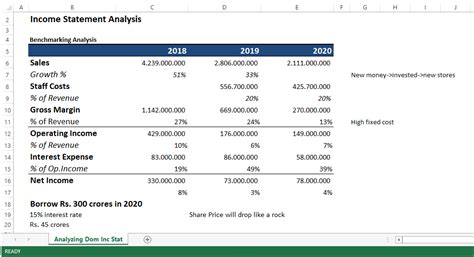

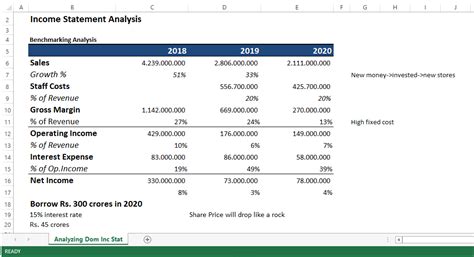

Income Statement Image Gallery

By following these 5 easy steps, you can create a perfect income statement that provides a clear picture of your business's financial performance. Remember to regularly review and analyze your income statement to identify areas for improvement and make informed decisions to drive your business forward.

We hope this article has been helpful in guiding you through the process of creating a perfect income statement. If you have any questions or need further clarification, please don't hesitate to comment below.