Intro

Planning for taxes can be a daunting task, especially for individuals who are not familiar with the complexities of tax laws and regulations. However, with the help of technology, tax planning has become easier and more efficient. One of the most popular tools used for tax planning is the income tax calculator Excel. In this article, we will explore the benefits of using an income tax calculator Excel and provide a step-by-step guide on how to use it for easy tax planning.

Benefits of Using an Income Tax Calculator Excel

Using an income tax calculator Excel offers several benefits, including:

- Accuracy: An income tax calculator Excel helps to ensure accuracy in tax calculations, reducing the risk of errors and penalties.

- Efficiency: With an income tax calculator Excel, you can quickly and easily calculate your tax liability, saving you time and effort.

- Customization: An income tax calculator Excel can be customized to meet your specific tax needs, allowing you to make adjustments and scenarios to optimize your tax planning.

- Ease of use: Income tax calculators are designed to be user-friendly, making it easy for individuals to navigate and use, even for those without extensive tax knowledge.

How to Use an Income Tax Calculator Excel

Using an income tax calculator Excel is a straightforward process that requires some basic information and calculations. Here's a step-by-step guide to get you started:

Step 1: Gather Required Information

Before using an income tax calculator Excel, you'll need to gather some basic information, including:

- Income: Your total income from all sources, including employment, investments, and self-employment.

- Deductions: Your total deductions, including standard deductions, itemized deductions, and exemptions.

- Tax Credits: Your total tax credits, including credits for education expenses, child care, and retirement savings.

Step 2: Set Up the Calculator

Once you have gathered the required information, you can set up the income tax calculator Excel. You can either create your own calculator from scratch or use a pre-designed template.

Step 3: Enter Your Information

Enter your income, deductions, and tax credits into the calculator. Make sure to use the correct formulas and calculations to ensure accuracy.

Step 4: Calculate Your Tax Liability

Once you've entered your information, the calculator will calculate your tax liability based on your income, deductions, and tax credits.

Step 5: Review and Adjust

Review your tax calculation to ensure accuracy and make any necessary adjustments.

Advanced Features of Income Tax Calculator Excel

While basic income tax calculators can provide a good estimate of your tax liability, advanced features can help you optimize your tax planning. Some advanced features to look for in an income tax calculator Excel include:

- Tax Scenario Planning: This feature allows you to create different tax scenarios to see how different income, deductions, and tax credits affect your tax liability.

- Tax Optimization: This feature uses algorithms to optimize your tax planning, identifying opportunities to reduce your tax liability.

- Tax Forecasting: This feature allows you to forecast your tax liability for future years, helping you plan for upcoming tax obligations.

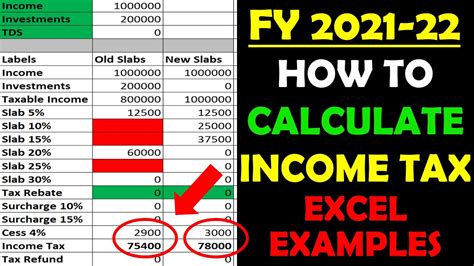

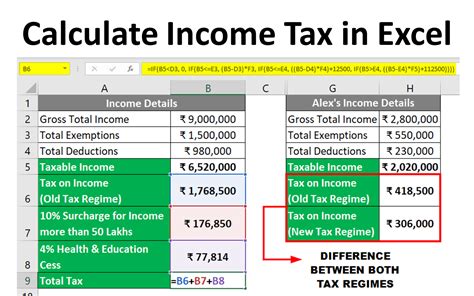

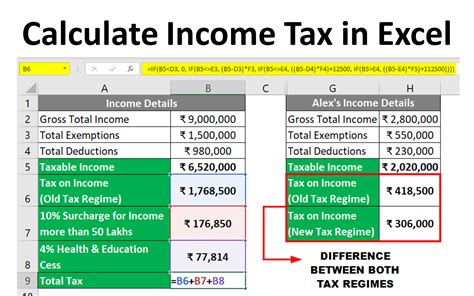

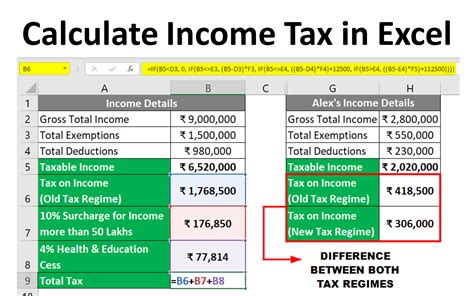

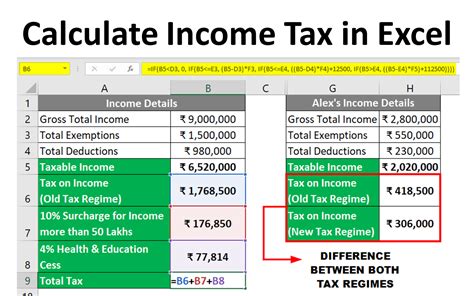

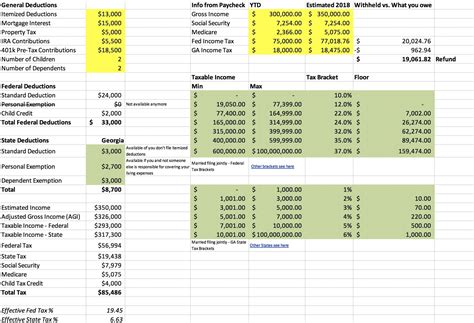

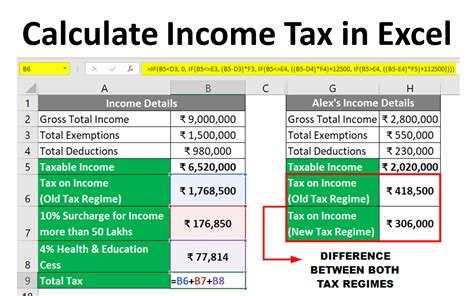

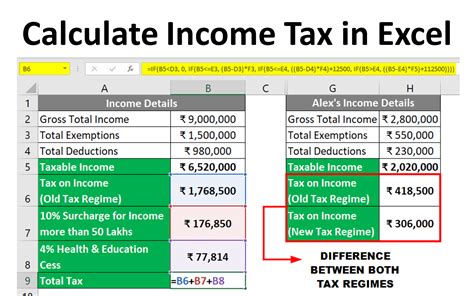

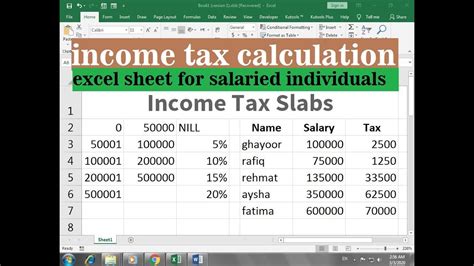

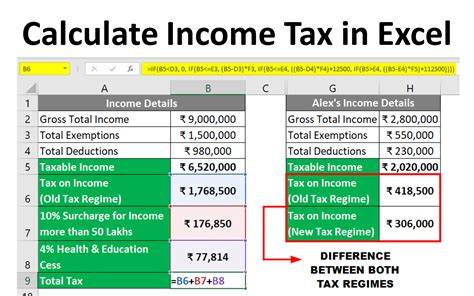

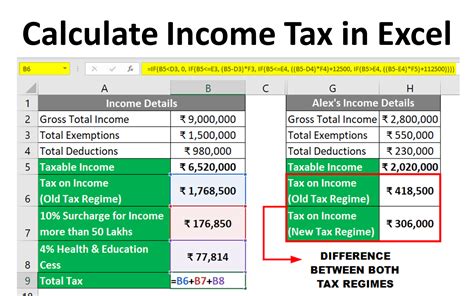

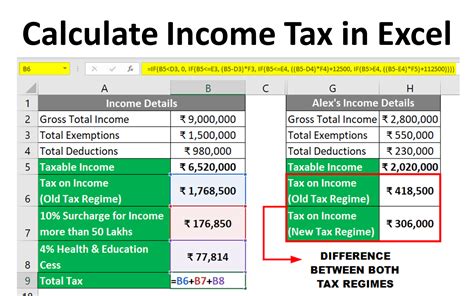

Example of Income Tax Calculator Excel

Here's an example of how an income tax calculator Excel might look:

| Income | Deductions | Tax Credits | Tax Liability |

|---|---|---|---|

| $100,000 | $20,000 | $5,000 | $15,000 |

In this example, the calculator takes into account the individual's income, deductions, and tax credits to calculate their tax liability.

Common Mistakes to Avoid When Using an Income Tax Calculator Excel

While income tax calculators can be a valuable tool for tax planning, there are some common mistakes to avoid:

- Inaccurate Information: Make sure to enter accurate information, including income, deductions, and tax credits.

- Incorrect Formulas: Use the correct formulas and calculations to ensure accuracy.

- Failure to Update: Make sure to update your calculator regularly to reflect changes in tax laws and regulations.

Best Practices for Using an Income Tax Calculator Excel

To get the most out of an income tax calculator Excel, follow these best practices:

- Use a Reputable Source: Use a reputable source for your calculator, such as a trusted financial institution or tax professional.

- Regularly Update: Regularly update your calculator to reflect changes in tax laws and regulations.

- Seek Professional Advice: Seek professional advice if you're unsure about how to use the calculator or if you have complex tax situations.

Conclusion

An income tax calculator Excel can be a valuable tool for tax planning, helping you optimize your tax liability and reduce your risk of errors and penalties. By following the steps outlined in this article and avoiding common mistakes, you can get the most out of your income tax calculator Excel. Remember to regularly update your calculator and seek professional advice if you're unsure about how to use it.

Gallery of Income Tax Calculator Excel

Income Tax Calculator Excel Image Gallery

We hope this article has provided you with a comprehensive guide to using an income tax calculator Excel for easy tax planning. If you have any questions or comments, please feel free to share them in the comments section below.