Intro

Discover 5 ways a tax calculator simplifies tax planning, estimation, and filing, using income tax calculators, refund estimators, and deduction finders for accurate tax returns and savings.

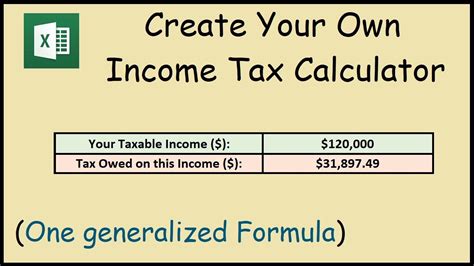

Tax season can be a daunting time for many individuals and businesses, as navigating the complex world of tax laws and regulations can be overwhelming. One tool that can help make the process easier is a tax calculator. A tax calculator is a software program or online tool that helps users estimate their tax liability or refund based on their income, deductions, and other factors. In this article, we will explore five ways that a tax calculator can be useful, and provide tips on how to get the most out of this valuable tool.

Tax calculators can be used for a variety of purposes, from estimating tax liability to identifying potential tax savings opportunities. By using a tax calculator, individuals and businesses can gain a better understanding of their tax situation and make informed decisions about their financial planning. Whether you are a seasoned tax professional or just starting to navigate the world of taxes, a tax calculator can be a valuable resource. With the right tool and a little bit of knowledge, you can take control of your taxes and ensure that you are getting the best possible outcome.

The importance of tax planning cannot be overstated. By taking a proactive approach to tax planning, individuals and businesses can minimize their tax liability, maximize their refund, and achieve their financial goals. A tax calculator is an essential tool in this process, as it allows users to estimate their tax liability and identify areas where they can save money. With a tax calculator, you can quickly and easily estimate your tax liability, identify potential tax savings opportunities, and make informed decisions about your financial planning.

Understanding Tax Calculators

There are many different types of tax calculators available, each with its own unique features and benefits. Some tax calculators are designed specifically for individuals, while others are designed for businesses or self-employed individuals. Some tax calculators are simple and easy to use, while others are more complex and require a higher level of tax knowledge. When choosing a tax calculator, it is essential to consider your specific needs and goals, as well as the level of complexity and accuracy you require.

Benefits of Using a Tax Calculator

Some of the key benefits of using a tax calculator include:

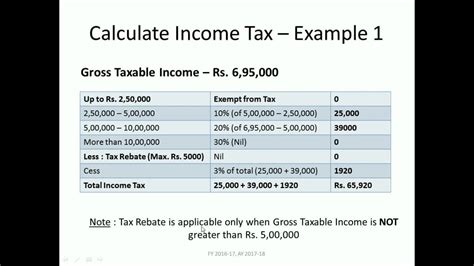

- Estimating tax liability: Tax calculators can help users estimate their tax liability, which can help them plan for tax season and avoid any unexpected surprises.

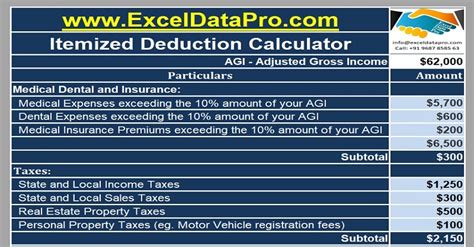

- Identifying potential tax savings opportunities: Tax calculators can help users identify areas where they can save money, such as by claiming deductions or credits.

- Comparing different tax scenarios: Tax calculators can help users compare different tax scenarios, such as the impact of itemizing deductions versus taking the standard deduction.

- Simplifying tax planning: Tax calculators can simplify the tax planning process by providing users with a clear and concise estimate of their tax liability.

How to Choose the Right Tax Calculator

Some of the key factors to consider when choosing a tax calculator include:

- Level of complexity: Consider the level of complexity of the tax calculator, as well as the level of tax knowledge required to use it.

- Type of tax return: Consider the type of tax return you need to file, as well as any specific forms or schedules that may be required.

- Level of accuracy: Consider the level of accuracy required, as well as any potential errors or limitations of the tax calculator.

- Cost: Consider the cost of the tax calculator, as well as any additional features or support that may be available.

Common Mistakes to Avoid When Using a Tax Calculator

Some of the key mistakes to avoid when using a tax calculator include:

- Failing to accurately input data: Make sure to accurately input all data, including income, deductions, and filing status.

- Failing to consider all sources of income: Make sure to consider all sources of income, including wages, investments, and self-employment income.

- Failing to update the tax calculator: Make sure to update the tax calculator regularly to reflect any changes in tax laws or regulations.

- Relying solely on the tax calculator: While tax calculators can be a valuable tool, it is essential to consult with a tax professional or financial advisor to ensure accuracy and completeness.

Best Practices for Using a Tax Calculator

Some of the key best practices for using a tax calculator include:

- Accurately inputting data: Make sure to accurately input all data, including income, deductions, and filing status.

- Regularly updating the tax calculator: Make sure to update the tax calculator regularly to reflect any changes in tax laws or regulations.

- Consulting with a tax professional: While tax calculators can be a valuable tool, it is essential to consult with a tax professional or financial advisor to ensure accuracy and completeness.

- Reviewing and revising the tax return: Make sure to review and revise the tax return to ensure accuracy and completeness.

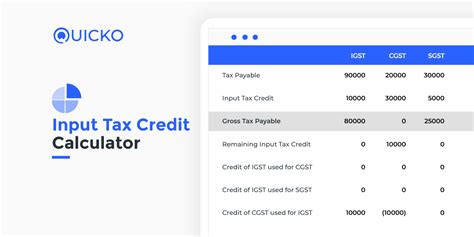

Gallery of Tax Calculators

Tax Calculator Image Gallery

In conclusion, a tax calculator can be a valuable tool for individuals and businesses looking to navigate the complex world of tax laws and regulations. By understanding how to use a tax calculator, choosing the right one, and following best practices, users can gain a better understanding of their tax situation and make informed decisions about their financial planning. Whether you are a seasoned tax professional or just starting to navigate the world of taxes, a tax calculator can help you take control of your taxes and achieve your financial goals. We invite you to share your thoughts and experiences with tax calculators in the comments below, and to share this article with anyone who may benefit from this valuable information.