Intro

Increasing your USAA credit limit can be a great way to improve your credit utilization ratio, reduce debt, and enhance your overall credit score. A higher credit limit can also provide more flexibility and purchasing power, which can be especially helpful for members of the military and their families who may face unique financial challenges. Here are five ways to increase your USAA credit limit:

You can request a credit limit increase online, by phone, or through the USAA mobile app. Simply log in to your account, navigate to the "Account Settings" or "Credit Card" section, and click on the "Request a Credit Limit Increase" option. You can also call USAA's customer service at 1-800-531-8722 or use the mobile app to submit a request. When you request a credit limit increase, USAA will typically review your account history, credit score, and income to determine whether you qualify for a higher limit.

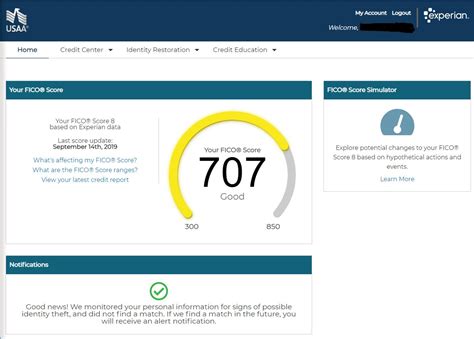

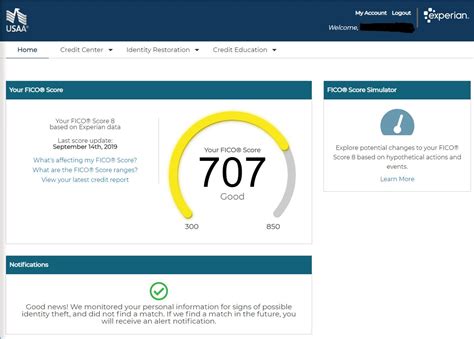

One of the main factors that USAA considers when evaluating credit limit increase requests is your credit utilization ratio. This is the percentage of your available credit that you're using at any given time. To improve your chances of getting a credit limit increase, try to keep your credit utilization ratio below 30%. This means that if you have a credit limit of $1,000, try to keep your balance below $300. By keeping your utilization ratio low, you can demonstrate to USAA that you're responsible with credit and can handle a higher limit.

USAA may also consider your income when evaluating your credit limit increase request. If you've recently received a raise or promotion, be sure to update your income information with USAA. You can do this by logging in to your account and navigating to the "Account Settings" section. Having a higher income can help you qualify for a higher credit limit, as it indicates that you have more financial resources available to make payments.

If you've made on-time payments and kept your credit utilization ratio low, you may be eligible for an automatic credit limit increase. USAA periodically reviews accounts and may offer automatic credit limit increases to eligible members. This can be a great way to get a higher credit limit without having to request it manually. However, keep in mind that automatic credit limit increases are not guaranteed and may vary based on your individual circumstances.

In addition to the methods described above, you can also try contacting USAA's customer service directly to request a credit limit increase. Be prepared to provide information about your income, employment, and credit history, as well as your reasons for requesting a credit limit increase. By being proactive and providing detailed information, you may be able to negotiate a higher credit limit with USAA.

Benefits of Increasing Your USAA Credit Limit

Increasing your USAA credit limit can have several benefits, including:

-

Improved Credit Utilization Ratio

A higher credit limit can help you maintain a lower credit utilization ratio, which can improve your credit score over time. By keeping your utilization ratio below 30%, you can demonstrate to lenders that you're responsible with credit and can handle a higher limit.

-

Reduced Debt

A higher credit limit can also provide more flexibility and purchasing power, which can be helpful for members of the military and their families who may face unique financial challenges. By having access to more credit, you may be able to consolidate debt or make larger purchases.

-

Enhanced Credit Score

Increasing your credit limit can also enhance your credit score over time. By demonstrating responsible credit behavior and maintaining a low utilization ratio, you can improve your credit score and qualify for better interest rates and terms on future credit applications.

Tips for Requesting a USAA Credit Limit Increase

When requesting a USAA credit limit increase, be sure to:

-

Keep Your Credit Utilization Ratio Low

Try to keep your credit utilization ratio below 30% to demonstrate to USAA that you're responsible with credit.

-

Make On-Time Payments

Make all payments on time to demonstrate to USAA that you're reliable and can handle a higher credit limit.

-

Update Your Income Information

If you've recently received a raise or promotion, be sure to update your income information with USAA to qualify for a higher credit limit.

-

Be Prepared to Provide Information

Be prepared to provide information about your income, employment, and credit history when requesting a credit limit increase.

USAA Credit Limit Increase Gallery

Conclusion

Increasing your USAA credit limit can be a great way to improve your credit utilization ratio, reduce debt, and enhance your overall credit score. By following the tips outlined above and requesting a credit limit increase, you can take control of your finances and achieve your long-term goals. Remember to always use credit responsibly and make on-time payments to maintain a healthy credit score.

We hope this article has been helpful in providing you with information about increasing your USAA credit limit. If you have any further questions or would like to request a credit limit increase, please don't hesitate to contact USAA's customer service team.