Creating an interest-only amortization schedule in Excel can be a useful tool for individuals and businesses looking to manage their loan payments. An amortization schedule helps to break down the loan into smaller, manageable payments, allowing you to see how much of each payment goes towards interest and principal. In this article, we will explore five ways to create an interest-only amortization schedule in Excel.

Understanding Amortization Schedules

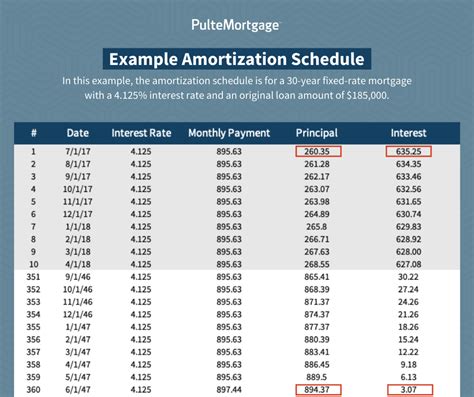

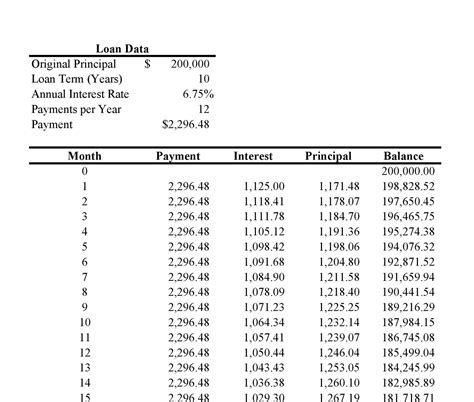

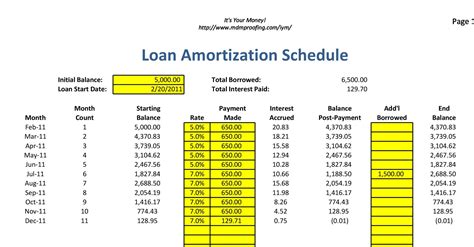

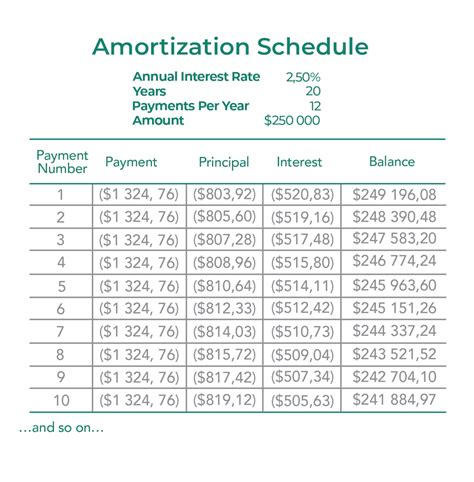

Before we dive into the methods, it's essential to understand what an amortization schedule is and how it works. An amortization schedule is a table that shows the breakdown of each loan payment, including the amount of interest and principal paid. The schedule takes into account the loan amount, interest rate, and loan term to calculate the monthly payments.

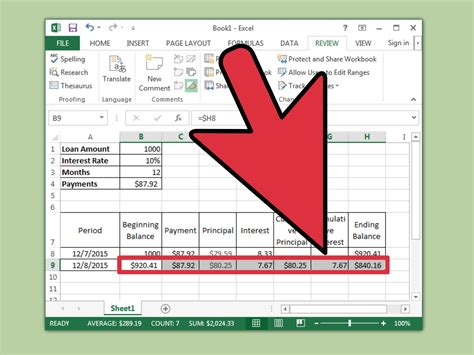

Method 1: Using Excel Formulas

One way to create an interest-only amortization schedule in Excel is by using formulas. You can use the IPMT and PPMT functions to calculate the interest and principal payments, respectively.

Assuming you have the following data:

| Loan Amount | Interest Rate | Loan Term |

|---|---|---|

| $100,000 | 5% | 5 years |

You can use the following formulas:

- Interest Payment: =IPMT($B$2/12,$B$3,$A$2)

- Principal Payment: =PPMT($B$2/12,$B$3,$A$2)

Create a table with the following columns: Payment Number, Payment Date, Interest Payment, Principal Payment, and Balance. Use the formulas to calculate the interest and principal payments for each payment period.

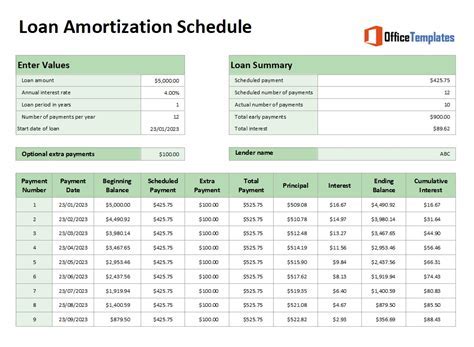

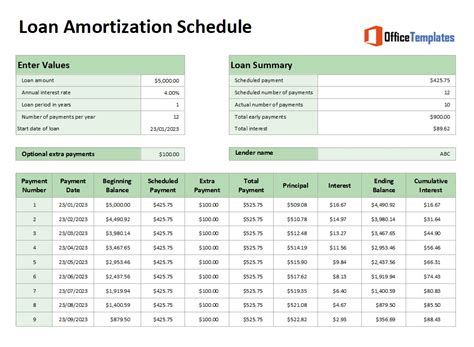

Method 2: Using Excel Templates

Another way to create an interest-only amortization schedule in Excel is by using pre-built templates. Excel offers a range of templates that you can use to create an amortization schedule.

To access the templates, go to the "File" tab and click on "New." In the "Search for online templates" field, type "amortization schedule" and press Enter. Choose a template that suits your needs and fill in the required data.

Method 3: Using Excel Add-ins

You can also use Excel add-ins to create an interest-only amortization schedule. Add-ins are third-party tools that can be installed in Excel to provide additional functionality.

One popular add-in for creating amortization schedules is the "Amortization Schedule" add-in. This add-in allows you to create a schedule with a few clicks, without having to use formulas or templates.

Method 4: Using VBA Macros

If you're comfortable with VBA programming, you can create an interest-only amortization schedule using macros.

Create a new module in the Visual Basic Editor and paste the following code:

Sub CreateAmortizationSchedule()

' Define variables

Dim loanAmount As Double

Dim interestRate As Double

Dim loanTerm As Integer

' Set values

loanAmount = 100000

interestRate = 0.05

loanTerm = 5

' Create schedule

Range("A1").Value = "Payment Number"

Range("B1").Value = "Payment Date"

Range("C1").Value = "Interest Payment"

Range("D1").Value = "Principal Payment"

Range("E1").Value = "Balance"

' Calculate payments

For i = 1 To loanTerm * 12

Range("A" & i + 1).Value = i

Range("B" & i + 1).Value = DateAdd("m", i, Date)

Range("C" & i + 1).Value = IPMT(interestRate / 12, loanTerm * 12, loanAmount)

Range("D" & i + 1).Value = PPMT(interestRate / 12, loanTerm * 12, loanAmount)

Range("E" & i + 1).Value = loanAmount - Range("D" & i + 1).Value

Next i

End Sub

Run the macro to create the schedule.

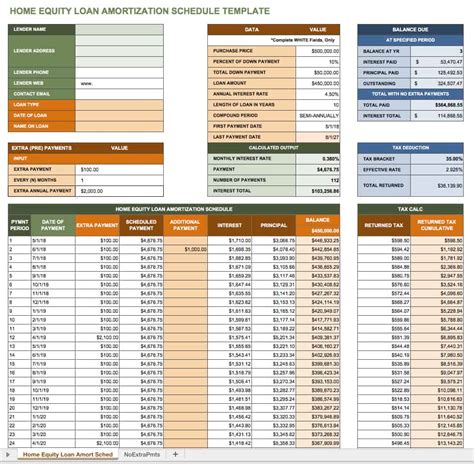

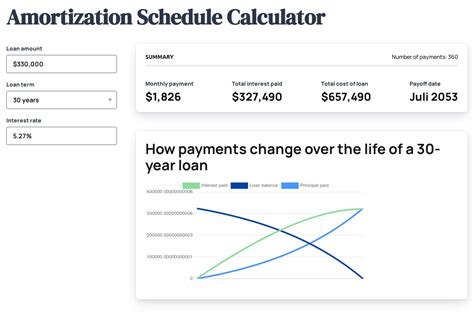

Method 5: Using Online Tools

Finally, you can use online tools to create an interest-only amortization schedule. There are many websites that offer free amortization schedule calculators.

One popular online tool is the "Amortization Schedule Calculator" by NerdWallet. Simply enter the loan amount, interest rate, and loan term, and the calculator will generate a schedule for you.

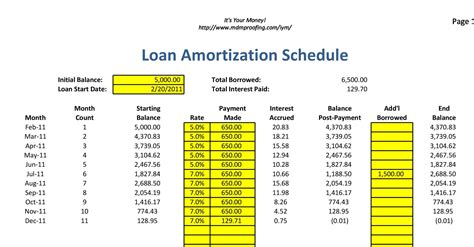

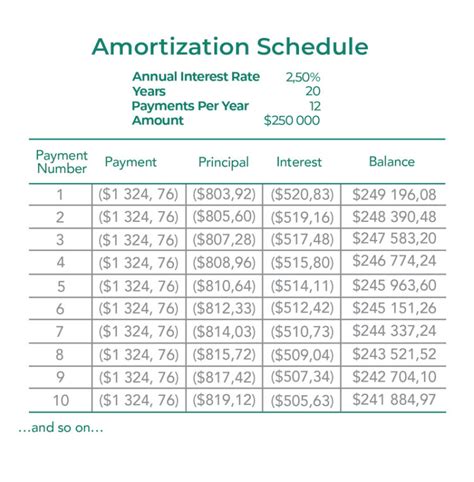

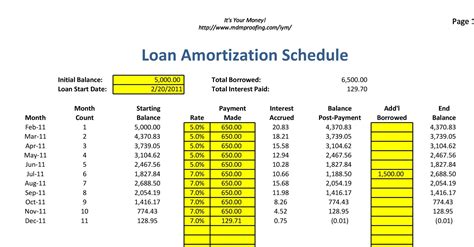

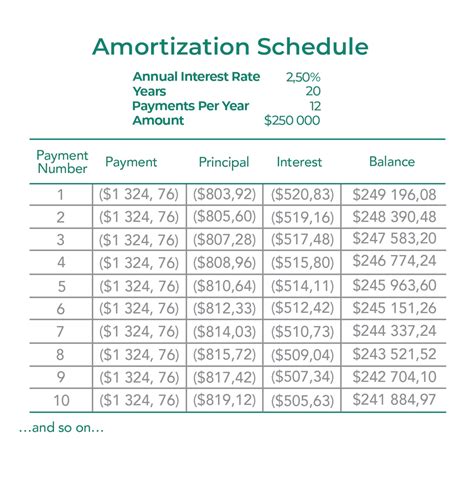

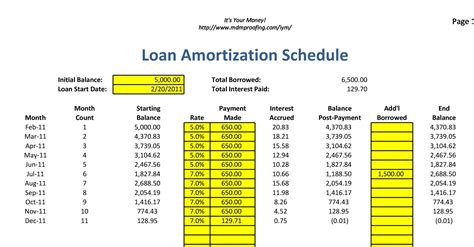

Gallery of Amortization Schedule Examples

Amortization Schedule Examples

Final Thoughts

Creating an interest-only amortization schedule in Excel can be a useful tool for managing loan payments. Whether you use formulas, templates, add-ins, VBA macros, or online tools, there are many ways to create a schedule that suits your needs. By following the methods outlined in this article, you can create a schedule that helps you understand your loan payments and make informed financial decisions.