Intro

Create a detailed interest-only loan amortization schedule in Excel with these 5 easy methods. Learn how to calculate interest-only payments, amortize loans, and visualize your mortgage schedule using Excel formulas and templates. Optimize your loan management with these expert tips and take control of your finances today!

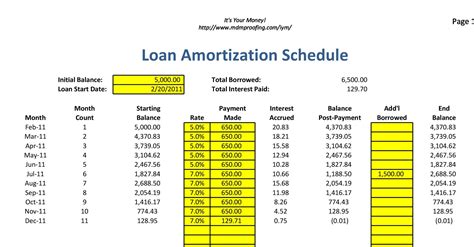

Creating an interest-only loan amortization schedule in Excel can be a valuable tool for understanding and managing loan payments. An amortization schedule provides a detailed breakdown of each payment, showing how much of the payment goes towards interest and how much towards principal. Here, we'll explore five ways to create an interest-only loan amortization schedule in Excel, highlighting the flexibility and customization options that Excel offers.

Understanding Interest-Only Loans

Before diving into the methods, it's essential to understand how interest-only loans work. In an interest-only loan, the borrower only pays the interest on the loan for a set period, usually 5-10 years. During this time, the loan balance remains unchanged, as the borrower is not making any principal payments. After the interest-only period, the loan typically converts to a principal-and-interest loan, where the borrower begins making payments towards both the interest and the principal.

Method 1: Using Excel Formulas

One way to create an interest-only loan amortization schedule in Excel is by using formulas. This method requires some knowledge of Excel formulas, but it provides a high degree of customization.

To create the schedule, you'll need to set up a table with the following columns:

- Payment Period

- Interest Rate

- Loan Balance

- Interest Payment

- Principal Payment

- Balance

Using formulas, you can calculate the interest payment, principal payment, and new balance for each period. For example, the interest payment formula would be =IPMT(Interest Rate, Payment Period, Loan Balance).

Method 2: Using Excel Templates

Another way to create an interest-only loan amortization schedule in Excel is by using pre-built templates. Excel offers a range of free templates that can be downloaded and customized to suit your needs.

To use a template, simply download and open the file in Excel. You can then customize the template by entering your loan details, such as the interest rate, loan amount, and payment period.

Method 3: Using the IPMT Function

The IPMT function in Excel is a powerful tool for calculating interest payments. By using the IPMT function, you can create an interest-only loan amortization schedule quickly and easily.

To use the IPMT function, simply enter the formula =IPMT(Interest Rate, Payment Period, Loan Balance) in the interest payment column. You can then copy the formula down to calculate the interest payment for each period.

Method 4: Using a Loan Amortization Schedule Add-In

If you're not comfortable using formulas or templates, you can use a loan amortization schedule add-in. These add-ins provide a user-friendly interface for creating custom amortization schedules.

To use a loan amortization schedule add-in, simply download and install the add-in in Excel. You can then access the add-in through the Excel ribbon and follow the prompts to create your custom amortization schedule.

Method 5: Using a Custom Macro

If you're an advanced Excel user, you can create a custom macro to automate the process of creating an interest-only loan amortization schedule.

To create a custom macro, you'll need to use the Visual Basic Editor in Excel. You can then write a macro that automates the process of creating the amortization schedule.

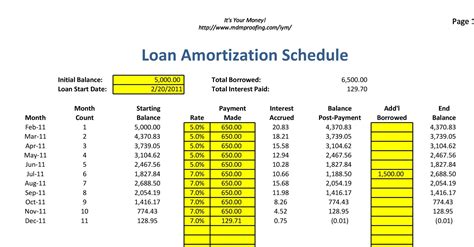

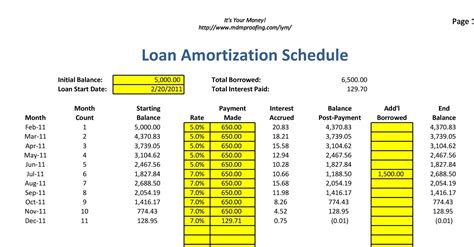

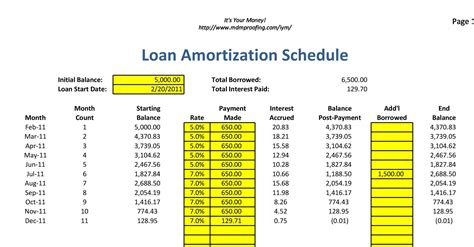

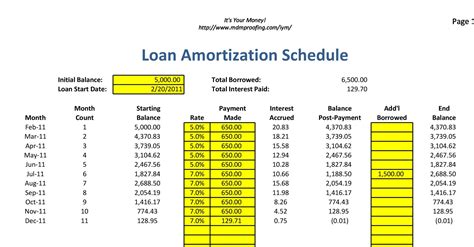

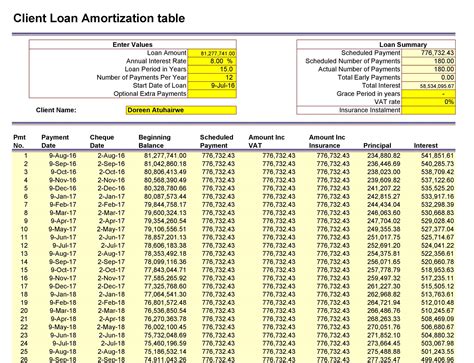

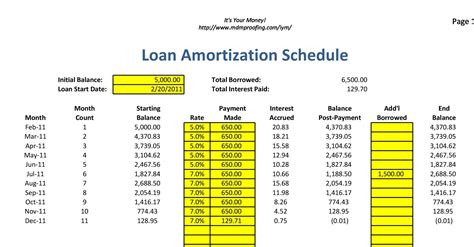

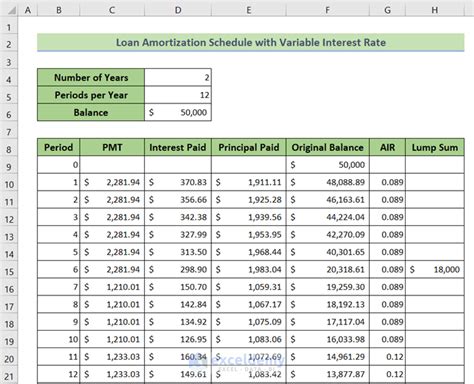

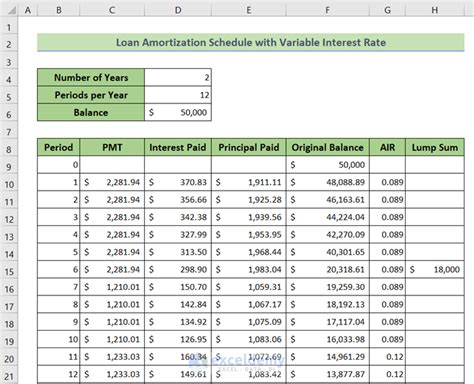

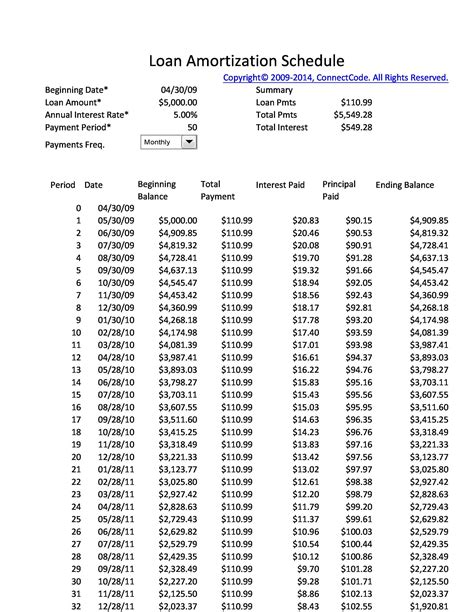

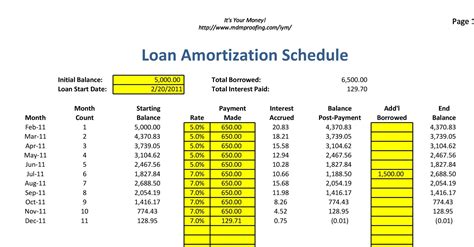

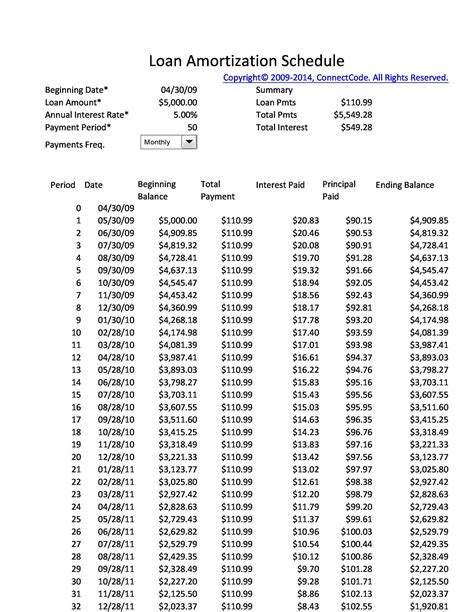

Gallery of Interest-Only Loan Amortization Schedules in Excel

Interest-Only Loan Amortization Schedules in Excel

Conclusion

Creating an interest-only loan amortization schedule in Excel can be a valuable tool for managing loan payments. Whether you use formulas, templates, or add-ins, Excel provides a range of options for creating custom amortization schedules. By following the methods outlined above, you can create a schedule that meets your needs and helps you understand the complexities of interest-only loans.

We encourage you to share your experiences and tips for creating interest-only loan amortization schedules in Excel in the comments below. Don't forget to share this article with your friends and colleagues who may benefit from learning more about Excel and loan amortization schedules.