Intro

Unlock the secrets to a thriving investment club with these 8 essential rules. Discover how to pool resources, share expertise, and mitigate risks with fellow investors. Learn about club management, investment strategies, and risk assessment. Elevate your investment game and achieve financial success with a well-structured investment club. Start investing wisely today!

Investing in the stock market can be a daunting task, especially for those who are new to the game. With so many options and opinions available, it's easy to get overwhelmed and make costly mistakes. This is where an investment club comes in – a group of individuals who pool their resources and knowledge to make informed investment decisions. By following these 8 essential rules, your investment club can set itself up for success and reap the rewards of the stock market.

Rule 1: Define Your Club's Purpose and Objectives

Before you start making investment decisions, it's crucial to define your club's purpose and objectives. What are your goals? Are you looking for long-term growth or short-term gains? Are you interested in investing in specific industries or sectors? By establishing a clear purpose and objectives, you can ensure that all members are on the same page and working towards the same goals.

Benefits of Defining Your Club's Purpose and Objectives

- Ensures all members are aligned and working towards the same goals

- Helps to focus investment decisions and avoid costly mistakes

- Provides a framework for evaluating investment opportunities

Rule 2: Establish a Strong Leadership Structure

A strong leadership structure is essential for the success of your investment club. This includes electing a president, vice president, secretary, and treasurer. Each member should have clearly defined roles and responsibilities, and there should be a process in place for making decisions and resolving conflicts.

Benefits of a Strong Leadership Structure

- Provides direction and guidance for the club

- Ensures that decisions are made in a fair and transparent manner

- Helps to prevent conflicts and ensure smooth operations

Rule 3: Develop a Comprehensive Investment Strategy

A comprehensive investment strategy is critical for the success of your investment club. This includes determining your investment approach, asset allocation, and risk tolerance. You should also establish a process for researching and evaluating investment opportunities, as well as a system for monitoring and adjusting your portfolio.

Benefits of a Comprehensive Investment Strategy

- Helps to ensure that investment decisions are made in a disciplined and systematic manner

- Reduces the risk of costly mistakes and emotional decision-making

- Provides a framework for evaluating investment opportunities and making adjustments to your portfolio

Rule 4: Educate and Inform Club Members

Education and information are key to the success of your investment club. Members should be encouraged to learn about investing and personal finance, and the club should provide resources and support to help them do so. This can include guest speakers, workshops, and online resources.

Benefits of Educating and Informing Club Members

- Helps to ensure that members are informed and engaged in the investment process

- Reduces the risk of costly mistakes and emotional decision-making

- Provides a framework for evaluating investment opportunities and making adjustments to your portfolio

Rule 5: Encourage Open Communication and Debate

Open communication and debate are essential for the success of your investment club. Members should be encouraged to share their opinions and ideas, and the club should provide a safe and respectful environment for discussion and debate.

Benefits of Open Communication and Debate

- Helps to ensure that all members are informed and engaged in the investment process

- Encourages critical thinking and analysis

- Provides a framework for evaluating investment opportunities and making adjustments to your portfolio

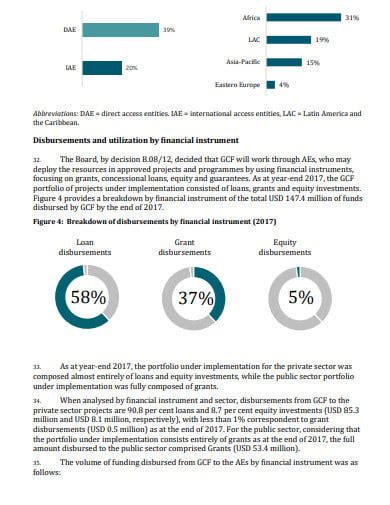

Rule 6: Establish a System for Managing Risk

Managing risk is critical to the success of your investment club. This includes establishing a system for evaluating and managing risk, as well as a process for adjusting your portfolio to minimize risk.

Benefits of Establishing a System for Managing Risk

- Helps to reduce the risk of costly mistakes and emotional decision-making

- Provides a framework for evaluating investment opportunities and making adjustments to your portfolio

- Encourages critical thinking and analysis

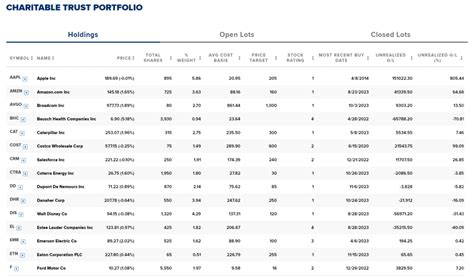

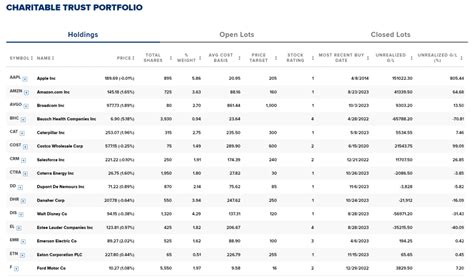

Rule 7: Monitor and Adjust Your Portfolio

Monitoring and adjusting your portfolio is essential to the success of your investment club. This includes regularly reviewing your portfolio to ensure that it remains aligned with your investment objectives and risk tolerance.

Benefits of Monitoring and Adjusting Your Portfolio

- Helps to ensure that your portfolio remains aligned with your investment objectives and risk tolerance

- Encourages critical thinking and analysis

- Provides a framework for evaluating investment opportunities and making adjustments to your portfolio

Rule 8: Review and Revise Your Investment Strategy

Finally, it's essential to regularly review and revise your investment strategy. This includes evaluating your investment performance, assessing your risk tolerance, and making adjustments to your portfolio as needed.

Benefits of Reviewing and Revising Your Investment Strategy

- Helps to ensure that your investment strategy remains effective and aligned with your objectives

- Encourages critical thinking and analysis

- Provides a framework for evaluating investment opportunities and making adjustments to your portfolio

Investment Club Image Gallery

By following these 8 essential rules, your investment club can set itself up for success and reap the rewards of the stock market. Remember to define your club's purpose and objectives, establish a strong leadership structure, develop a comprehensive investment strategy, educate and inform club members, encourage open communication and debate, establish a system for managing risk, monitor and adjust your portfolio, and review and revise your investment strategy.