Intro

Are you tired of manually tracking your mileage for tax purposes? Do you struggle to keep accurate records of your business-related drives? Look no further! An IRS-approved mileage log printable template can simplify the process and help you maximize your tax deductions.

The importance of accurate mileage tracking cannot be overstated. According to the IRS, you can deduct up to 58 cents per mile driven for business purposes in 2022. This can add up quickly, especially if you drive frequently for work or use your vehicle for business-related activities.

Benefits of Using an IRS-Approved Mileage Log Template

Using an IRS-approved mileage log template offers several benefits, including:

- Simplified tracking: A printable template makes it easy to record your mileage and keep accurate records.

- Increased accuracy: A template ensures that you capture all the necessary information, reducing the risk of errors or missed entries.

- Time-saving: With a template, you can quickly and easily log your mileage, saving you time and effort.

- Maximizing deductions: By accurately tracking your mileage, you can ensure that you're taking advantage of the maximum deductions allowed by the IRS.

What to Look for in an IRS-Approved Mileage Log Template

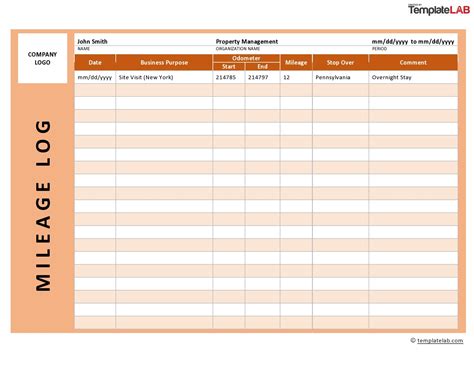

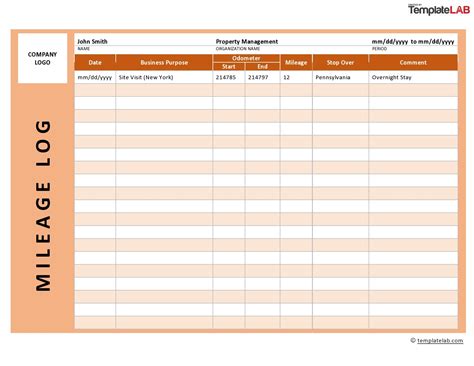

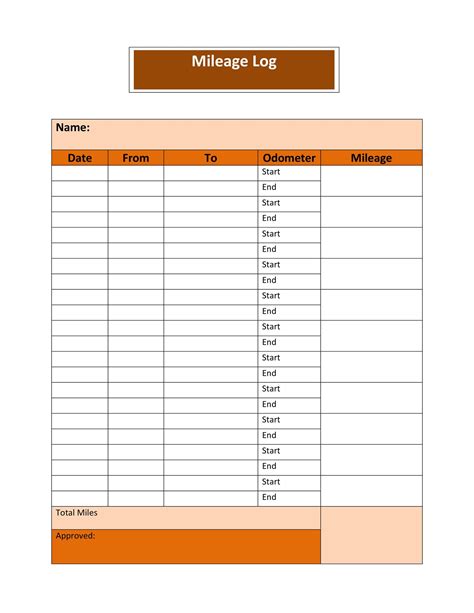

When selecting a mileage log template, look for the following features:

- IRS approval: Ensure that the template meets the IRS's requirements for mileage logs.

- Easy to use: Choose a template that is simple and easy to understand.

- Customizable: Select a template that allows you to customize the fields and layout to suit your needs.

- Space for notes: Consider a template that includes space for notes or additional information.

How to Use an IRS-Approved Mileage Log Template

Using an IRS-approved mileage log template is straightforward. Here's a step-by-step guide:

- Download and print the template.

- Record your mileage at the beginning and end of each trip.

- Log the date, purpose, and location of each trip.

- Calculate the total miles driven and multiply by the IRS's approved rate (58 cents per mile in 2022).

- Keep the template in a safe place, such as a binder or digital file.

Tips for Accurate Mileage Tracking

To ensure accurate mileage tracking, follow these tips:

- Record your mileage immediately after each trip.

- Use a separate log for each vehicle.

- Keep receipts and records of fuel purchases, maintenance, and repairs.

- Review and update your log regularly.

Common Mistakes to Avoid When Using a Mileage Log Template

When using a mileage log template, avoid the following common mistakes:

- Incomplete or inaccurate information.

- Failure to keep receipts and records.

- Not updating the log regularly.

- Using a template that is not IRS-approved.

Conclusion

An IRS-approved mileage log printable template can simplify the process of tracking your mileage for tax purposes. By using a template, you can ensure accurate records, maximize your deductions, and save time. Remember to choose a template that meets the IRS's requirements, is easy to use, and customizable. By following the tips outlined in this article, you can ensure accurate mileage tracking and make the most of your tax deductions.

Frequently Asked Questions

Q: What is the IRS's approved mileage rate for 2022? A: The IRS's approved mileage rate for 2022 is 58 cents per mile driven for business purposes.

Q: Can I use a mileage log template for personal trips? A: No, a mileage log template is only for business-related trips. Personal trips are not deductible.

Q: Do I need to keep receipts and records of fuel purchases, maintenance, and repairs? A: Yes, it's recommended to keep receipts and records of fuel purchases, maintenance, and repairs to support your mileage log.

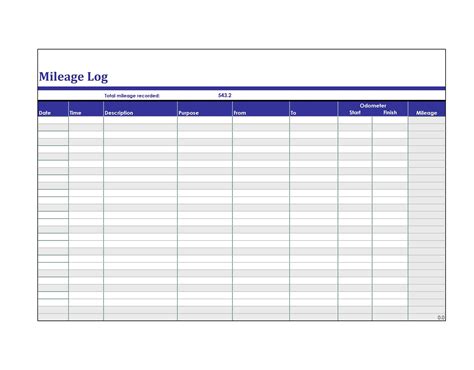

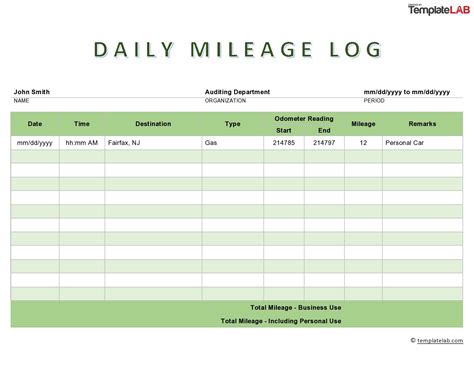

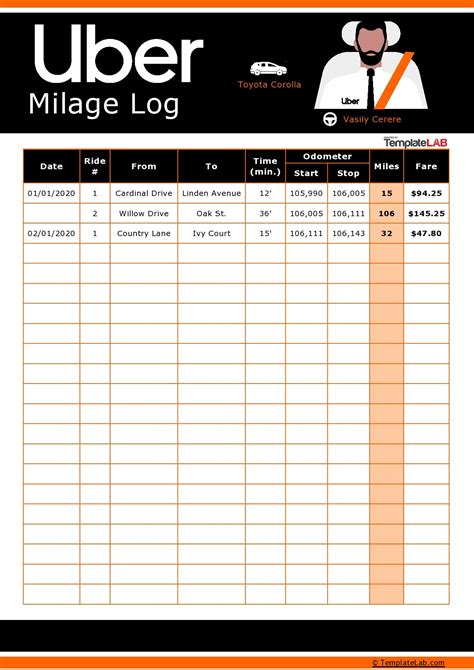

Mileage Log Template Image Gallery

We hope this article has provided you with valuable information on using an IRS-approved mileage log printable template for tax purposes. If you have any further questions or concerns, please don't hesitate to comment below. Share this article with your friends and colleagues who may benefit from using a mileage log template.