The IRS B Notice - a letter that can strike fear into the hearts of many businesses. If you've received one, you're likely wondering what it means and how to respond. Don't worry, we've got you covered. In this article, we'll break down the 5 ways to respond to an IRS B Notice, so you can navigate this situation with confidence.

Understanding the IRS B Notice

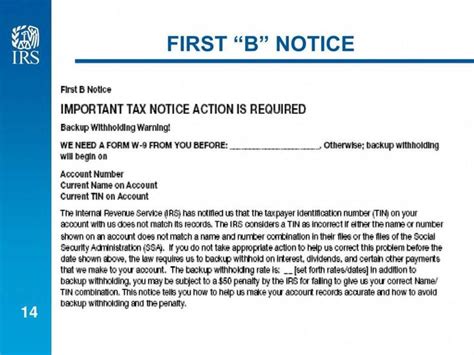

Before we dive into the response strategies, let's take a step back and understand what an IRS B Notice is. The B Notice is a letter sent by the IRS to businesses that have reported incorrect or incomplete taxpayer identification numbers (TINs) on their information returns, such as 1099s. The notice informs the business that they need to correct the issue to avoid backup withholding and potential penalties.

The Importance of Responding to the IRS B Notice

Responding to the IRS B Notice is crucial to avoid additional penalties and backup withholding. If you don't respond, the IRS may start backup withholding on your payments, which can lead to a significant financial burden. Moreover, ignoring the notice can also result in penalties, fines, and even an audit.

5 Ways to Respond to an IRS B Notice

Now that we've covered the basics, let's explore the 5 ways to respond to an IRS B Notice:

1. Verify the Information

The first step is to verify the information on the notice. Check the TINs and names listed on the notice to ensure they match your records. If you find any discrepancies, correct them immediately. You can also contact the IRS to confirm the accuracy of the information.

2. Gather Required Documentation

Gather all relevant documentation, including:

- W-9 forms for each payee

- 1099 forms for the previous tax year

- Any correspondence with the payee regarding their TIN

Having these documents ready will help you respond to the notice efficiently.

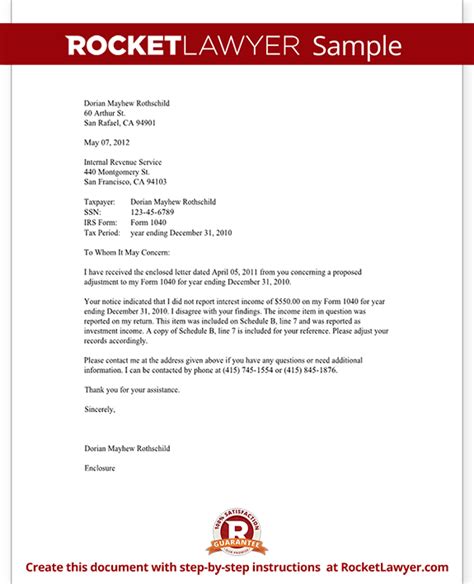

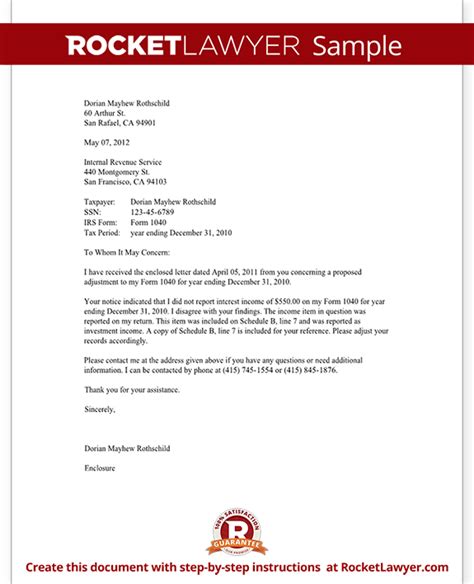

3. Complete the B Notice Response Form

The IRS provides a response form, which you can use to respond to the notice. Complete the form accurately, providing all required information. Make sure to:

- Correct any errors on the form

- Provide updated TINs and names

- Sign and date the form

4. Submit the Response

Submit the completed response form to the IRS address listed on the notice. Make sure to keep a copy of the form for your records.

5. Follow Up with the IRS

After submitting your response, follow up with the IRS to confirm receipt and ensure the issue is resolved. You can contact the IRS via phone or mail to verify the status of your response.

Gallery of IRS B Notice Response

IRS B Notice Response Gallery

Frequently Asked Questions

Q: What is an IRS B Notice? A: An IRS B Notice is a letter sent by the IRS to businesses that have reported incorrect or incomplete taxpayer identification numbers (TINs) on their information returns.

Q: Why did I receive an IRS B Notice? A: You received an IRS B Notice because the IRS has identified errors or discrepancies in the TINs or names listed on your information returns.

Q: How do I respond to an IRS B Notice? A: You can respond to an IRS B Notice by verifying the information, gathering required documentation, completing the response form, submitting the response, and following up with the IRS.

Q: What happens if I don't respond to the IRS B Notice? A: If you don't respond to the IRS B Notice, the IRS may start backup withholding on your payments, which can lead to a significant financial burden. You may also face penalties, fines, and even an audit.

Call to Action

Don't let the IRS B Notice intimidate you. Take action today by verifying the information, gathering required documentation, and completing the response form. Submit your response to the IRS and follow up to ensure the issue is resolved. Remember, responding to the IRS B Notice is crucial to avoid additional penalties and backup withholding.

By following these 5 ways to respond to an IRS B Notice, you'll be well on your way to resolving the issue and avoiding any further complications. So, don't wait - take control of the situation and respond to the IRS B Notice today!