Intro

Streamline your expense tracking with an IRS compliant mileage log template. Easily record and calculate business miles driven, ensuring accurate reimbursements and tax deductions. Our template simplifies mileage logging, reducing errors and audit risks. Say goodbye to manual calculations and hello to seamless expense reporting.

Maintaining accurate and detailed records of business mileage is essential for individuals and companies to take advantage of tax deductions and reimbursements. The IRS requires specific documentation to support mileage claims, which is where an IRS compliant mileage log template comes into play. In this article, we will explore the importance of mileage logging, the benefits of using a template, and provide a comprehensive guide on how to create and use an IRS compliant mileage log template.

Why is Mileage Logging Important?

Mileage logging is crucial for businesses and individuals who use their vehicles for work-related purposes. The IRS allows taxpayers to deduct business miles driven on their tax returns, which can result in significant savings. However, the IRS requires detailed records to support these claims, including dates, miles driven, and business purposes.

Beyond Tax Benefits: The Importance of Mileage Logging

Mileage logging offers several benefits beyond tax deductions:

- Accurate reimbursement: Mileage logging helps employers reimburse employees accurately for business miles driven.

- Vehicle maintenance: Tracking mileage helps individuals and companies stay on top of vehicle maintenance, ensuring timely oil changes, tire rotations, and other necessary repairs.

- Fuel efficiency: Monitoring mileage can help identify areas for improvement in fuel efficiency, reducing costs and environmental impact.

Benefits of Using an IRS Compliant Mileage Log Template

Using an IRS compliant mileage log template offers several advantages:

- Simplifies record-keeping: A template helps ensure that all necessary information is captured, making it easier to maintain accurate records.

- Reduces errors: A template minimizes the risk of errors, which can lead to denied tax deductions or reimbursements.

- Saves time: A template streamlines the logging process, saving time and increasing productivity.

What to Look for in an IRS Compliant Mileage Log Template

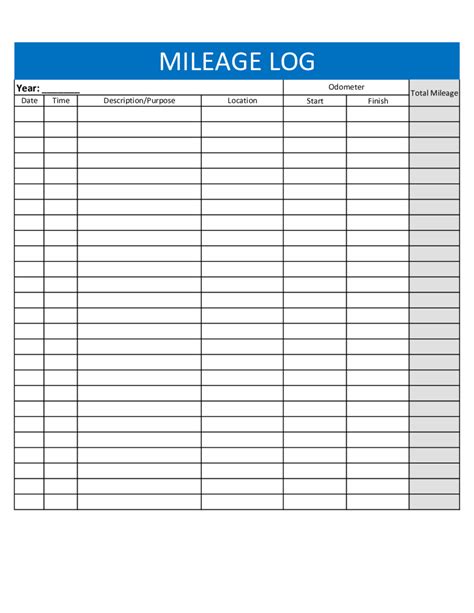

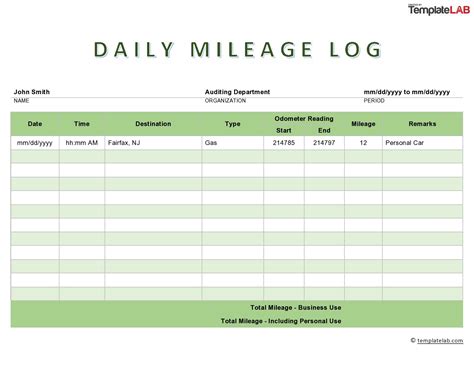

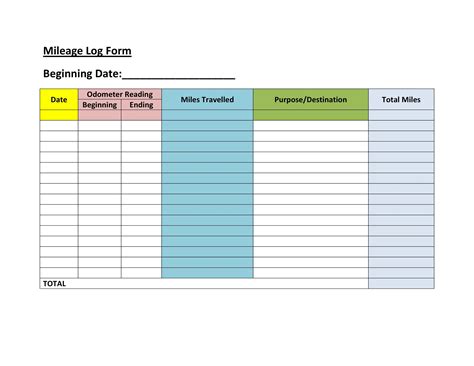

When selecting or creating a mileage log template, ensure it includes the following essential elements:

- Date: Record the date of each trip

- Starting and ending odometer readings: Capture the beginning and ending mileage for each trip

- Business purpose: Describe the business purpose of each trip

- Total miles driven: Calculate the total miles driven for each trip

- Location: Record the starting and ending locations of each trip

Creating an IRS Compliant Mileage Log Template

To create an IRS compliant mileage log template, follow these steps:

- Choose a format: Select a spreadsheet software, such as Microsoft Excel or Google Sheets, or a dedicated mileage logging app.

- Set up columns: Create columns for date, starting and ending odometer readings, business purpose, total miles driven, and location.

- Add formulas: Use formulas to calculate total miles driven and summarize data.

- Include a summary page: Create a summary page to track total miles driven, average miles per day, and other relevant metrics.

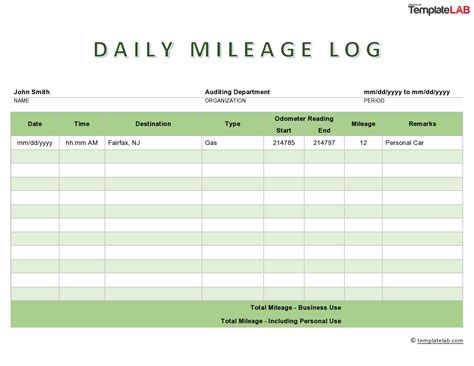

Example of an IRS Compliant Mileage Log Template

Here is an example of what an IRS compliant mileage log template might look like:

| Date | Starting Odometer | Ending Odometer | Business Purpose | Total Miles | Location |

|---|---|---|---|---|---|

| 2023-02-01 | 10000 | 10050 | Client meeting | 50 | New York |

| 2023-02-02 | 10050 | 10100 | Business lunch | 50 | New York |

| 2023-02-03 | 10100 | 10150 | Conference | 50 | Chicago |

Best Practices for Using an IRS Compliant Mileage Log Template

To get the most out of your IRS compliant mileage log template, follow these best practices:

- Log miles regularly: Update your log regularly to ensure accuracy and reduce the risk of errors.

- Keep receipts: Store receipts for fuel, tolls, and other expenses related to business miles driven.

- Review and reconcile: Regularly review and reconcile your mileage log to ensure accuracy and identify areas for improvement.

Common Mistakes to Avoid When Using an IRS Compliant Mileage Log Template

When using an IRS compliant mileage log template, avoid the following common mistakes:

- Incomplete records: Ensure that all necessary information is captured, including dates, miles driven, and business purposes.

- Inaccurate calculations: Double-check calculations to ensure accuracy and avoid errors.

- Lack of documentation: Keep receipts and other supporting documentation to substantiate mileage claims.

Conclusion

Maintaining accurate and detailed records of business mileage is essential for individuals and companies to take advantage of tax deductions and reimbursements. An IRS compliant mileage log template simplifies record-keeping, reduces errors, and saves time. By following the guidelines outlined in this article, you can create and use an IRS compliant mileage log template to ensure accuracy and maximize your tax benefits.

Mileage Log Template Image Gallery

We hope this article has provided you with a comprehensive guide on creating and using an IRS compliant mileage log template. Share your experiences and tips on using mileage log templates in the comments below.