Understanding the Importance of the IRS Form 8332

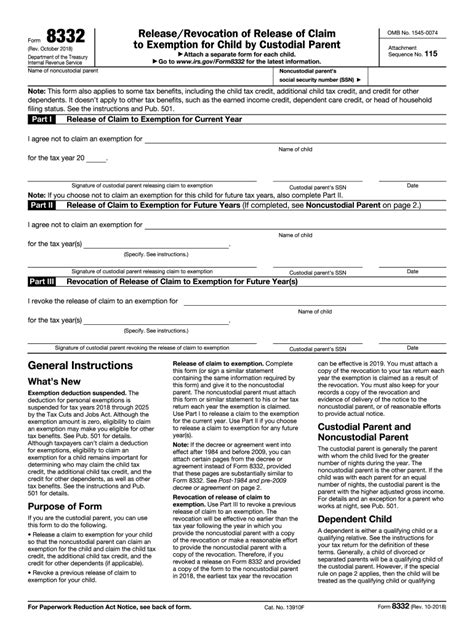

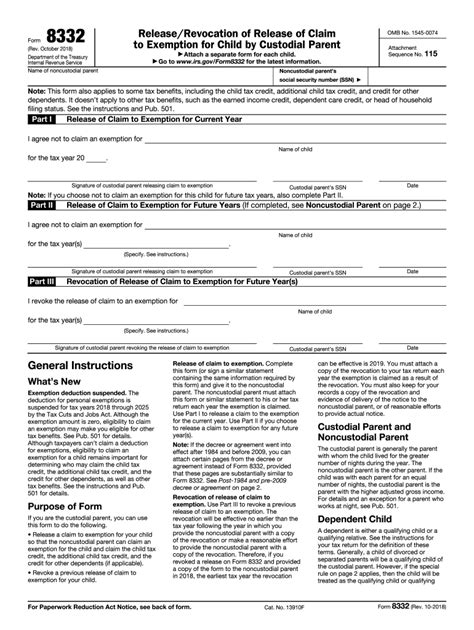

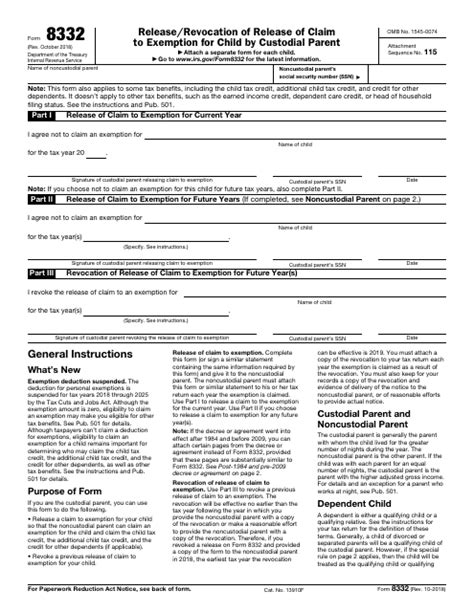

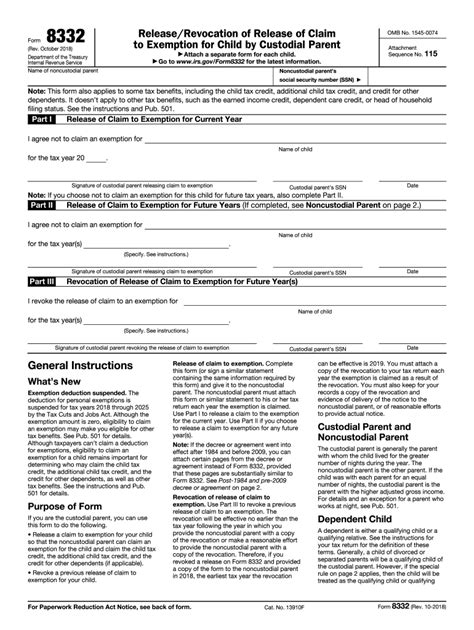

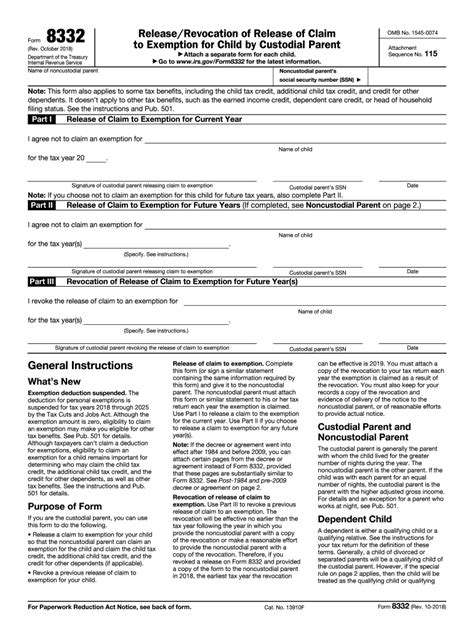

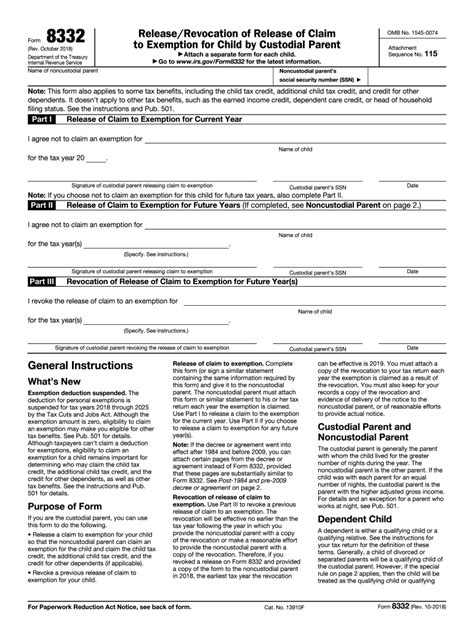

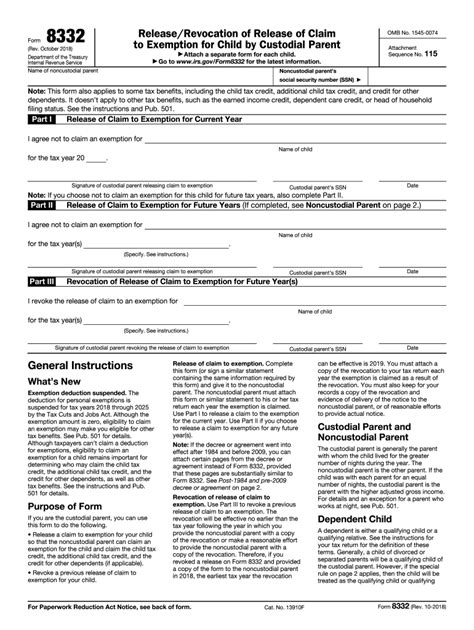

When it comes to taxes, there are numerous forms and documents that individuals and families need to familiarize themselves with. One such form is the IRS Form 8332, also known as the Release/Revocation of Release of Claim to Exemption for Child by Custodial Parent. This form plays a crucial role in determining which parent can claim a child as a dependent on their tax return.

The significance of the IRS Form 8332 lies in its ability to resolve disputes between divorced or separated parents regarding who can claim their child as a dependent. In general, the custodial parent is entitled to claim the child as a dependent, but there are situations where the non-custodial parent may also be eligible. The IRS Form 8332 provides a way for the custodial parent to release their claim to exemption, allowing the non-custodial parent to claim the child as a dependent.

How to Download and Fill the IRS Form 8332

Downloading and filling the IRS Form 8332 is a relatively straightforward process. Here's a step-by-step guide to help you get started:

- Visit the official IRS website (irs.gov) and search for Form 8332.

- Click on the "Download" button to save the form to your computer or mobile device.

- Open the form using a PDF reader or editor, such as Adobe Acrobat.

- Fill out the form carefully, ensuring you provide accurate and complete information.

- Sign and date the form, if required.

Benefits of Using the IRS Form 8332

The IRS Form 8332 offers several benefits to taxpayers, including:

Resolving Disputes Between Parents

The most significant advantage of the IRS Form 8332 is its ability to resolve disputes between divorced or separated parents regarding who can claim their child as a dependent. By signing the form, the custodial parent releases their claim to exemption, allowing the non-custodial parent to claim the child as a dependent.

Claiming the Child Tax Credit

The IRS Form 8332 also enables the non-custodial parent to claim the Child Tax Credit, which can provide significant tax savings. The Child Tax Credit is a non-refundable credit that can reduce the taxpayer's tax liability dollar-for-dollar.

Reducing Tax Liability

By claiming the child as a dependent, the non-custodial parent may be eligible for other tax deductions and credits, such as the Earned Income Tax Credit (EITC) and the Dependent Care Credit. These credits can help reduce the taxpayer's tax liability, resulting in a lower tax bill.

Common Mistakes to Avoid When Filing the IRS Form 8332

While filling the IRS Form 8332 is a relatively straightforward process, there are common mistakes that taxpayers should avoid. Here are some of the most common mistakes to watch out for:

Incorrect Information

Ensure that you provide accurate and complete information on the form, including the child's name, Social Security number, and address.

Missing Signatures

The IRS Form 8332 requires the signatures of both parents, so ensure that you obtain the necessary signatures before submitting the form.

Incorrect Filing Status

The IRS Form 8332 should be filed with the taxpayer's annual tax return, so ensure that you file the form with the correct tax return.

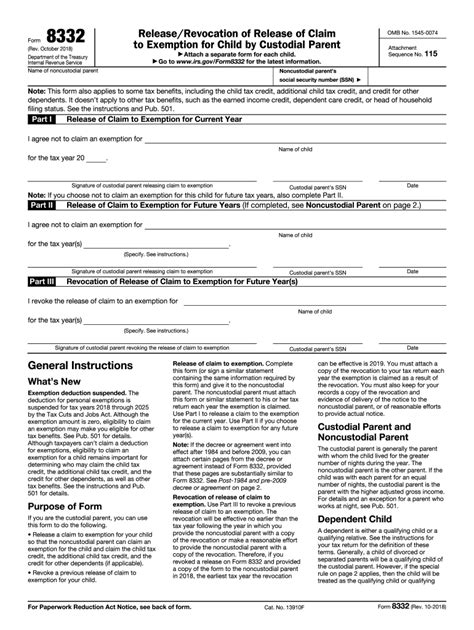

Gallery of IRS Form 8332 Printable

IRS Form 8332 Printable Gallery

Conclusion

The IRS Form 8332 is a crucial document for taxpayers who need to resolve disputes regarding who can claim their child as a dependent. By downloading and filling the form, taxpayers can ensure that they claim the correct deductions and credits, resulting in a lower tax bill. Remember to avoid common mistakes, such as incorrect information, missing signatures, and incorrect filing status, to ensure that your form is processed correctly.

What's your experience with the IRS Form 8332? Share your thoughts and questions in the comments below!